Latest News

The financial world was sent into a frenzy last week as Goldman Sachs (NYSE: GS) reported a staggering fourth-quarter performance for 2025, significantly outstripping analyst predictions and signaling a robust return to form for the "Vampire Squid" of Wall Street. On January 15, 2026, the firm posted a diluted earnings

Via MarketMinute · January 20, 2026

Applovin shares are down on Tuesday, reflecting a broader market trend as major indices struggle.

Via Benzinga · January 20, 2026

WASHINGTON D.C. / NEW YORK — Global financial markets were plunged into a state of "Arctic uncertainty" this Tuesday, January 20, 2026, as U.S. stock futures cratered following a weekend of unprecedented geopolitical brinkmanship. President Donald Trump, marking the one-year anniversary of his second term, has reignited his long-standing ambition

Via MarketMinute · January 20, 2026

Texas Roadhouse (TXRH) has a strong track record of outperforming same-store sales, with a Buy rating and $215 price target from analyst Andrew Charles.

Via Benzinga · January 20, 2026

Bakkt Holdings shares are tumbling on Tuesday after the company announced a $300 million ATM equity program.

Via Benzinga · January 20, 2026

TSMC continues to turn in strong results, driven by demand for AI chips.

Via The Motley Fool · January 20, 2026

As of January 20, 2026, a historic transformation is sweeping through the U.S. stock market, marking the most significant reallocation of capital since the post-pandemic recovery. Investors are aggressively rotating out of the high-flying, mega-cap technology stocks that dominated the last decade and into the "unloved" sectors of the

Via MarketMinute · January 20, 2026

Jeffs' Brands (JFBR) stock pulled back amid market sell-off. KeepZone AI signs exclusive reseller agreement for anti-drone systems in Mexico.

Via Benzinga · January 20, 2026

The United States economy finds itself at a complex crossroads following the delayed release of critical macroeconomic data that paints a picture of a surprisingly robust consumer base tempered by stubborn wholesale inflation. On January 14, 2026, the Department of Commerce and the Bureau of Labor Statistics finally broke a

Via MarketMinute · January 20, 2026

Amazon stock fell on new U.S. tariffs related to Greenland. CEO Andy Jassy warned that tariffs are starting to increase prices.

Via Investor's Business Daily · January 20, 2026

Via Benzinga · January 20, 2026

Dynatrace shares are facing increasing selling pressure after a critical technical breakdown. Our analysis explains why weakness may persist.

Via Benzinga · January 20, 2026

With risk assets retreating and commodities exploding higher, investors are hunting for durable growth stories trading below consensus value.

Via Talk Markets · January 20, 2026

Venus Concept skyrocketed late last week as Madryn Asset Management announced a 91% ownership stake. But investing in VERO shares remains a very high-risk proposition.

Via Barchart.com · January 20, 2026

Citigroup Inc. (NYSE: C) reported a sharp 13.4% decline in its fourth-quarter 2025 profit, a result heavily weighed down by a $1.2 billion pre-tax loss tied to the finalization of its exit from the Russian market. The banking giant’s net income fell to $2.5 billion, or

Via MarketMinute · January 20, 2026

Via MarketBeat · January 20, 2026

Novavax shares are trading higher Tuesday after the company announced it entered into a license agreement with Pfizer for Matrix-M adjuvant.

Via Benzinga · January 20, 2026

Wells Fargo & Co. (NYSE: WFC) reported fourth-quarter 2025 earnings that trailed analyst expectations, as the banking giant continues to navigate a complex restructuring phase. The San Francisco-based lender posted diluted earnings per share (EPS) of $1.62, missing the consensus Wall Street estimate of $1.67. The miss was largely

Via MarketMinute · January 20, 2026

Critical Metals announces a joint venture for a production facility in Saudi Arabia. Analyst lifts price target on CRML stock.

Via Investor's Business Daily · January 20, 2026

CoreWeave shares are down on Tuesday following a recent strong rebuttal from the company's CEO regarding its financing strategy.

Via Benzinga · January 20, 2026

As the second week of 2026 draws to a close, the credit card industry is facing its most significant legislative challenge in decades. A bipartisan push to cap credit card annual percentage rates (APRs) at a flat 10% has moved from a fringe populist idea to a central pillar of

Via MarketMinute · January 20, 2026

AST SpaceMobile shares are flat, pulling back following recent strength, as the company has secured a prime position on the U.S. Missile Defense Agency's SHIELD program.

Via Benzinga · January 20, 2026

Portugal orders Polymarket shutdown after $120M election bets as Hungary joins crackdown, pushing total restricted countries past 30.

