Latest News

Amazon and Microsoft are two crucial names in the artificial intelligence market, but if you can only buy one of them this year, which would you pick?

Via The Motley Fool · January 20, 2026

Two separate news items weighed on the stock today.

Via The Motley Fool · January 20, 2026

The CBOE Volatility Index (VIX), often hailed as the stock market’s “fear gauge,” surged past the critical 20.00 threshold on January 20, 2026, marking a significant shift in investor sentiment as the new year’s optimism collided with a wall of geopolitical and fundamental headwinds. Closing at 20.

Via MarketMinute · January 20, 2026

Via Benzinga · January 20, 2026

As the dust settles on the fourth-quarter earnings season of 2025, the financial sector has emerged as the undisputed titan of the S&P 500. Surpassing even the high-flying technology sector, financial institutions have reported a staggering 55% earnings growth rate in key sub-sectors, marking a definitive end to the

Via MarketMinute · January 20, 2026

The nuclear energy sector, once the darling of the artificial intelligence boom, faced a brutal reckoning this week as rumors of cloud infrastructure shifts turned into a stark regulatory reality. On Friday, January 16, 2026, shares of major independent power producers plummeted following a series of strategic pivots by Microsoft

Via MarketMinute · January 20, 2026

Choosing whether to own SiriusXM stock may come down to one's investment goals.

Via The Motley Fool · January 20, 2026

As the dawn of 2026 breaks over Wall Street, the era of the "Magnificent 7" moving as a monolithic force has officially come to an end. Once the collective engine of the global equity markets, this elite group of technology titans is now defined more by its internal divisions than

Via MarketMinute · January 20, 2026

Morgan Stanley's investment arm buys a $110M advanced manufacturing property in Fremont, CA. Adds to $1.5B portfolio of US industrial assets.

Via Benzinga · January 20, 2026

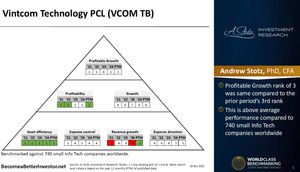

Vintcom Technology Public Company Limited is a Digital Transformation Enabler providing IT solutions and consulting in Thailand and Cambodia.

Via Talk Markets · January 20, 2026

Meta Platforms and Walt Disney are compelling buys for value investors in the new year.

Via The Motley Fool · January 20, 2026

Exactly one year ago, the American consumer—long considered the indomitable engine of the global economy—hit a sudden and jarring roadblock. On February 14, 2025, the U.S. Commerce Department released a retail sales report for January that sent shockwaves through Wall Street: a 0.9% broad-based decline that

Via MarketMinute · January 20, 2026

The American manufacturing sector has finally crossed the threshold into expansion territory, with the latest Institute for Supply Management (ISM) Manufacturing PMI rising to 50.9. This mark represents the strongest performance for the sector in nearly a year, sparking a flurry of optimism on Wall Street and suggesting that

Via MarketMinute · January 20, 2026

Citi’s target cuts underscore that DDOG, FSLY, and TEAM face real AI‑driven competitive pressure and stretched multiples, so investors may want to exit or reduce positions before the market fully reprices these names for a slower, more crowded post‑A...

Via Barchart.com · January 20, 2026

March NY world sugar #11 (SBH26 ) on Tuesday closed down -0.24 (-1.60%). March London ICE white sugar #5 (SWH26 ) closed down -5.30 (-1.24%). Sugar prices retreated on Tuesday amid ramped-up production in India. On Monday, the India Sugar Mill Asso...

Via Barchart.com · January 20, 2026

March ICE NY cocoa (CCH26 ) on Tuesday closed down -428 (-8.43%). March ICE London cocoa #7 (CAH26 ) closed down -302 (-8.28%). Cocoa prices plunged on Tuesday, with NY cocoa posting a 2-year nearest-futures low and London cocoa posting a 2.25-year...

Via Barchart.com · January 20, 2026

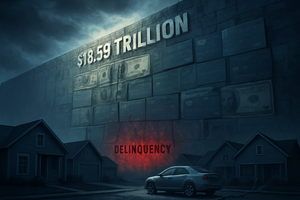

As of January 20, 2026, the American consumer is navigating a financial landscape defined by a staggering milestone: total household debt has officially surged past the $18 trillion mark, settling at a record $18.59 trillion. While the headline figure represents a massive expansion of credit, the underlying data reveals

Via MarketMinute · January 20, 2026

March arabica coffee (KCH26 ) on Tuesday closed down -8.80 (-2.48%). March ICE robusta coffee (RMH26 ) closed down -75 (-1.87%). Coffee prices settled sharply lower on Tuesday, with arabica falling to a 2-week low. Forecasts for rain in Brazil's co...

Via Barchart.com · January 20, 2026

The digital asset market faced a stern reality check on January 20, 2026, as Bitcoin (BTC), the world’s premier cryptocurrency, tumbled below the critical $90,000 psychological support level. This breach triggered a synchronized sell-off across the equity markets, specifically targeting companies whose balance sheets and business models are

Via MarketMinute · January 20, 2026

I sold my shares, but I may have made a huge mistake.

Via The Motley Fool · January 20, 2026

As the markets reopened following the Martin Luther King Jr. Day holiday on January 20, 2026, the financial world found itself gripped by a paradoxical tug-of-war. The yield on the US 10-year Treasury note—a global benchmark for borrowing costs—settled at 4.26%, a level that reflects a complex

Via MarketMinute · January 20, 2026

Palantir Technologies (NYSE:PLTR) is currently navigating a period of intense market turbulence, with its share price sliding nearly 25% from its all-time high of $207.52 reached in early November 2025. As of January 20, 2026, the stock is trading near the $167 level, reflecting a sharp "valuation showdown"

Via MarketMinute · January 20, 2026

As of January 20, 2026, the dust has finally settled on one of the most tumultuous chapters in the history of the artificial intelligence infrastructure boom. Super Micro Computer, Inc. (Nasdaq: SMCI), once the stock market’s "AI darling," is navigating a new reality as a high-volume, lower-margin industrial giant.

