Latest News

Via MarketBeat · January 20, 2026

Ryanair Turns Up Heat After Calling Press Briefing On Musk, Launches ‘Great Idiots Sale’ Taking Aim At SpaceX Ownerstocktwits.com

Via Stocktwits · January 20, 2026

Vistra is one of the largest competitive power generators in the U.S., and has emerged as a key player in the tech-fueled energy boom

Via Talk Markets · January 20, 2026

Strategy's stock is highly correlated to Bitcoin, although its returns are often at more extreme levels.

Via The Motley Fool · January 20, 2026

Despite a challenging year, the company has a lot to look forward to in the coming years.

Via The Motley Fool · January 20, 2026

Blackstone Shares Dive 5% As It Reportedly Weighs $5B-Plus Sale of Beacon Offshorestocktwits.com

Via Stocktwits · January 20, 2026

Rice was higher, the market might have finished a bottom formation on the daily and weekly charts.

Via Talk Markets · January 20, 2026

The Bitcoin maximalist expects the token's price to hit $1 million this year.

Via The Motley Fool · January 20, 2026

Is it finally time to bet on flying electric taxis?

Via The Motley Fool · January 20, 2026

Expense differences and metal exposure set these two ETFs apart, shaping their appeal for investors with distinct risk preferences.

Via The Motley Fool · January 20, 2026

Shares of carbonate fuel cell technology developer FuelCell Energy (NASDAQ:FCEL)

jumped 6.8% in the afternoon session after it announced a strategic collaboration with Sustainable Development Capital (SDCL) to explore providing power for data centers. The partnership planned to deploy up to 450 megawatts of FuelCell's advanced power systems to support the growth of data centers and other critical power needs around the world. This move was driven by the rapid expansion of artificial intelligence, which has created a surging demand for electricity that is outpacing what the traditional power grid can supply. The collaboration aimed to address this challenge by offering a direct power source that bypasses grid limitations, providing the steady, high-density power that modern data centers require.

Via StockStory · January 20, 2026

Shares of computer processor maker Intel (NASDAQ:INTC)

jumped 2.6% in the afternoon session after Wall Street signaled belief in the turnaround narrative, as the company received a dual vote of confidence from major analyst firms just days before its fourth-quarter earnings report.

Via StockStory · January 20, 2026

Shares of fertility benefits company Progyny (NASDAQ:PGNY)

jumped 3.3% in the afternoon session after Citizens upgraded the fertility benefits company's stock from Market Perform to Market Outperform, setting a price target of $30.00.

Via StockStory · January 20, 2026

Shares of behavioral health company Acadia Healthcare (NASDAQ:ACHC)

jumped 24% in the afternoon session after the company announced the departure of Christopher H. Hunter and immediately reappointed former CEO Debra K. Osteen to lead.

Via StockStory · January 20, 2026

Shares of electrical energy control systems manufacturer Powell (NYSE:POWL) jumped 3% in the afternoon session after Roth Capital raised its price target on the company's shares to $450 from $350, while maintaining a 'Buy' rating.

Via StockStory · January 20, 2026

Shares of pharmaceutical company Organon (NYSE:OGN)

jumped 8.9% in the afternoon session after reports surfaced that Sun Pharmaceutical Industries submitted a non-binding proposal to acquire the company.

Via StockStory · January 20, 2026

Shares of nutrition products company Bellring Brands (NYSE:BRBR)

jumped 9.5% in the afternoon session after a major industry peer validated the company's core growth thesis.

Via StockStory · January 20, 2026

Shares of health insurance company Clover Health (NASDAQ:CLOV) jumped 2.5% in the afternoon session after Canaccord Genuity maintained its 'Buy' rating and $3.70 price target on the company.

Via StockStory · January 20, 2026

The ‘Get Low’ collection has been removed from the firm’s website merely days after its debut, Bloomberg reported.

Via Stocktwits · January 20, 2026

The Greenland saga continues, and it also continues to be remarkably similar to what happened last year regarding the tariff war with China.

Via Talk Markets · January 20, 2026

Stay informed with the top movers within the S&P500 index on Tuesday.chartmill.com

Via Chartmill · January 20, 2026

The past couple of years have been challenging for the company. But this could be the beginning of a new chapter.

Via The Motley Fool · January 20, 2026

Here are the top movers in Tuesday's session.chartmill.com

Via Chartmill · January 20, 2026

U.S. stocks slid as Trump tariff threats tied to Greenland fueled risk-off trading, higher yields, and a weaker dollar.

Via Talk Markets · January 20, 2026

Alphabet's stock was up more than 65% in 2025.

Via The Motley Fool · January 20, 2026

The company on Friday had made two announcements in relation to Texas Critical Data Centers.

Via Stocktwits · January 20, 2026

Explore how differences in volatility, fund size, and costs shape the risk and role of these two precious metals investments.

Via The Motley Fool · January 20, 2026

Amazon and Microsoft are two crucial names in the artificial intelligence market, but if you can only buy one of them this year, which would you pick?

Via The Motley Fool · January 20, 2026

Two separate news items weighed on the stock today.

Via The Motley Fool · January 20, 2026

The CBOE Volatility Index (VIX), often hailed as the stock market’s “fear gauge,” surged past the critical 20.00 threshold on January 20, 2026, marking a significant shift in investor sentiment as the new year’s optimism collided with a wall of geopolitical and fundamental headwinds. Closing at 20.