Via Benzinga · January 20, 2026

SANTA CLARA, CA — As the sun sets on a transformative 2025 for the semiconductor industry, all eyes are fixed on Intel Corporation (NASDAQ:INTC) as it prepares to report its fourth-quarter earnings on Thursday, January 22, 2026. The stakes have rarely been higher for the Silicon Valley titan. With the

Via MarketMinute · January 20, 2026

What's going on in today's session: S&P500 gap up and gap down stockschartmill.com

Via Chartmill · January 20, 2026

Palantir Technologies shares are trading lower Tuesday amid overall market weakness after President Donald Trump posted on social media that, starting February 1st, Denmark, Norway, France, Germany, the UK, the Netherlands and Finland will be charged a 10% tariff on all goods sent to the U.S. Trump has recently escalated rhetoric about making Greenland a U.S. territory.

Via Benzinga · January 20, 2026

Microsoft stock heads into its Jan. 28 earnings report with elevated expectations as investors weigh strong growth against rising AI-related costs.

Via Barchart.com · January 20, 2026

March U.S. Treasury note futures present a selling opportunity on more price weakness.

Via Barchart.com · January 20, 2026

Micron looks poised to outperform in 2026.

Via The Motley Fool · January 20, 2026

The dollar index (DXY00 ) dropped to a 2-week low today and is down by -0.84%. The dollar is falling today as President Trump's push to take over Greenland is reviving fears of trade confrontations between the US and its European allies, with little...

Via Barchart.com · January 20, 2026

LONDON — January 20, 2026 — In a milestone moment for global capital markets, pharmaceutical giant AstraZeneca (NYSE: AZN) has officially filed its formal notice of voluntary withdrawal from the Nasdaq Stock Market today. The move marks the final countdown for one of the most significant listing migrations in recent history, as

Via MarketMinute · January 20, 2026

The GBP/USD outlook turns bullish despite mixed UK labor market data.

Via Talk Markets · January 20, 2026

Sun Pharma is evaluating a potential $10 billion acquisition of Organon, a move that could become India's largest cross-border pharma deal.

Via Benzinga · January 20, 2026

Top Wealth Group Holding Limited (NASDAQ: TWG) announced acquisition of Airentity International Limited to diversify beverage offerings.

Via Benzinga · January 20, 2026

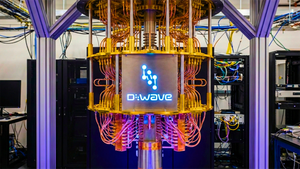

D-Wave Quantum shares are trading lower Tuesday morning despite officially completed its acquisition of Quantum Circuits

Via Benzinga · January 20, 2026

Via Benzinga · January 20, 2026

During an interview with Bloomberg, AkademikerPension’s Chief Investment Officer, Anders Schelde, said that the fund held about $100 million in U.S. Treasuries at the end of 2025.

Via Stocktwits · January 20, 2026

Let's uncover which stocks are experiencing notable gaps during today's session.chartmill.com

Via Chartmill · January 20, 2026

As the opening bell approaches on January 21, 2026, all eyes on Wall Street are fixed on Johnson & Johnson (NYSE: JNJ), which is set to report its fourth-quarter and full-year 2025 financial results. This report serves as a critical barometer for the healthcare giant’s first full year as a

Via MarketMinute · January 20, 2026

Tuesday marks one year since President Donald Trump took office for his second presidential term.

Via Benzinga · January 20, 2026

ZenaTech launched the IQ Quad, an autonomous VTOL AI drone by ZenaDrone, designed for fast, accurate surveying and mapping. It will be deployed through its Drone as a Service platform across construction, planning, and public works markets.

Via Stocktwits · January 20, 2026

VettaFi's Roxanna Islam explains how crypto ETFs are being used as high-beta growth and tech-like trades, tracking risk-on and risk-off market cycles.

Via Benzinga · January 20, 2026

Three stocks in the Berkshire Hathaway public portfolio could be right for you.

Via The Motley Fool · January 20, 2026

Axon Enterprise is all set to announce its fiscal fourth-quarter earnings soon, and analysts project a notable triple-digit earnings drop.

Via Barchart.com · January 20, 2026

Fastenal (NASDAQ: FAST) shares drop after mixed Q4 results: earnings up, revenue misses. Double-digit sales growth.

Via Benzinga · January 20, 2026

Via Benzinga · January 20, 2026

XRP could be ready to take off over the rest of the decade.

Via The Motley Fool · January 20, 2026

Although the benchmark indices opened flat, they traded negatively throughout the session and ultimately closed red.

Via Talk Markets · January 20, 2026

Intel has been mounting a recovery, but a failure in Q4 could end up ruining the rally. This analyst believes otherwise and has increased his price target instead.

Via Barchart.com · January 20, 2026