Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

The U.S. Treasury market has been gripped by a sudden wave of volatility this March, as the benchmark 10-year yield decisively broke through the 4.08% threshold, sending a clear signal that the era of "easy money" expectations is firmly in the rearview mirror. This surge, fueled by resilient

Via MarketMinute · March 12, 2026

In a startling blow to economic optimism, American consumer sentiment took a sharp dive in January, hitting its lowest point in over a decade. The Conference Board’s latest reading has sent shockwaves through Wall Street, signaling a potentially rocky road ahead for the U.S. economy in 2026. The

Via MarketMinute · March 12, 2026

As of March 12, 2026, the global financial markets have undergone a profound transformation. The speculative fervor that defined the "AI hype" of 2023 and 2024 has matured into a disciplined, industrial-scale expansion. In what analysts are calling the "Year of Proof," the narrative has shifted from the mere possibility

Via MarketMinute · March 12, 2026

As of March 12, 2026, the industrial sector is still processing the fallout from the fiscal second-quarter 2026 earnings season. At the center of the conversation is Applied Industrial Technologies (NYSE:AIT), which recently reported its financial results for the quarter ended December 31, 2025. Despite posting an earnings-per-share (EPS)

Via MarketMinute · March 12, 2026

The high-stakes world of Artificial Intelligence infrastructure faced a stark reality check this quarter as Sanmina Corporation (NASDAQ: SANM) saw its market value crater by more than 20% in a single trading session. The dramatic sell-off, which sent shockwaves through the Electronics Manufacturing Services (EMS) sector, came immediately following the

Via MarketMinute · March 12, 2026

In a stark reminder that top-line growth is not always enough to satisfy Wall Street, Agilysys (Nasdaq: AGYS) saw its shares crater by more than 15% in after-hours trading following the release of its third-quarter fiscal 2026 results. While the company celebrated its 16th consecutive quarter of record-breaking revenue—reaching

Via MarketMinute · March 12, 2026

ARLINGTON, VA — In a definitive signal that the aerospace and defense "super-cycle" has arrived, RTX Corp (NYSE: RTX) reported a blockbuster fourth quarter for 2025, comfortably exceeding Wall Street’s expectations on both the top and bottom lines. The industrial titan, formerly known as Raytheon Technologies, announced a staggering $24.

Via MarketMinute · March 12, 2026

As the Federal Open Market Committee (FOMC) prepares to convene on March 17-18, 2026, the financial world has reached a consensus on the immediate outcome, but remains deeply divided on the path ahead. With the federal funds rate currently sitting at a range of 3.50% to 3.75%, market

Via MarketMinute · March 12, 2026

CHICAGO — In a move that signals a definitive shift from its legacy as a traditional brewer to a diversified beverage powerhouse, Molson Coors Beverage Company (NYSE: TAP) has officially unveiled its "Horizon 2030" strategic framework alongside its fourth-quarter financial results. The company reported quarterly sales of $2.66 billion, a

Via MarketMinute · March 12, 2026

In a move that signals a massive consolidation in the circular economy, e-commerce giant eBay Inc. (NASDAQ: EBAY) has officially entered into a definitive agreement to acquire the social fashion marketplace Depop from Etsy, Inc. (NASDAQ: ETSY) for $1.2 billion in cash. The deal, announced in late February 2026,

Via MarketMinute · March 12, 2026

In a decisive move that has re-energized investor confidence, eBay Inc. (NASDAQ: EBAY) has reported a powerhouse fourth-quarter performance for the fiscal year ending 2025. The e-commerce pioneer posted a revenue of $3 billion and an adjusted earnings per share (EPS) of $1.41, handily outperforming Wall Street’s consensus

Via MarketMinute · March 12, 2026

The semiconductor industry has entered a new era of automated ingenuity, and Cadence Design Systems (NASDAQ:CDNS) is currently holding the blueprints. In its latest quarterly earnings report, the electronic design automation (EDA) giant posted a resounding beat on both the top and bottom lines, reporting $1.44 billion in