Via MarketMinute · January 20, 2026

As the dust settles on the fourth-quarter earnings season of 2025, the financial sector has emerged as the undisputed titan of the S&P 500. Surpassing even the high-flying technology sector, financial institutions have reported a staggering 55% earnings growth rate in key sub-sectors, marking a definitive end to the

Via MarketMinute · January 20, 2026

The nuclear energy sector, once the darling of the artificial intelligence boom, faced a brutal reckoning this week as rumors of cloud infrastructure shifts turned into a stark regulatory reality. On Friday, January 16, 2026, shares of major independent power producers plummeted following a series of strategic pivots by Microsoft

Via MarketMinute · January 20, 2026

Choosing whether to own SiriusXM stock may come down to one's investment goals.

Via The Motley Fool · January 20, 2026

As the dawn of 2026 breaks over Wall Street, the era of the "Magnificent 7" moving as a monolithic force has officially come to an end. Once the collective engine of the global equity markets, this elite group of technology titans is now defined more by its internal divisions than

Via MarketMinute · January 20, 2026

Morgan Stanley's investment arm buys a $110M advanced manufacturing property in Fremont, CA. Adds to $1.5B portfolio of US industrial assets.

Via Benzinga · January 20, 2026

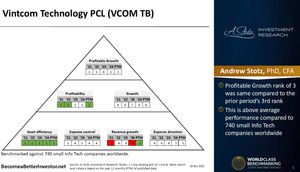

Vintcom Technology Public Company Limited is a Digital Transformation Enabler providing IT solutions and consulting in Thailand and Cambodia.

Via Talk Markets · January 20, 2026

Meta Platforms and Walt Disney are compelling buys for value investors in the new year.

Via The Motley Fool · January 20, 2026

Exactly one year ago, the American consumer—long considered the indomitable engine of the global economy—hit a sudden and jarring roadblock. On February 14, 2025, the U.S. Commerce Department released a retail sales report for January that sent shockwaves through Wall Street: a 0.9% broad-based decline that

Via MarketMinute · January 20, 2026

The American manufacturing sector has finally crossed the threshold into expansion territory, with the latest Institute for Supply Management (ISM) Manufacturing PMI rising to 50.9. This mark represents the strongest performance for the sector in nearly a year, sparking a flurry of optimism on Wall Street and suggesting that

Via MarketMinute · January 20, 2026

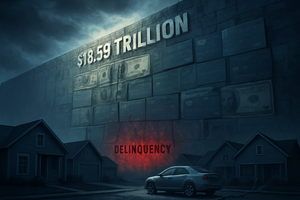

As of January 20, 2026, the American consumer is navigating a financial landscape defined by a staggering milestone: total household debt has officially surged past the $18 trillion mark, settling at a record $18.59 trillion. While the headline figure represents a massive expansion of credit, the underlying data reveals

Via MarketMinute · January 20, 2026

The digital asset market faced a stern reality check on January 20, 2026, as Bitcoin (BTC), the world’s premier cryptocurrency, tumbled below the critical $90,000 psychological support level. This breach triggered a synchronized sell-off across the equity markets, specifically targeting companies whose balance sheets and business models are

Via MarketMinute · January 20, 2026

I sold my shares, but I may have made a huge mistake.

Via The Motley Fool · January 20, 2026

As the markets reopened following the Martin Luther King Jr. Day holiday on January 20, 2026, the financial world found itself gripped by a paradoxical tug-of-war. The yield on the US 10-year Treasury note—a global benchmark for borrowing costs—settled at 4.26%, a level that reflects a complex

Via MarketMinute · January 20, 2026

Palantir Technologies (NYSE:PLTR) is currently navigating a period of intense market turbulence, with its share price sliding nearly 25% from its all-time high of $207.52 reached in early November 2025. As of January 20, 2026, the stock is trading near the $167 level, reflecting a sharp "valuation showdown"

Via MarketMinute · January 20, 2026

As of January 20, 2026, the dust has finally settled on one of the most tumultuous chapters in the history of the artificial intelligence infrastructure boom. Super Micro Computer, Inc. (Nasdaq: SMCI), once the stock market’s "AI darling," is navigating a new reality as a high-volume, lower-margin industrial giant.

Via MarketMinute · January 20, 2026

Comments from U.S. Treasury Secretary Scott Bessent at the World Economic Forum in Davos have reignited speculation around a formal U.S.

Via Benzinga · January 20, 2026

Halliburton is one of the first oil companies to report quarterly results since U.S. military action in Venezuela. Will the country be a key topic?

Via Benzinga · January 20, 2026

As the financial world settles into early 2026, all eyes have turned toward Omaha, where Berkshire Hathaway (NYSE:BRK.B) has just cemented its status as the world’s most formidable financial fortress. In a period defined by market volatility and shifting interest rate expectations, Berkshire’s recent financial disclosures

Via MarketMinute · January 20, 2026

The first weeks of 2026 have brought a sudden gust of wind to the sails of Nike (NYSE: NKE), with shares climbing more than 5% as institutional confidence returns to the footwear giant. The rally, which gathered steam following a series of insider purchases and high-profile analyst upgrades, reached a

Via MarketMinute · January 20, 2026