Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

We’re getting close to the February natural gas expiration, which is going to create some extreme volatility, but March may play catch-up if the temperatures start to plummet again.

Via Talk Markets · January 28, 2026

The UK’s leading stock market index, the FTSE 100, suffered losses on Wednesday, weighed down by declines in banking and healthcare stocks.

Via Talk Markets · January 28, 2026

Telekom Austria combines modest price growth with a steady dividend, suggesting returns may come about equally from income and gradual share appreciation.

Via Talk Markets · January 28, 2026

Amazon is laying off about 16,000 more employees as it works to cut bureaucracy and respond to growing competition from AI.

Via Talk Markets · January 28, 2026

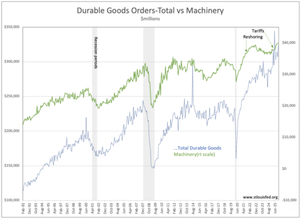

Taking out the volatile Aircraft orders, Durable Goods continues to reflect decent economic expansion. This is as expected and investors should maintain a positive equities outlook.

Via Talk Markets · January 28, 2026

Stocks dipped early then reversed, reinforcing that this choppy, event-heavy market (FOMC + big tech earnings) favors quick intraday profit-taking over swing trends, with only a shaky USD bounce so far.

Via Talk Markets · January 28, 2026

After a prolonged period of calm in the foreign exchange space, the currency market has been jolted awake by a surge in dollar selling.

Via Talk Markets · January 28, 2026

Uranium is about to follow Silver’s parabolic lead.

Via Talk Markets · January 28, 2026

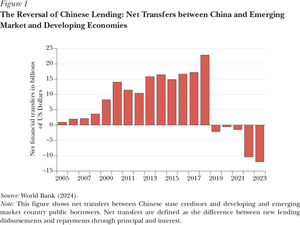

Lending from state-owned Chinese banks to developing countries took off around 2010.

Via Talk Markets · January 28, 2026

Australia’s CPI beat expectations, with services and housing inflation staying persistently above target, while labour data remains resilient. Together, these strengthen the case for a cautious 25bp RBA hike in February

Via Talk Markets · January 28, 2026

HYPEUSD approached key Fibonacci support during its ABC correction, and recent price action shows bulls regaining control, signaling potential further upside.

Via Talk Markets · January 28, 2026

The January regional Fed reports suggest that headline activity and new orders continue to improve, and at an improving pace (after a pause in December).

Via Talk Markets · January 28, 2026

The Australian Dollar is trading sideways against the US Dollar on Wednesday, as the Greenback finds some footing ahead of the Federal Reserve’s interest rate decision due...

Via Talk Markets · January 28, 2026

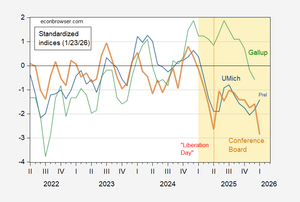

A one standard deviation drop is no small thing. Actual at 85.4 vs. 90.5 Bloomberg consensus, down from upwardly revised 94.2.

Via Talk Markets · January 28, 2026

Global markets are entering a new macro regime marked by broad US dollar weakness.

Via Talk Markets · January 28, 2026

Tuesday saw the dollar sell-off extend across the board.

Via Talk Markets · January 28, 2026

Cable remained bullish as the dollar sell-off continues across the board.

Via Talk Markets · January 28, 2026

Google joins a $425M funding round for Redwood Materials to scale battery recycling and storage. This move supports a circular supply chain for EVs and renewable energy, aligning with Google’s goal for carbon-free operations by 2030.

Via Talk Markets · January 28, 2026

Automatic Data Processing, Inc. beat Q2 expectations with EPS of $2.62 and revenue of $5.4 billion, and raised its full-year outlook on continued business momentum.

Via Talk Markets · January 28, 2026

The sell-off in PINS stock seems at least somewhat warranted considering the ongoing ad market pressures, monetization gaps, and the short-term pain from the restructuring.

Via Talk Markets · January 28, 2026

The Bank of Canada is widely expected to leave its key interest rate unchanged on Wednesday.

Via Talk Markets · January 28, 2026

In this video, Ira Epstein covers a range of financial topics in his Morning Flash Update for January 28, 2026. He discusses the mixed performance in the stock market, notably the decline in the Dow due to fallout from healthcare shares...

Via Talk Markets · January 28, 2026

Traders preparing for FOMC Wednesday should focus on

Via Talk Markets · January 27, 2026

This analysis challenges the traditional

Via Talk Markets · January 27, 2026

The oil markets had a mixed day today.