Via MarketMinute · March 12, 2026

NEW YORK — Omnicom Group Inc. (NYSE: OMC) sent shockwaves through the advertising world this quarter, reporting a gargantuan revenue figure that shattered analyst expectations but failed to deliver the bottom-line precision investors had craved. As the marketing giant navigates the early stages of its historic consolidation with Interpublic Group, the

Via MarketMinute · March 12, 2026

Booking Holdings Inc. (NASDAQ: BKNG) has once again solidified its position as the undisputed leader of the global travel industry, reporting fourth-quarter 2025 financial results that comfortably cleared Wall Street’s high bar. The company posted record revenue of $6.35 billion and a staggering adjusted earnings per share (EPS)

Via MarketMinute · March 12, 2026

As of March 12, 2026, the U.S. stock market presents a jarring paradox that has left seasoned analysts sounding the alarm. While the flagship S&P 500 (NYSE: SPY) recently flirted with the historic 7,000 milestone and the Dow Jones Industrial Average (NYSE: DIA) remains within striking distance

Via MarketMinute · March 12, 2026

The private equity landscape reached a significant milestone this week as Hg Capital announced a definitive agreement to acquire OneStream (Nasdaq: OS) in an all-cash transaction valued at approximately $6.4 billion. The deal, which offers shareholders $24 per share, represents a substantial 31% premium over the company’s closing

Via MarketMinute · March 12, 2026

As of March 12, 2026, the traditional tug-of-war between inflation and growth has shifted decisively toward a singular, high-stakes metric: the American worker. Following a series of volatile employment reports throughout the winter, the US labor market has emerged as the primary "hinge variable" for Federal Reserve policy. Investors have

Via MarketMinute · March 12, 2026

As of March 12, 2026, the U.S. financial landscape is grappling with a "stagflation" narrative that has fundamentally shifted market expectations for the year ahead. Recent data releases have presented a dual-threat scenario: Q4 2025 GDP growth sputtered to a meager 1.4%, significantly hamstrung by a record-breaking 43-day

Via MarketMinute · March 12, 2026

As the retail world braces for the final accounting of the 2025 holiday season, all eyes are on Walmart Inc. (NYSE: WMT). The retail behemoth is set to release its fourth-quarter earnings report, a document that traditionally serves as the definitive pulse check for the American consumer. With the broader

Via MarketMinute · March 12, 2026

As of March 12, 2026, the U.S. stock market is undergoing its most profound structural realignment in a decade. The "Great Rotation"—a massive migration of capital away from the high-flying technology giants that defined the post-pandemic era and toward the foundational "Old Economy" sectors—has reached a fever

Via MarketMinute · March 12, 2026

The global financial landscape fractured today, March 12, 2026, as the Dow Jones Industrial Average suffered a staggering 600-point collapse. The sell-off was ignited by the "Mojtaba Ultimatum," a defiant decree from Iran’s new leadership that officially rejected a G7-mediated ceasefire and declared the Strait of Hormuz—the world’

Via MarketMinute · March 12, 2026

As of March 12, 2026, the U.S. equity markets are witnessing an unprecedented "Buyback Boom," with S&P 500 corporations on track to authorize a record-breaking $1.2 trillion in share repurchases this year. This surge comes at a critical juncture for Wall Street, as investors grapple with a

Via MarketMinute · March 12, 2026

As the Federal Reserve prepares for its critical March 17-18 policy meeting, a flurry of contradictory economic data has left investors and policymakers grappling with a narrowing path to a "Goldilocks" outcome. Recent reports showing weekly jobless claims hitting 222,000 and a continued slide in the Job Openings and

Via MarketMinute · March 12, 2026

NEW YORK — The long-standing dominance of the technology sector is facing its most significant challenge in years as the "Great Rotation" of 2026 takes hold. As of March 12, 2026, the equity markets are witnessing a dramatic divergence: while the broader economy shows signs of resilience, the mega-cap giants that

