News

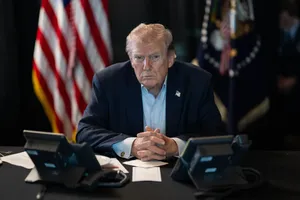

Oil whipsawed, with WTI briefly topping $119 before plunging toward the low $80s as Trump said the Iran war could end soon.

Via Stocktwits · March 9, 2026

Turn $25,000 into monthly passive income! Discover how a single TSX ETF, a TFSA, and a DRIP can build a bulletproof portfolio that pays you cash every single month, tax-free...

Via The Motley Fool · March 9, 2026

Many investors think a portfolio of stocks and bonds is diversified. The last few years have proven that's not always the case.

Via The Motley Fool · March 9, 2026

The calendar notations did not indicate the content of the 13 calls, each of which lasted 10 or 15 minutes, a report from Reuters said.

Via Stocktwits · March 9, 2026

Via Benzinga · March 9, 2026

Via Benzinga · March 9, 2026

Wall Street’s long-standing era of "unbridled optimism" came to a grinding halt this week as the CBOE Volatility Index (VIX) experienced a jarring 9.9% spike, landing at 23.57 and signaling a decisive shift toward a "risk-off" market environment. This sudden surge in the market's primary "fear gauge"

Via MarketMinute · March 9, 2026

The long-standing resilience of the equity markets faced its most grueling test last week as the S&P 500 decisively broke through critical technical floors that had anchored the bull market for nearly a year. In a series of sessions that analysts are describing as a "regime shift," the index

Via MarketMinute · March 9, 2026

Investors have ridden tech stocks and the S&P 500 for years. But the time for large-caps might finally be coming to an end.

Via The Motley Fool · March 9, 2026

XFUNDS' newly launched nuclear and defense ETFs target uranium and critical metals, highlighting growing investor focus on strategic supply chains.

Via Benzinga · March 9, 2026

Agriculture ETFs CORN, WEAT, and SOYB see surging volumes as Teucrium's Jake Hanley says war-driven energy and fertilizer shocks are lifting grain markets.

Via Benzinga · March 9, 2026

Via Benzinga · March 9, 2026

This is the biggest ETF in the world, but the details still matter.

Via The Motley Fool · March 9, 2026

The smart money is preparing for a breakdown in small-cap stocks.

Via Barchart.com · March 9, 2026

According to a post from a CBS News reporter on X, the president said in a phone interview that Iran did not have the military equipage to continue the war.

Via Stocktwits · March 9, 2026

There are different ways to approach investing in Nvidia. An option income strategy can deliver growth and yield.

Via The Motley Fool · March 9, 2026

Ethereum based crypto Pepeto just announced that the latest presale stage sold out in under 48 hours, and the team

Via First Publisher · March 9, 2026

Pepeto just announced an AI powered market protection system designed by the former Binance executive on the advisory board, and

Via First Publisher · March 9, 2026

Cathie Wood added CRWV, AMD, and AVGO across Ark Invest funds in February.

Via Barchart.com · March 9, 2026

A key principle of risk management is something that many investors ignore at their peril.

Via The Motley Fool · March 9, 2026

Via Benzinga · March 9, 2026

U.S. West Texas Intermediate futures expiring in April soared to a new 52-week high of $119.43 a barrel before cooling down slightly to hover at $95.53 at the time of writing.

Via Stocktwits · March 9, 2026

As the first quarter of 2026 draws to a close, Wall Street finds itself locked in a high-stakes waiting game. The upcoming April U.S. Jobs Report, which will detail labor market performance for the month of March, has become the primary focal point for investors, policymakers, and economists alike.

Via MarketMinute · March 9, 2026

The Iran war might not lead to a big spike in inflation -- but here's what to do just in case.

Via The Motley Fool · March 9, 2026