Latest News

The mid-January earnings gauntlet has turned into a freezing reality for the titans of American finance. In the first three weeks of 2026, the "Big Four" US banks have collectively surrendered more than $50 billion in market capitalization, a staggering retreat driven by a perfect storm of legislative threats and

Via MarketMinute · January 20, 2026

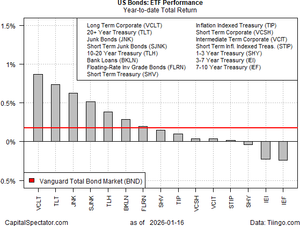

Maturity risk has been in favor so far this year in the bond market.

Via Talk Markets · January 20, 2026

In a move that has sent shockwaves through the financial sector and the corridors of Capitol Hill, President Donald Trump officially endorsed the Credit Card Competition Act (CCCA) on January 13, 2026. Characterizing the prevailing credit card "swipe fees" as a "hidden tax" and an "out-of-control ripoff" on the American

Via MarketMinute · January 20, 2026

Via Benzinga · January 20, 2026

TSLA Stock Falls Below 100-DMA For First Time In Over Six Months – Retail Expects Shares To Hit $400 Mark Soonstocktwits.com

Via Stocktwits · January 20, 2026

TTE stock rose on 2025 oil and gas production expectations, with 4% full-year growth and improved segment performance.

Via Benzinga · January 20, 2026

The "AI-driven energy trade," which dominated Wall Street headlines throughout 2024 and 2025, faced its harshest reality check to date this week. On January 16, 2026, shares of Constellation Energy (NASDAQ: CEG) plummeted 9.8%, marking the stock’s steepest single-day decline in nearly a year. The sell-off, which wiped

Via MarketMinute · January 20, 2026

The stock for this memory storage specialist is up over 1,000% in that span.

Via The Motley Fool · January 20, 2026

On Friday, January 16, 2026, Micron Technology (NASDAQ: MU) shares ignited a massive rally, surging 7.7% to reach a fresh all-time high of $368.50. This leap, which continued to stabilize through the morning of January 20, marks a definitive shift in the semiconductor landscape, as the "memory supercycle"

Via MarketMinute · January 20, 2026

MU Stock Garners Attention Amid Analyst Target Hikes — How Much Upside Does Retail Expect?stocktwits.com

Via Stocktwits · January 20, 2026

CoreWeave is an AI infrastructure company growing rapidly. Is CRWV a good stock to own right now?

Via Barchart.com · January 20, 2026

So far in 2026, the Magnificent 7 are not moving together. Let's take a look at who's up, who's down, and what comes next for these tech-stock darlings.

Via Barchart.com · January 20, 2026

WASHINGTON, D.C. — January 20, 2026 — Exactly one year after Donald Trump was sworn in as the 47th President of the United States, a new kind of ticker tape is dominating the financial landscape. It isn't tracking the S&P 500 or the price of gold, but rather the specific syllables spoken by the Commander-in-Chief. [...]

Via PredictStreet · January 20, 2026

March arabica coffee (KCH26 ) today is down -8.25 (-2.32%). March ICE robusta coffee (RMH26 ) is down -77 (-1.92%). Coffee prices are sharply lower today on forecasts of rain in Brazil's coffee-growing regions throughout this week, which have eased...

Via Barchart.com · January 20, 2026

Salesforce Inc (CRM) shares have dropped to a price level that has been support in the past. There is a chance it rallies.

Via Benzinga · January 20, 2026

Our top technical strategist takes a closer look at a big-money straddle trade that crossed the tape on LQD during Friday’s session.

Via Barchart.com · January 20, 2026

As New York City enters the first weeks of the Zohran Mamdani administration, political analysts and financial traders alike are looking back at the 2025 mayoral race not just for its ideological shift, but as a watershed moment for the prediction market industry. For the first time in a major U.S. municipal election, real-time betting [...]