Via MarketMinute · March 12, 2026

HOUSTON — In a dramatic reversal of the market doldrums that characterized much of the previous year, the S&P 500 Energy Sector (NYSE Arca: XLE) has surged to an all-time record high as of March 12, 2026. The rally comes as global crude oil prices breached the psychologically critical $100-per-barrel

Via MarketMinute · March 12, 2026

In a move that has sent shockwaves through the technology sector, software giant Adobe Inc. (NASDAQ: ADBE) saw its shares plummet by nearly 13% in a single trading session following its fiscal first-quarter earnings report. While the company technically surpassed analyst estimates for both revenue and earnings per share, its

Via MarketMinute · March 12, 2026

GOODLETTSVILLE, Tenn. — In a stark reminder that the stock market is a forward-looking machine, Dollar General (NYSE: DG) saw its shares tumble 7.8% during Thursday’s trading session, despite delivering fourth-quarter results that comfortably cleared Wall Street’s hurdles. The discount titan reported earnings and revenue that outpaced analyst

Via MarketMinute · March 12, 2026

As the Federal Open Market Committee (FOMC) prepares for its pivotal March 17–18 meeting, the air in Washington is thick with a level of political-economic tension not seen in decades. Today, March 12, 2026, President Donald Trump doubled down on his public assault against the Federal Reserve’s current

Via MarketMinute · March 12, 2026

As the first quarter of 2026 passes its midway point, a seismic shift in market leadership is unfolding on Wall Street. After years of playing second fiddle to the "Magnificent Seven" and the artificial intelligence arms race, small-cap stocks are finally having their moment in the sun. In a stunning

Via MarketMinute · March 12, 2026

On March 12, 2026, the U.S. financial system reached a critical inflection point as Treasury yields surged toward levels not seen in years, sending shockwaves through global equity markets. The 30-year Treasury bond yield climbed to 4.87%, while the benchmark 10-year note rose to 4.24%, driven by

Via MarketMinute · March 12, 2026

Shares of GlobalFoundries (Nasdaq: GFS) experienced a sharp decline of 5.4% on March 12, 2026, following the pricing and execution of a massive $840 million secondary equity offering. The sell-off, which erased more than $1.3 billion in market capitalization, reflects growing investor caution regarding "supply overhang" as the

Via MarketMinute · March 12, 2026

The long-standing dominance of the Fair Isaac Corporation (NYSE: FICO) in the credit scoring market faced its most severe challenge yet on March 12, 2026. Shares of the data analytics giant plunged 9% in heavy trading, wiping out billions in market capitalization in a single session. The selloff was triggered

Via MarketMinute · March 12, 2026

The tech-heavy Nasdaq 100 has hit a formidable wall at the 25,000 psychological resistance level, retreating sharply as investors grapple with a shifting macroeconomic landscape. After a brief foray above the milestone earlier this month, the index has spent the last several trading sessions rejecting the mark, raising concerns

Via MarketMinute · March 12, 2026

The long-standing resilience of the equity markets faced its most significant challenge in over a year today as the S&P 500 (NYSEARCA:SPY) decisively pierced key technical support levels. In a session marked by heavy institutional selling, the index fell through both its 100-day and 20-week moving averages, a

Via MarketMinute · March 12, 2026

As of March 12, 2026, a fundamental shift in the tectonic plates of the global financial markets has reached a fever pitch. Investors are aggressively fleeing the high-octane, AI-driven growth stories that defined the early 2020s, opting instead for the perceived safety and "boring" reliability of the Consumer Staples sector.

