Target Corp (TGT)

113.34

-3.35 (-2.87%)

NYSE · Last Trade: Feb 23rd, 7:52 PM EST

WASHINGTON, D.C. — The global trading order has descended into a state of unprecedented paralysis this week as the Trump administration’s sudden pivot to a 15% universal import surcharge triggered an immediate and fierce international backlash. By February 23, 2026, the diplomatic "peace-for-security" deals painstakingly negotiated over the past

Via MarketMinute · February 23, 2026

The United States Supreme Court delivered a stunning blow to the administration’s trade agenda on Friday, February 20, 2026, striking down the use of the International Emergency Economic Powers Act (IEEPA) to bypass Congress in the imposition of broad-based national tariffs. In a 6-3 decision, the Court ruled that

Via MarketMinute · February 23, 2026

The global financial markets are reeling this Monday, February 23, 2026, as a historic "tariff whiplash" has sent the benchmark 10-year Treasury yield tumbling to its lowest level in three months. In a classic "flight to quality," investors are aggressively rotating out of riskier assets and into the safety of

Via MarketMinute · February 23, 2026

The retail world is currently processing a whirlwind of data after Walmart Inc. (NYSE: WMT) released its fourth-quarter fiscal 2026 earnings on February 19, 2026. The report, which surpassed analyst expectations across nearly every key metric, offers a vital window into the state of the American shopper following a year

Via MarketMinute · February 23, 2026

In a weekend move that has sent shockwaves through global markets, President Donald Trump announced a new 15% global import surcharge, invoking the long-dormant Section 122 of the Trade Act of 1974. The announcement follows a stinging defeat at the Supreme Court on Friday, February 20, 2026, which invalidated the

Via MarketMinute · February 23, 2026

In a landmark 6–3 decision that has sent shockwaves through the global economy, the United States Supreme Court ruled on February 20, 2026, that the President cannot unilaterally impose sweeping tariffs under the International Emergency Economic Powers Act (IEEPA). The decision in the consolidated cases of Learning Resources, Inc.

Via MarketMinute · February 23, 2026

The dream of a "pivot" to lower interest rates in early 2026 has been dealt a staggering blow following the release of the latest Personal Consumption Expenditures (PCE) price index. On February 23, 2026, investors are grappling with data that confirms inflation is not merely "sticky" but potentially re-accelerating, forcing

Via MarketMinute · February 23, 2026

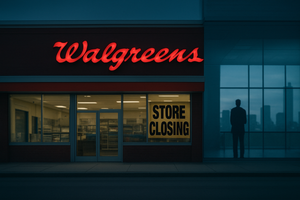

DEERFIELD, IL — February 23, 2026 — In a move that underscores the continued volatility of the American retail pharmacy landscape, the newly private Walgreens Boots Alliance has announced a significant expansion of its workforce reductions and a finalized timeline for its massive store closure initiative. Under the leadership of the private

Via MarketMinute · February 23, 2026

WASHINGTON D.C. — In a weekend that has fundamentally reshaped the American economic landscape, President Trump has officially signed an executive proclamation raising global tariffs to a uniform 15%. This aggressive maneuver follows a Friday afternoon bombshell from the Supreme Court, which struck down the administration's previous "reciprocal" tariff framework.

Via MarketMinute · February 23, 2026

In a weekend that has sent shockwaves through global financial centers, President Donald Trump has signed a sweeping executive order imposing a 15% across-the-board global tariff. This move, announced late Saturday, February 21, 2026, serves as a direct and aggressive counter-maneuver to a landmark Supreme Court ruling issued just one

Via MarketMinute · February 23, 2026

A lot of companies hit hard by tariffs could get back on track under a kinder climate.

