Vanguard Intermediate-Term Corporate Bond ETF (VCIT)

83.76

-0.25 (-0.30%)

NASDAQ · Last Trade: Dec 12th, 9:45 AM EST

Detailed Quote

| Previous Close | 84.01 |

|---|---|

| Open | 83.79 |

| Day's Range | 83.76 - 83.81 |

| 52 Week Range | 74.28 - 84.84 |

| Volume | 81,342 |

| Market Cap | - |

| Dividend & Yield | 4.008 (4.79%) |

| 1 Month Average Volume | 10,279,066 |

Chart

News & Press Releases

As the calendar turns towards 2026, the fixed income landscape is drawing significant attention from investors, largely due to persistently elevated long-end yields and the anticipation of further monetary policy adjustments by the Federal Reserve. This confluence of factors is setting the stage for a compelling environment for bond investments,

Via MarketMinute · December 11, 2025

Three Vanguard bond ETFs stand out as potential winners for 2026.

Via The Motley Fool · December 11, 2025

This Fund Sold Its $5 Million EPAM Stake Amid the Stock's Steep, Years-Long Decline

Via The Motley Fool · November 4, 2025

These are the best Vanguard ETFs that investors can consider for 2023, given macroeconomic uncertainties in the market.

Via InvestorPlace · January 16, 2023

Major Fixed Income ETF Bought, as Investment Management Firm Reshuffles Its Portfolio

Via The Motley Fool · October 30, 2025

Towerpoint Wealth Sells Over $2.5 Million VCIT Shares

Via The Motley Fool · October 29, 2025

Focused Wealth Expands VCIT Stake to Strengthen Portfolio Balance

Via The Motley Fool · October 28, 2025

Via The Motley Fool · October 17, 2025

ETF buyers invested $18.3B in US-listed funds, using a barbell strategy to allocate between growth and safety.

Via Benzinga · August 26, 2025

Via The Motley Fool · August 11, 2025

Via The Motley Fool · July 14, 2025

This figure not only tops all other ETFs industry-wide but also underscores a growing divergence in investor behavior.

Via Benzinga · June 23, 2025

Via The Motley Fool · April 14, 2025

Via The Motley Fool · March 16, 2025

Low-beta ETFs provide stability and minimize risk for investors amid market uncertainty. Options include bond, gold, and muni bond ETFs.

Via Benzinga · March 6, 2025

U.S. bond market faces volatility as Trump's policies could push yields up. Fed's rate cuts may not ease borrowing costs.

Via Benzinga · November 11, 2024

The Fed is expected to reduce interest rates at the FOMC meeting, with a 25 or 50 basis point cut. Investors are betting on a 50 basis point cut and are reshuffling their portfolios, favoring value-oriented ETFs and gold.

Via Benzinga · September 17, 2024

A little number-crunching reveals the nation's Social Security beneficiaries are slowly but surely losing buying power.

Via The Motley Fool · August 19, 2024

Although there are 32 Vanguard ETFs in the top 100 U.S.-listed ETFs by assets, some smaller ones are worth exploring.

Via InvestorPlace · April 25, 2024

When interest rates fall, bond prices rise. And while it has been some time since we’ve been able to say interest rates are dropping, the past few months have done just that.

