News

This Vanguard ETF offers international exposure with a 3.3% dividend yield.

Via The Motley Fool · March 13, 2026

As of March 13, 2026, the global financial markets are grappling with a complex convergence of "sticky" inflation, a massive federal deficit, and a Federal Reserve that appears increasingly backed into a corner. The release of the delayed January Personal Consumption Expenditures (PCE) index today has confirmed the market's worst

Via MarketMinute · March 13, 2026

As of March 13, 2026, the advanced battery sector has reached a definitive inflection point, moving beyond the "promise" phase of next-generation chemistries into high-volume industrial reality. At the center of this transition is Amprius Technologies, Inc. (NYSE: AMPX), a company that has spent over a decade perfecting silicon anode technology and is now reaping [...]

Via Finterra · March 13, 2026

In a historic shift for global capital markets, the SPDR Gold Shares (NYSE: GLD) has officially surpassed $180 billion in Assets Under Management (AUM), marking a definitive return to tangible stores of value. This milestone, reached this week on March 13, 2026, comes as institutional and retail investors lead a

Via MarketMinute · March 13, 2026

Explore how leverage levels, volatility, and sector focus set these popular ETFs apart for tactical traders seeking amplified returns.

Via The Motley Fool · March 13, 2026

Explore how differences in sector exposure, fees, and portfolio makeup could influence your next tech ETF pick.

Via The Motley Fool · March 13, 2026

Bitcoin has surged 20% from its February low — technically entering a bull market — as inflows into spot ETFs continue despite rising geopolitical tensions.

Via Benzinga · March 13, 2026

These ETFS track two different small-cap indexes. Which one is a better fit for you?

Via The Motley Fool · March 13, 2026

Bitcoin climbed to $72,000 on Friday, with Bitcoin ETFs seeing $53.9 million in net inflows on Thursday, while Ethereum ETFs reported $72.4 million in net inflows.

Via Benzinga · March 13, 2026

The news media may (once again) be stoking more fear than is genuinely merited.

Via The Motley Fool · March 13, 2026

Data from S3 Partners showed short interest in Coinbase has nearly doubled since the start of the year.

Via Stocktwits · March 13, 2026

Broadcom is one of several industry-leading companies that underpin the Vanguard High Dividend Yield ETF.

Via The Motley Fool · March 13, 2026

After seeing its jaw-dropping price appreciation over the long run, investors should certainly consider ways to gain Bitcoin exposure.

Via The Motley Fool · March 13, 2026

M&T Bank has trailed its large-cap peers over the past year, though analysts maintain a moderately positive outlook on the stock.

Via Barchart.com · March 13, 2026

Data from Stocktwits indicated that retail sentiment remains cautious, with a bearish outlook on SPY and QQQ.

Via Stocktwits · March 13, 2026

March 13, 2026 -- Real-World Asset (RWA) Tokenization Achieves Liquidity Breakthrough Amid Global Economic Volatility and Geopolitical Tensions

Via 24-7 Press Release · March 13, 2026

Fifth Third Bancorp has fallen behind peers recently, though analysts suggest the tide could turn with steadier momentum ahead.

Via Barchart.com · March 13, 2026

Japanese fintech major PayPay’s stock began trading on the Nasdaq Global Select Market on Thursday.

Via Stocktwits · March 13, 2026

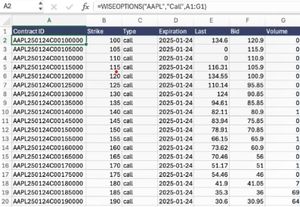

Toronto, ON - Wisesheets, the financial data platform that delivers institutional-grade market data directly inside Microsoft Excel and Google Sheets, today announced that its Pro plan now includes full options chain data coverage, making it the only spreadsheet-based tool to offer real-time options data for under $10 per month.

Via Get News · March 12, 2026

Mohamed El-Erian warned that new developments in the Iran conflict could trigger broader financial spillovers, including a “noticeable” shift toward cash.

Via Stocktwits · March 12, 2026

The Vanguard 0-3 Month Treasury Bill ETF invests in ultra-short U.S. Treasury securities, giving investors a way to earn short-term government yields while keeping interest-rate risk and portfolio volatility low.

Via The Motley Fool · March 12, 2026

The VYMI's value-oriented approach to international stocks might be better than VXUS.

Via The Motley Fool · March 12, 2026

Identical yields mask key differences in sector exposure and risk, making portfolio fit a crucial factor for income-focused investors.

Via The Motley Fool · March 12, 2026

As of March 12, 2026, the U.S. financial landscape is grappling with a "stagflation" narrative that has fundamentally shifted market expectations for the year ahead. Recent data releases have presented a dual-threat scenario: Q4 2025 GDP growth sputtered to a meager 1.4%, significantly hamstrung by a record-breaking 43-day

Via MarketMinute · March 12, 2026