Via The Motley Fool · February 23, 2026

In a highly anticipated financial disclosure released this week, retail giant Walmart Inc. (NYSE:WMT) reported fourth-quarter earnings that surpassed Wall Street’s expectations on both the top and bottom lines. The company posted record-breaking quarterly revenue of $190.7 billion, driven by a surge in high-income households flocking to

Via MarketMinute · February 20, 2026

In a watershed moment for the global retail industry, Amazon.com Inc. (NASDAQ: AMZN) has officially surpassed Walmart Inc. (NYSE: WMT) in annual revenue for the first time in history. For decades, Walmart stood as the undisputed titan of commerce, a symbol of brick-and-mortar dominance that once seemed untouchable. However,

Via MarketMinute · February 20, 2026

The United States economy hit a significant speed bump in the final stretch of 2025, with Fourth Quarter Gross Domestic Product (GDP) growing at a lackluster 1.4% annualized rate. The figure, released earlier this morning, fell sharply short of the 2.5% to 3.0% growth range projected by

Via MarketMinute · February 20, 2026

In a day of breakneck legal and economic shifts, President Donald Trump has reignited his trade war strategy just hours after suffering a major setback at the nation’s highest court. Following a morning ruling by the U.S. Supreme Court that dismantled his administration's broad emergency tariff authorities, the

Via MarketMinute · February 20, 2026

In a historic 6-3 decision that reshaped the landscape of American trade policy, the U.S. Supreme Court on February 20, 2026, struck down the sweeping "emergency" tariffs imposed by President Donald Trump under the International Emergency Economic Powers Act (IEEPA). The ruling in Learning Resources Inc. v. Trump declared

Via MarketMinute · February 20, 2026

Can the retail giant's new CEO revive its struggling business?

Via The Motley Fool · February 20, 2026

The S&P 500 (^GSPC) briefly crossed the psychological and technical threshold of 7,000 in early February 2026, a momentous occasion that underscored the market's relentless drive toward an artificial intelligence-integrated future. This milestone, occurring less than two years after the index first breached 5,000, reflects a period

Via MarketMinute · February 20, 2026

The American consumer has once again defied expectations, steering the U.S. economy toward a "soft landing" as retail sales staged a robust recovery in January 2026. Following a stagnant December that was marred by a 43-day federal government shutdown and late-year economic "data fog," the latest figures from the

Via MarketMinute · February 20, 2026

Walmart Inc. (NYSE: WMT), the world's largest retailer and a primary bellwether for the American consumer economy, sent shockwaves through the financial markets this week after issuing a cautious financial outlook for the 2026 calendar year. Citing the volatile impact of "Liberation Day" tariffs and persistent inflation in general merchandise,

Via MarketMinute · February 20, 2026

Investors weigh booming online sales against cautious profit guidance and fresh shareholder-return moves, today, Feb. 19, 2026.

Via The Motley Fool · February 19, 2026

Retail giant Walmart Inc. (NYSE:WMT) reported its fourth-quarter fiscal 2026 earnings on February 19, 2026, delivering a performance that exceeded analyst expectations on both revenue and earnings. Despite reaching a historic milestone of e-commerce profitability and announcing a massive $30 billion share repurchase program, the company’s stock faced

Via MarketMinute · February 19, 2026

In a move that underscores the shifting landscape of local commerce, Deutsche Bank has reaffirmed its "Buy" rating for DoorDash, Inc. (NASDAQ: DASH) as of February 19, 2026. The financial institution set a price target of $255, signaling a robust confidence in the company’s pivot from a simple food-delivery

Via MarketMinute · February 19, 2026

The U.S. economy displayed unexpected vigor this morning as the Department of Labor released the February 2026 employment figures, revealing that employers added 130,000 jobs last month. This figure dramatically outpaced the 75,000 positions anticipated by a consensus of Wall Street economists, signaling that the labor market

Via MarketMinute · February 19, 2026

Walmart Inc. (NYSE: WMT) reported a record-breaking fourth quarter for fiscal year 2025 today, surpassing analyst estimates on both the top and bottom lines driven by a surge in holiday spending and a robust e-commerce performance. Despite the revenue beat and the announcement of a massive $30 billion share buyback

Via MarketMinute · February 19, 2026