Via MarketMinute · March 12, 2026

Oracle Corporation (NYSE: ORCL) has sent shockwaves through the technology sector following a blockbuster fiscal third-quarter earnings report that far exceeded Wall Street’s most optimistic projections. The enterprise software giant reported a stunning 22% jump in total revenue, fueled by a massive 44% expansion in its cloud business. The

Via MarketMinute · March 12, 2026

In a move that solidifies the next era of computing infrastructure, Nvidia (NASDAQ:NVDA) has announced a massive $2 billion strategic investment and partnership with Nebius Group (NASDAQ:NBIS), sending shockwaves through the technology sector. The deal, unveiled early today on March 12, 2026, aims to accelerate the development of

Via MarketMinute · March 12, 2026

The global travel industry faced a brutal reckoning on March 12, 2026, as a perfect storm of geopolitical instability and skyrocketing energy costs sent shockwaves through the equity markets. The epicenter of the sell-off was United Airlines Holdings, Inc. (NASDAQ: UAL), which saw its share price crater by a staggering

Via MarketMinute · March 12, 2026

The global economy is facing its most severe energy crisis in decades as the shadow of total war in the Middle East looms over the financial markets. On March 12, 2026, international benchmark Brent crude surged to $101.59 per barrel, while the U.S. West Texas Intermediate (WTI) jumped

Via MarketMinute · March 12, 2026

As the Federal Reserve prepares for its critical March 17-18 policy meeting, the U.S. economy has entered a precarious "policy trap" that pits a cooling labor market against a violent resurgence in energy costs. Data released this week shows the February 2026 Consumer Price Index (CPI) holding steady at

Via MarketMinute · March 12, 2026

The S&P 500 (INDEXSP:.INX) has just concluded a blockbuster Q4 2025 earnings season, cementing a historic run of corporate profitability that has defied both high interest rates and global geopolitical jitters. As of mid-March 2026, the final data confirms that the index has achieved its fifth consecutive quarter

Via MarketMinute · March 12, 2026

As the curtains draw on China’s 2026 "Two Sessions"—the annual concurrent meetings of the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC)—the global financial landscape is grappling with a profound structural shift. Beijing has formally moved away from the era of

Via MarketMinute · March 12, 2026

The financial markets have entered a period of profound recalibration as of March 12, 2026, driven by a widening gap between short-term and long-term Treasury yields. This phenomenon, often referred to as a "bear steepening," has effectively reintroduced "valuation gravity" to the equity markets, particularly affecting the high-growth sectors that

Via MarketMinute · March 12, 2026

The technology sector, long the darling of the bull market, faced a harsh reality check in February 2026 as the Nasdaq 100 (INDEXNASDAQ: NDX) retreated by 2.32%. While the headline figure suggests a moderate pullback, it masks a violent internal re-pricing within the software and artificial intelligence sectors. The

Via MarketMinute · March 12, 2026

The global financial markets are bracing for a high-stakes technical showdown as the S&P 500 (NYSE Arca: SPY) continues its persistent slide toward a critical psychological and technical floor. As of March 12, 2026, the index is hovering near 6,740, but all eyes are fixed on the 200-day

Via MarketMinute · March 12, 2026

The energy sector has emerged as the undisputed leader in the global markets this week, fueled by an unprecedented 35% surge in West Texas Intermediate (WTI) crude oil prices. This historic rally, the largest weekly percentage gain in the history of oil futures trading, has fundamentally rewritten the earnings outlook

Via MarketMinute · March 12, 2026

The first full week of March 2026 will likely be remembered as the moment the "soft landing" narrative finally met its match. Investors were hit with a potent "Catalyst Cocktail"—a toxic mix of a stalling labor market, a geopolitical explosion in oil prices, and a sudden collapse of key

Via MarketMinute · March 12, 2026

The global financial landscape is currently undergoing a shift of historic proportions, driven by the rapid evolution and integration of artificial intelligence (AI). As of mid-March 2026, the initial "hype cycle" that characterized much of 2024 and 2025 has matured into a fundamental restructuring of how business is conducted, how

Via MarketMinute · March 12, 2026

As of March 12, 2026, the financial landscape has undergone a startling transformation. The long-standing dominance of high-growth technology stocks has faltered, giving way to an unexpected champion: the Consumer Staples sector. In a historic "decoupling" of market segments, investors have aggressively rotated out of speculative AI ventures and into

Via MarketMinute · March 12, 2026

As the global financial community prepares for NVIDIA’s (NASDAQ:NVDA) annual GPU Technology Conference (GTC), scheduled to begin on March 16, 2026, in San Jose, the stakes have never been higher for the semiconductor giant and the broader artificial intelligence sector. Often dubbed the "Super Bowl of AI," this

