News

Bread Financial (BFH) Q4 2025 Earnings Transcript

Via The Motley Fool · January 29, 2026

On Jan. 28, 2026, Fed caution barely moved markets as investors watch AI and tech earnings closely.

Via The Motley Fool · January 29, 2026

This fintech has momentum heading into 2026 with some clear catalysts to send the stock even higher.

Via The Motley Fool · January 29, 2026

Financial services company Bread Financial (NYSE:BFH) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 5.3% year on year to $975 million. Its non-GAAP profit of $2.07 per share was significantly above analysts’ consensus estimates.

Via StockStory · January 29, 2026

As silver prices continue to set new highs, pundits speculate about supply issues, market manipulation, and inflation fears.

Via Talk Markets · January 29, 2026

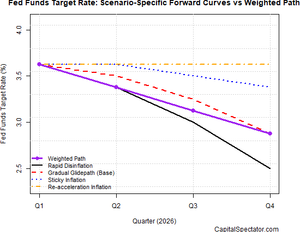

At its January 2026 meeting, the US Federal Reserve left the federal funds rate unchanged in the 3.50-3.75% range, fully meeting market expectations.

Via Talk Markets · January 29, 2026

Alongside Germany, the UK and Italy, France sports a significant portion of the European retail sector (14%) at USD 756.60 Billion in 2025. The market is projected to grow at a CAGR of 3.10% between 2025 and 2034 to reach USD 1,026.72 Billion by 2034.

Via AB Newswire · January 29, 2026

GBank Financial (GBFH) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 29, 2026

As usual, the Federal Reserve did exactly what everybody expected at its January meeting.

Via Talk Markets · January 29, 2026

We don't expect any changes from the European Central Bank at next week's meeting.

Via Talk Markets · January 29, 2026

Maxing out a credit card once can ding your score and flexibility, but the damage is usually temporary if you act fast.

Via The Motley Fool · January 29, 2026

The Federal Reserve left interest rates unchanged yesterday, as expected, but the challenges are increasing for identifying the right monetary policy for the path ahead.

Via Talk Markets · January 29, 2026

Regional banking company Valley National Bancorp (NASDAQ:VLY) announced better-than-expected revenue in Q4 CY2025, with sales up 12% year on year to $541.2 million. Its non-GAAP profit of $0.31 per share was 7.1% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Trump calls for immediate rate cuts, slams Powell over national security, as the Fed holds steady and gold and silver surge to record highs.

Via Benzinga · January 29, 2026

Don’t miss REX Shares’ Feb. 5 Webinar on using options to generate income and capitalize on volatility in the markets.

Via NewMediaWire · January 29, 2026

Don’t miss REX Shares’ Feb. 5 Webinar on using options to generate income and capitalize on volatility in the markets.

Via TheNewswire.com · January 29, 2026

Via PRLog · January 29, 2026

That’s what Powell keeps saying.

Via Talk Markets · January 29, 2026

He added that the U.S. should have a substantially lower rate while adding that Powell thinks that inflation is no longer a problem or threat.

Via Stocktwits · January 29, 2026

If you like dividend stocks, here's a high yielder, a Dividend King, and a turnaround story to consider as January comes to a close.

Via The Motley Fool · January 29, 2026

Mondelez International has underperformed the broader market over the past year, but analysts are moderately optimistic about the stock’s prospects.

Via Barchart.com · January 29, 2026

The largest expense for most companies is labor, so how a company chooses, manages, and pays its workforce can be a crucial consideration when evaluating it as an investment.

Via The Motley Fool · January 29, 2026

LTCRFP announces expansions to its specialized services guiding long-term care facility leaders through the pharmacy Request-For-Proposal process. The company helps administrators and directors of nursing evaluate pharmacy providers, reduce medication costs, and improve clinical outcomes through a structured RFP process.

Via Press Release Distribution Service · January 29, 2026

March S&P 500 E-Mini futures (ESH26) are up +0.17%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.19% this morning as investors digest earnings reports from big U.S. tech companies.

Via Barchart.com · January 29, 2026

EUR/USD treads water near 1.2000 after bouncing up from the 1.1900 area.

Via Talk Markets · January 29, 2026