Via MarketMinute · January 20, 2026

Comments from U.S. Treasury Secretary Scott Bessent at the World Economic Forum in Davos have reignited speculation around a formal U.S.

Via Benzinga · January 20, 2026

Halliburton is one of the first oil companies to report quarterly results since U.S. military action in Venezuela. Will the country be a key topic?

Via Benzinga · January 20, 2026

As the financial world settles into early 2026, all eyes have turned toward Omaha, where Berkshire Hathaway (NYSE:BRK.B) has just cemented its status as the world’s most formidable financial fortress. In a period defined by market volatility and shifting interest rate expectations, Berkshire’s recent financial disclosures

Via MarketMinute · January 20, 2026

The first weeks of 2026 have brought a sudden gust of wind to the sails of Nike (NYSE: NKE), with shares climbing more than 5% as institutional confidence returns to the footwear giant. The rally, which gathered steam following a series of insider purchases and high-profile analyst upgrades, reached a

Via MarketMinute · January 20, 2026

In Trump’s twisted vision, Venezuela, Canada, and Greenland are part of the USA.

Via Talk Markets · January 20, 2026

A major dynamic that's led to some unusual market action of late could be on the verge of a sweeping reversal.

Via The Motley Fool · January 20, 2026

The momentum that propelled the stock market to record heights in early January came to a grinding halt in February 2025, as a "perfect storm" of persistent inflation and geopolitical policy shifts battered investor confidence. The technology-heavy Nasdaq Composite led the retreat, suffering a 4% decline—its worst monthly performance

Via MarketMinute · January 20, 2026

Ondas Holdings shares are trading higher on Tuesday after several Wall Street analysts raised their price targets on the stock.

Via Benzinga · January 20, 2026

Geopolitical tensions are driving precious metals to outperform. Six large-cap miners with high quality scores and strong profit margins are Hecla Mining, DRDGold, and Kinross Gold.

Via Benzinga · January 20, 2026

Tesla, Inc. (NASDAQ:TSLA) shares are facing a brutal start to 2026, dropping significantly in early January as investors react to a harrowing set of sales figures from the European market. Following a year that many analysts are calling a "bloodbath" for the electric vehicle (EV) pioneer in the European

Via MarketMinute · January 20, 2026

Positive earnings outlook for US solar companies: steady growth, strong bookings momentum, policy uncertainties fade.

Via Benzinga · January 20, 2026

As the financial world braces for the upcoming 2026 fiscal year-end reports, the shadow of last year’s mid-cycle performance continues to loom large over the retail sector. On January 20, 2026, market analysts are still dissecting the "Great Retail Divergence" of early 2025—a pivotal moment when the two

Via MarketMinute · January 20, 2026

Dogecoin (CRYPTO: DOGE) is down 4%over the past 24 hours, despite the Dogecoin Foundation’s corporate arm launching a new payments app called “Such̶

Via Benzinga · January 20, 2026

These all have incredible long-term opportunities.

Via The Motley Fool · January 20, 2026

The American consumer is retreating into a defensive posture as the new year begins. The Conference Board announced today, January 20, 2026, that its Consumer Confidence Index fell to 98.3, an eight-month low that significantly missed economist expectations of 102.7. This decline reflects a deepening sense of unease

Via MarketMinute · January 20, 2026

As the clock struck noon on January 20, 2026, marking exactly one year since the second inauguration of President Donald J. Trump, the financial markets were greeted not with a celebratory rally, but with a sharp spike in volatility. The "Trump Trade," which once fueled optimism through deregulation and tax

Via MarketMinute · January 20, 2026

Figma stock is trading lower Tuesday morning trading as investors rotated out of high-growth software names following fresh trade tensions with Europe.

Via Benzinga · January 20, 2026

As the financial world reflects on the economic milestones of the past year, few data points stand out as vividly as the January PCE inflation report. Released in late February 2025, the report revealed a headline year-over-year cooling to 2.5%—marking the first significant deceleration in price pressures in

Via MarketMinute · January 20, 2026

These S&P500 stocks are the most active in today's sessionchartmill.com

Via Chartmill · January 20, 2026

One of Detroit's icons, Ford Motor Company, ended 2025 with strong sales momentum, and the data answered lingering questions facing investors.

Via The Motley Fool · January 20, 2026

The artificial intelligence titan NVIDIA Corporation (NASDAQ: NVDA) continues to rewrite the record books, reporting a massive Fourth Quarter revenue beat of $39.3 billion, well ahead of analyst expectations. However, the celebration on Wall Street was short-lived. Despite the blistering top-line growth, the company’s stock suffered a sharp

Via MarketMinute · January 20, 2026

United States Antimony Corp (NYSE: UAMY) shares are trading higher on Tuesday after the company announced it has acquired a fully operational critical‑minerals flotation facility.

Via Benzinga · January 20, 2026

Via Benzinga · January 20, 2026

Regional banking company BOK Financial (NASDAQ:BOKF) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 12.7% year on year to $592.1 million. Its non-GAAP profit of $2.48 per share was 14.8% above analysts’ consensus estimates.

Via StockStory · January 20, 2026

Via Benzinga · January 20, 2026