Via PredictStreet · January 20, 2026

In a dramatic shift of sentiment for the high-performance computing sector, Super Micro Computer (NASDAQ:SMCI) saw its stock price rocket 11.01% on Friday, January 16, 2026, closing at $32.64. This double-digit rally marks a significant "relief" moment for a company that spent much of 2025 battling intense

Via MarketMinute · January 20, 2026

Why chasing a portfolio number sabotages financial independence. The Finish Line Fallacy explained—and what to focus on instead.

Via Benzinga · January 20, 2026

In a move that has sent shockwaves through the real estate industry and the broader financial markets, the White House formally announced a proposal on January 7, 2026, to ban large institutional investors from purchasing single-family homes. Aimed at addressing a national housing affordability crisis that has persisted despite cooling

Via MarketMinute · January 20, 2026

As of January 20, 2026, a fundamental shift has occurred in the plumbing of global finance. For decades, the "tape"—the real-time feed of stock and bond prices—was the undisputed source of truth for traders. Today, that tape has a rival. Professional desks at major banks and hedge funds are increasingly turning to prediction markets like [...]

Via PredictStreet · January 20, 2026

FuelCell Energy shares are trading higher Tuesday morning following the announcement of a collaboration with Sustainable Development Capital

Via Benzinga · January 20, 2026

French approval of C3IV tax credits—covering 45% of equipment costs and €130M for real estate—is driving the stock surge. The government is also weighing additional support for hiring and training programs.

Via Talk Markets · January 20, 2026

AstraZeneca plans to delist from Nasdaq and move to the NYSE, while its breast cancer drug Enhertu enters European regulatory review after strong trial results.

Via Benzinga · January 20, 2026

As of January 20, 2026, the prediction market world is grappling with a new reality: the prospect of a federal ban on government employees and politicians trading the very outcomes they influence. Prompted by a suspicious $400,000 windfall on the offshore platform Polymarket, Congressman Ritchie Torres (D-NY) has formally introduced the Public Integrity in Financial [...]

Via PredictStreet · January 20, 2026

The financial world is reeling following the unprecedented disclosure that the U.S. Department of Justice (DOJ) has launched a formal criminal investigation into Federal Reserve Chair Jerome Powell. The probe, which centers on allegations of false statements regarding a multi-billion dollar renovation project at the Federal Reserve’s headquarters,

Via MarketMinute · January 20, 2026

As of January 20, 2026, the global commodities markets are witnessing an unprecedented flight to safety. Gold prices have surged to a staggering record high of $4,740 per ounce, while silver has shocked the industrial world by climbing toward $95.50 per ounce. This dramatic appreciation in precious metals

Via MarketMinute · January 20, 2026

As the Federal Reserve prepares for its first policy meeting of 2026 on January 27–28, a significant shift has occurred in how the financial world anticipates interest rate decisions. The traditional dominance of professional economic surveys and even standard bond-market derivatives is being challenged by prediction markets like Kalshi and Polymarket. For the upcoming January [...]

Via PredictStreet · January 20, 2026

In a move that has sent shockwaves through the global media and technology sectors, Electronic Arts (NASDAQ: EA) has officially entered the final stages of a $56.5 billion leveraged buyout (LBO). The deal, which was announced in late 2025 and is finalizing as of January 20, 2026, represents the

Via MarketMinute · January 20, 2026

Private equity firm Renovus Partners has sold its portfolio company Pillr Health to Water Street Healthcare Partners.

Via Benzinga · January 20, 2026

As the NFL post-season reaches its fever pitch, the prediction market landscape is signaling a seismic shift in the professional football hierarchy. With Super Bowl LX just weeks away, the Seattle Seahawks have defied preseason expectations to become the definitive favorites to lift the Lombardi Trophy. According to the latest data from the regulated prediction [...]

Via PredictStreet · January 20, 2026

ServiceNow partners with OpenAI in a three-year deal to embed ChatGPT-powered AI into enterprise workflows, aiming to boost automation and reignite growth after a steep stock decline.