Via MarketMinute · March 12, 2026

The economic narrative of 2026 has taken an unexpected and stubborn turn. According to data released this week, the Core Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred inflation gauge—rose to an annual rate of 3.0% in February. This milestone marks a frustrating departure from

Via MarketMinute · March 12, 2026

As the Federal Open Market Committee (FOMC) prepares for its pivotal March 17-18, 2026, meeting, a heavy silence has descended upon the nation’s capital. The Federal Reserve’s mandatory "quiet period," which began on March 7, has effectively muzzled central bank officials, leaving investors to navigate a sea of

Via MarketMinute · March 12, 2026

As of March 12, 2026, the financial landscape has undergone a seismic shift that few predicted with such velocity: the long-awaited "Great Rotation." After three years of dominance by artificial intelligence and mega-cap technology firms, capital is aggressively flowing out of Silicon Valley and into the "Real Economy"—specifically the

Via MarketMinute · March 12, 2026

Marvell Technology (NASDAQ:MRVL) has officially signaled a turnaround in its fiscal fourth-quarter 2026 earnings report, delivering record-breaking revenue and profit figures that have effectively pulled the semiconductor designer out of a prolonged period of market skepticism. Reporting on March 5, 2026, the company posted a blowout quarter driven by

Via MarketMinute · March 12, 2026

As the semiconductor industry hurtles toward a projected $1 trillion in annual sales, all eyes have turned to Broadcom Inc. (NASDAQ: AVGO) as it navigates a period of intense market scrutiny. Despite its pivotal role in the global AI infrastructure build-out, the company’s stock has recently weathered a turbulent

Via MarketMinute · March 12, 2026

In a historic session for the retail sector, Costco Wholesale Corporation (NASDAQ: COST) officially crossed the $1,000 share price threshold on March 5, 2026, marking a new era for the membership-based warehouse giant. The milestone occurred just hours before the company released its fiscal second-quarter 2026 earnings report, which

Via MarketMinute · March 12, 2026

The S&P 500 has officially triggered a "mini death cross," a bearish technical signal where the 20-day moving average crosses below the 50-day moving average, signaling a sharp deterioration in market momentum. This development, occurring in early March 2026, has sent ripples through Wall Street as the index struggles

Via MarketMinute · March 12, 2026

The S&P 500 (INDEXSP: .INX) plummeted to a closing level of 6,740 on March 12, 2026, marking its lowest point since mid-December and signaling a potentially grueling shift in market regime. This decline represents a decisive breach of both the 50-day and 100-day moving averages, technical levels that

Via MarketMinute · March 12, 2026

The global energy landscape has been thrust into a state of acute crisis as West Texas Intermediate (WTI) crude oil prices surged past the $90 per barrel threshold this week, fueled by a dramatic military escalation between the United States and Iran. Following the effective closure of the Strait of

Via MarketMinute · March 12, 2026

The U.S. labor market sent shockwaves through global financial centers following the release of the February 2026 employment report, which revealed a staggering net loss of 92,000 jobs. This figure stood in stark contrast to economist expectations of a 70,000-job gain, marking the sharpest divergence from consensus

Via MarketMinute · March 12, 2026

As American households prepare for the 2026 summer grilling season, the traditional center-of-the-plate staple is becoming a luxury item. According to data from Barchart and the latest reports from Feedlot Magazine, the livestock market is entering the warmer months characterized by a "Beef Super-Cycle"—a period of structural scarcity that

Via MarketMinute · March 12, 2026

As of March 12, 2026, the global aluminum market is navigating a period of intense volatility and structural shifts, with prices on the London Metal Exchange (LME) surging to nearly four-year highs between $3,269 and $3,544 per tonne. While the industry entered the year with cautious optimism, a