Via Talk Markets · January 27, 2026

Confidence in the economy fell sharply in January, slumping to a 12-year low, according to the Conference Board latest survey data.

Via Talk Markets · January 28, 2026

The first bit of data on the Italian economy for 2026 points to a continuation of a gradual recovery, with services and manufacturing as a supply-side driver.

Via Talk Markets · January 28, 2026

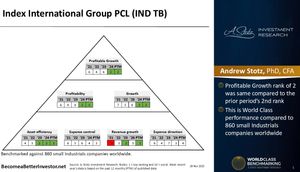

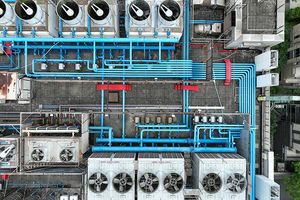

Index International Group Public Company Limited is a consulting and engineering design firm.

Via Talk Markets · January 28, 2026

Markets head into today’s FOMC decision expecting little in the way of policy fireworks, with the Fed widely forecast to hold rates steady at 3.50 to 3.75% after three consecutive cuts late last year.

Via Talk Markets · January 28, 2026

President Trump's comments sent the dollar spiraling lower yesterday.

Via Talk Markets · January 28, 2026

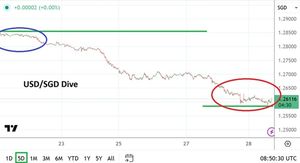

USD/SGD has plunged to decade lows amid heavy USD selling and pre-Fed volatility, rewarding momentum traders but demanding tight risk control in case of sharp reversals.

Via Talk Markets · January 28, 2026

Comparative analysis of Ford vs. Tesla stock for 2025 and 2026.

Via Talk Markets · January 28, 2026

Some European pension funds and other foreign buyers are trimming their exposure to US stocks.

Via Talk Markets · January 28, 2026

EUR/USD reached 1.2000 on Wednesday after rising to 1.2082 the previous evening, marking a strong four-day rally.

Via Talk Markets · January 28, 2026

Find out the spring pattern that's trapping the bear, the exact price level that bulls must defend, the volume secret that told me to buy when everyone else was selling, and the next big move.

Via Talk Markets · January 28, 2026

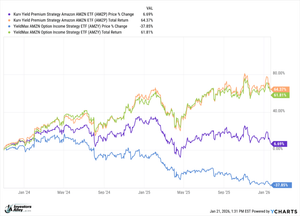

YieldMax ETFs began offering single-stock covered call exchange-traded funds in November 2022, with Tesla as the underlying stock.

Via Talk Markets · January 28, 2026

The Federal Reserve sets monetary policy in the United States with two main goals in mind.

Via Talk Markets · January 28, 2026

Oil held the trading zone between support 58.80 and resistance 62.60.

Via Talk Markets · January 28, 2026

The GBP/USD forecast points to further gains to 1.4000 provided the Fed shows a dovish stance in today’s meeting.

Via Talk Markets · January 28, 2026

Gold rises to another record high as the USD drops. Will the Fed spur a pullback? FTSE slips after the pound hit a 4-year high.

Via Talk Markets · January 28, 2026

Today, the Bank of Canada will hold its scheduled monetary policy meeting.

Via Talk Markets · January 28, 2026

AT&T reported Q4 earnings of $0.52 per share on $33.5 billion in revenue, beating expectations as fiber and wireless growth continued to drive results.

Via Talk Markets · January 28, 2026

Today’s rate decision from the Fed comes against a backdrop of an impending announcement from Trump over who will be the next Fed chair.

Via Talk Markets · January 28, 2026

The Fed is set to announce its monetary policy decision on Wednesday amid growing concerns about its autonomy.

Via Talk Markets · January 28, 2026

Investors often assume that avoiding bubbles entails foregoing opportunities to profit from innovation.

Via Talk Markets · January 28, 2026

The technical picture is a recent strong rise, with the price having just reached a major round number at $0.7000, which is starting to act as resistance.

Via Talk Markets · January 28, 2026

Indian share markets are trading higher with the Sensex trading 381 points higher, and the Nifty is trading 119 points higher.

Via Talk Markets · January 28, 2026

Bitcoin price remained in a tight range on Wednesday as investors continued to focus on the booming stock market and commodity prices.

Via Talk Markets · January 28, 2026

West Texas Intermediate (WTI) Oil price depreciates after registering 2.86% gains in the previous session, trading around $62.40 per barrel during the European hours on Wednesday.