Via Benzinga · January 20, 2026

As of January 2026, the global technology landscape is recalibrating following the largest acquisition in the history of Alphabet Inc. (NASDAQ: GOOGL). The tech giant’s $32 billion definitive agreement to acquire cloud security leader Wiz marks a watershed moment for the industry, signaling a shift from general cloud infrastructure

Via MarketMinute · January 20, 2026

This tech juggernaut is building multiple revenue streams to monetize its AI technology.

Via The Motley Fool · January 20, 2026

US Bancorp reported strong fourth-quarter results beating estimates and providing in-line guidance for 2026.

Via Benzinga · January 20, 2026

On Tuesday, gold prices surged to around 4670 USD per ounce, reaching a new record.

Via Talk Markets · January 20, 2026

UK stocks faced significant pressure on Tuesday, driven by a wave of global risk aversion following President Trump's announcement of potential tariffs on European nations.

Via Talk Markets · January 20, 2026

As the 2026 legislative session kicks off in Albany, a high-stakes battle is unfolding over the future of decentralized and regulated forecasting in the Empire State. New York lawmakers are currently scrambling to pass legislation that could either legitimize prediction markets as the next frontier of finance or crush them under the weight of "reckless [...]

Via PredictStreet · January 20, 2026

The American consumer has once again defied gravity, as the U.S. Census Bureau’s delayed report on November retail sales showed a robust 0.6% increase, significantly outpacing the 0.4% gain projected by Wall Street. This surge, released on January 14, 2026, after a 43-day federal government shutdown

Via MarketMinute · January 20, 2026

These 6 financial moves may feel responsible but they're actually holding you back.

Via Benzinga · January 20, 2026

As of January 20, 2026, the American financial landscape is facing a seismic shift as the White House’s proposed 10% cap on credit card interest rates moves from a campaign-trail firebrand to a looming regulatory reality. The mandate, which President Trump aggressively revived earlier this month, seeks to provide

Via MarketMinute · January 20, 2026

February WTI crude oil (CLG26 ) today is up +0.94 (+1.58%), and February RBOB gasoline (RBG26 ) is up +0.0354 (+1.98%). Crude oil and gasoline prices recovered from early losses today and rallied sharply after the dollar index (DXY00 ) tumbled to a 2...

Via Barchart.com · January 20, 2026

Don't let these blunders upend your finances.

Via The Motley Fool · January 20, 2026

The sudden and dramatic capture of Nicolás Maduro by U.S. special operations forces in early January 2026 sent shockwaves through the global political landscape. However, for those watching the prediction markets, the real explosion happened hours before the first Delta Force helicopter crossed the Venezuelan border. A single, anonymous trader placed a high-stakes bet that [...]

Via PredictStreet · January 20, 2026

Goldman Sachs (NYSE: GS) has delivered a resounding message to the financial world with its fourth-quarter 2025 earnings, reporting a massive $4.38 billion quarterly profit that signals a definitive end to the "dealmaking winter." The investment banking giant surpassed analyst expectations by a wide margin, fueled by a 25%

Via MarketMinute · January 20, 2026

As the second year of the second Trump administration begins on this January 20, 2026, the political world is already looking toward the horizon of 2028. While traditional pundits often wait for the midterm results to declare favorites, prediction market traders have already reached a consensus. Vice President JD Vance has solidified his position as [...]

Via PredictStreet · January 20, 2026

Wells Fargo & Company (NYSE: WFC) reported a fourth-quarter 2025 earnings miss that underscored the high cost of its multi-year transformation. The San Francisco-based lender posted earnings per share (EPS) of $1.62, falling short of the $1.67 consensus estimate. While the headline figure disappointed investors, the miss was primarily

Via MarketMinute · January 20, 2026

Adobe's stock faces AI headwinds but shows signs of undervaluation and potential recovery through business evolution, with analysts still bullish on its prospects.

Via Barchart.com · January 20, 2026

In a quarter defined by the messy resolution of long-standing geopolitical entanglements, Citigroup (NYSE: C) reported a sharp 13.4% decline in fourth-quarter profits for 2025, driven primarily by a $1.2 billion accounting loss tied to its final departure from the Russian market. The results, released on January 14,

Via MarketMinute · January 20, 2026