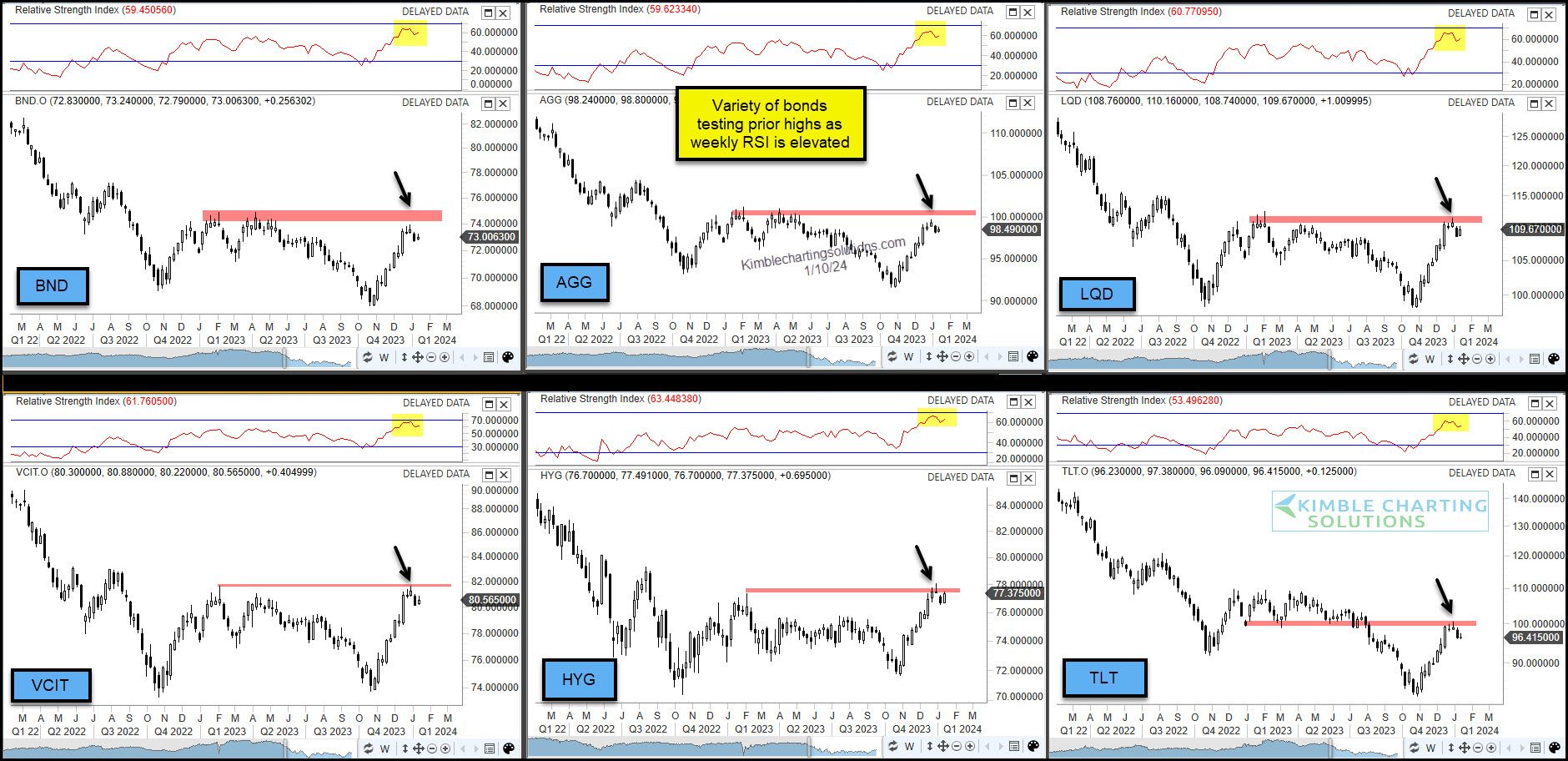

Via Talk Markets · January 11, 2024

If you are looking for safe havens to turn to in 2024 then you should consider adding these investments to your portfolio.

Via InvestorPlace · December 28, 2023

BlackRock Inc sees rate cuts in second half of 2024. Shape of the yield curve to be key drivers of returns. ETFs could be good investment vehicles.

Via Benzinga · December 14, 2023

Can the stock market's strong performance following the midterm elections keep going?

Via The Motley Fool · August 3, 2023

The complexities of forecasting in 2023 include: The market is betting on Fed rate cuts and a soft landing; is that a reasonable assumption? What will break the logjam?

Via Talk Markets · May 13, 2023

If we examine the market's current tolerance for risk, is it pointing to a soft landing, mild recession, or something much worse?

Via Talk Markets · April 14, 2023