Via Talk Markets · January 28, 2026

UPS has decided to permanently retire its fleet of 27 MD-11 aircraft and take a $137 million after-tax write off instead of returning the widebody freighters to service.

Via Talk Markets · January 28, 2026

As two portfolio-worthy value stocks to consider, the idea of buying GM stock for higher highs and picking up IVZ shares on the dip is very tempting following their Q4 reports.

Via Talk Markets · January 28, 2026

The Japanese Yen remains on the back foot amid a rebounding US Dollar heading into the European session as bulls pause for a breather following a three-day rally to a nearly three-month high, touched the previous day.

Via Talk Markets · January 28, 2026

SanDisk shares have been melting higher over recent months as its role in the broader AI frenzy finally comes into focus.

Via Talk Markets · January 28, 2026

The EUR/USD pair attracts some sellers to near 1.1990, snapping the four-day winning streak during the early European session on Wednesday.

Via Talk Markets · January 28, 2026

Markets kept flattish along their separate trajectories today, with the Nasdaq and S&P 500 opening the session in the green, the small-cap Russell 2000 riding the zero-balance for most of the day...

Via Talk Markets · January 27, 2026

LLY is surging as its weight-loss duopoly remains a 2026

Via Talk Markets · January 27, 2026

PetroChina has told traders not to buy or trade Venezuela’s oil - a trade that is now under U.S. control after the capture of Nicolas Maduro, trading sources with knowledge of the matter told Reuters on Tuesday.

Via Talk Markets · January 27, 2026

Although rates on other instruments appear to be firming up and even rising, it seems that mortgage rates are very close to moving substantially lower.

Via Talk Markets · January 27, 2026

In this video, Ira Epstein discusses the current state of the financial markets, highlighting the impact of the US government's insufficient Medicare payment increase on healthcare stocks...

Via Talk Markets · January 27, 2026

Revaluing US gold from $42/oz to market rates could inject $1T into the Treasury without new debt. Aimed at boosting the economy before the 2026 midterms, this move is bullish for stocks and gold but risks long-term inflation by 2027.

Via Talk Markets · January 27, 2026

So while the S&P 500 grinds higher, mainly due to the implied volatility dispersion trade ahead of earnings from the mega-cap technology names, implied volatility on the index is rising, too.

Via Talk Markets · January 27, 2026

US money market balances are near a record $8T as cautious investors seek safety amid low consumer sentiment. What does the US money market balance tell us, and what does it mean for investors?

Via Talk Markets · January 27, 2026

Unlike the 2022 UK crisis, Japan’s rising bond yields coincide with climbing stock prices. This suggests growth-driven rates rather than a fiscal crash, though markets remain wary of PM Takaichi’s tax pause ahead of the upcoming snap election.

Via Talk Markets · January 27, 2026

Gold price (XAU/USD) rises to near a fresh record high around $5,160 during the early Asian session on Wednesday.

Via Talk Markets · January 27, 2026

GBP/USD is well on its way to a second straight week of strong gains as the US Dollar (USD) gives up the ghost on the back of ongoing trade war rhetoric undercutting the Greenback’s strength.

Via Talk Markets · January 27, 2026

The AI boom is creating huge opportunities for plenty of companies besides the giant tech names.

Via Talk Markets · January 27, 2026

Gold and silver are increasingly being treated as real collateral in a world burdened by unsustainable debt, currency debasement, and geopolitical fragmentation.

Via Talk Markets · January 27, 2026

Gold and silver came in struggling, but rocketed higher in the late day trade as the Dollar continued its cascading decline.

Via Talk Markets · January 27, 2026

Silver rises over 5% weekly as US trade-war tensions revive aggressive 'sell America' positioning.

Via Talk Markets · January 27, 2026

A falling dollar makes imports more expensive. Trump is cheering inflation.

Via Talk Markets · January 27, 2026

At the press conference following the Federal Reserve's rate decision, Chair Powell is not likely to talk about the things we want to know.

Via Talk Markets · January 27, 2026

Japan’s bond market is blowing up.

Via Talk Markets · January 27, 2026

The explosive growth of AI data centers has ignited unprecedented demand for NAND flash and other memory solutions, propelling Micron Technology from a stagnant performer to a market darling.

Via Talk Markets · January 27, 2026

No doubt the USD is losing in value in nominal terms against a basket of currencies as well gold, since the weekend.

Via Talk Markets · January 27, 2026

Today it was the turn of the S&P and Nasdaq to make their moves as the Russell 2000 takes a rest after its breakout.

Via Talk Markets · January 27, 2026