Via MarketMinute · March 12, 2026

As of March 12, 2026, the global mining landscape is witnessing a historic capital pivot as BHP (NYSE: BHP; ASX: BHP) accelerates a massive $10 billion to $14 billion investment strategy in Chile. This aggressive multi-year roadmap is designed to secure the company’s dominance in the copper market, which

Via MarketMinute · March 12, 2026

The honeymoon phase for commodity bulls has come to a screeching halt. After two years of historic price surges that sent the cost of chocolate and caffeine to eye-watering heights, the "softs" market has entered a period of violent correction. In February 2026, cocoa futures plummeted by more than 31%

Via MarketMinute · March 12, 2026

The global agricultural sector is facing a period of intense volatility as of March 12, 2026, driven by a perfect storm of geopolitical escalation and climatic instability. In February 2026, Chicago Board of Trade (CBOT) soybean and wheat futures surged by more than 8%, a rally that has caught the

Via MarketMinute · March 12, 2026

As of March 12, 2026, the global silver market is grappling with a paradigm shift that has seen the "poor man’s gold" evolve into a premier strategic asset. The iShares Silver Trust (NYSE Arca: SLV) has delivered a staggering performance, gaining over 150% in the past twelve months. Currently

Via MarketMinute · March 12, 2026

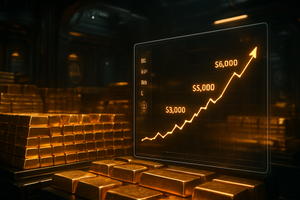

The global financial landscape reached a historic inflection point this week as gold prices shattered the psychological $5,000 per ounce ceiling in London, signaling a seismic shift in investor sentiment. Driven by a volatile cocktail of escalating military conflict in the Middle East and a shocking contraction in the

Via MarketMinute · March 12, 2026

The natural gas market has entered a period of unprecedented turbulence, shifting from a historic price collapse in February to a geopolitical powder keg in March. After natural gas futures plummeted by 29% in February 2026, the market outlook has turned "haywire," as traders pivot from domestic oversupply fears to

Via MarketMinute · March 12, 2026

As of March 12, 2026, the global commodity markets are witnessing a generational shift as copper futures firmly hold their ground above the $5.90 per pound mark. Once a mere barometer for global industrial health, "Doctor Copper" has evolved into the indispensable backbone of the two most significant technological

Via MarketMinute · March 12, 2026

The global energy landscape has been thrust into a state of high-velocity volatility as of March 2026, marking what many analysts are calling the "Third Great Oil Shock." In a stunning reversal from the relative stability seen at the start of the year, oil prices have undergone a violent upward

Via MarketMinute · March 12, 2026

As of March 12, 2026, the global financial landscape is undergoing a structural realignment that is fundamentally altering how wealth is preserved for the next generation. The traditional 60/40 asset allocation model—a cornerstone of conservative investing for nearly half a century—is being dismantled in favor of a

Via MarketMinute · March 12, 2026

As of March 12, 2026, the global financial landscape has witnessed a tectonic shift in the valuation of precious metals, driven not by retail speculation, but by the relentless "base load demand" of the world’s most powerful central banks. Over the past two years, gold has shed its reputation

Via MarketMinute · March 12, 2026

NEW YORK — In a historic display of resilience, spot gold prices surged on Wednesday, March 11, 2026, firmly reclaiming territory above the $5,000 mark and signaling a potential end to the volatility that has gripped the precious metals market since the start of the year. As of the market

Via MarketMinute · March 12, 2026

The financial landscape shifted decisively in late February 2026 as gold mining equities finally decoupled from their underlying bullion, entering a rare "outperformance mode" that has sent shockwaves through global markets. After nearly fifteen years of trading at a discount relative to the price of gold, the VanEck Gold Miners

Via MarketMinute · March 12, 2026

The global commodities market has entered a period of unprecedented turbulence, punctuated by a historic "flash-rally" and a subsequent sharp correction in precious metals. As of March 12, 2026, investors are still reeling from the events of the past two weeks, which saw gold prices breach the psychological $5,400

Via MarketMinute · March 12, 2026