Cheniere Energy, Inc. Common Stock (LNG)

248.98

+2.91 (1.18%)

NYSE · Last Trade: Mar 4th, 6:28 PM EST

Detailed Quote

| Previous Close | 246.07 |

|---|---|

| Open | 245.30 |

| Bid | 248.20 |

| Ask | 251.77 |

| Day's Range | 241.14 - 249.67 |

| 52 Week Range | 186.20 - 255.78 |

| Volume | 2,893,654 |

| Market Cap | 62.22B |

| PE Ratio (TTM) | 10.31 |

| EPS (TTM) | 24.2 |

| Dividend & Yield | 2.220 (0.89%) |

| 1 Month Average Volume | 2,181,560 |

Chart

About Cheniere Energy, Inc. Common Stock (LNG)

Cheniere Energy is a leading energy company primarily engaged in the liquefied natural gas (LNG) sector. It focuses on the development and operation of LNG facilities in the United States, facilitating the production and export of LNG to international markets. By leveraging its integrated LNG infrastructure, Cheniere plays a significant role in enhancing energy security and diversification for its customers worldwide. The company is committed to providing reliable energy solutions while adhering to environmental and safety standards in its operations. Read More

News & Press Releases

The global energy market is reeling today, March 4, 2026, as the Strait of Hormuz remains effectively closed to commercial traffic following a dramatic escalation in the Middle East conflict. The Islamic Revolutionary Guard Corps (IRGC) of Iran initiated a total blockade of the 21-mile-wide waterway earlier this week, halting

Via MarketMinute · March 4, 2026

The global energy landscape fractured in spectacular fashion during February 2026, revealing a stark divergence between domestic abundance and international instability. While U.S. natural gas prices plummeted by a staggering 52% over the month, settling near $2.82/MMBtu, the rest of the energy complex moved in the opposite

Via MarketMinute · March 4, 2026

Cheniere Energy Inc (NYSE:LNG) Reports Q4 2025 Earnings Miss, Announces $10 Billion Share Buyback Programchartmill.com

Via Chartmill · February 26, 2026

The global commodity market is currently navigating a period of intense volatility as a series of short-term supply shocks clash with a looming long-term surplus. According to the World Bank’s latest Commodity Markets Outlook, the start of 2026 has been defined by a sharp reversal of the downward trend

Via MarketMinute · March 2, 2026

The European natural gas market, long considered to be stabilizing after the energy shocks of the early 2020s, has been plunged back into a state of high-alert volatility. As of March 2, 2026, the Dutch Title Transfer Facility (TTF) benchmark—the primary pricing index for European gas—has seen a

Via MarketMinute · March 2, 2026

Qatar’s Ministry of Defense on Monday confirmed that it was attacked by two drones from Iran.

Via Stocktwits · March 2, 2026

The U.S. Energy Information Administration (EIA) released its latest weekly storage report on February 26, 2026, confirming that the massive withdrawals triggered by mid-winter Arctic blasts have left domestic natural gas inventories at their lowest late-February levels in years. While the most recent weekly draw of 52 billion cubic

Via MarketMinute · February 27, 2026

In a definitive display of operational dominance and strategic timing, Cheniere Energy (NYSE: LNG) reported a staggering fourth-quarter 2025 earnings per share of $10.68 yesterday, February 26, 2026. This figure blew past analyst expectations of roughly $3.90, marking a watershed moment for the Houston-based liquefied natural gas (LNG)

Via MarketMinute · February 27, 2026

The global natural gas market has entered a period of unprecedented structural divergence, as a "perfect storm" of climatic and industrial factors reshaped the energy landscape in early 2026. While the United States grapples with a violent upward trajectory in domestic benchmarks—highlighted by a staggering 78.4% price spike

Via MarketMinute · February 27, 2026

Cheniere Energy (LNG) Q4 2025 Earnings Transcript

Via The Motley Fool · February 26, 2026

As of February 26, 2026, Cheniere Energy, Inc. (NYSE: LNG) stands as a titan of the global energy transition, representing the largest producer of liquefied natural gas in the United States and the second-largest operator globally. Following its latest Q4 and Full-Year 2025 earnings report, released today, the company finds itself at a critical juncture. [...]

Via Finterra · February 26, 2026

As of February 26, 2026, Cheniere Energy (NYSE: LNG) stands as the undisputed titan of the American liquefied natural gas (LNG) sector. At a time when global energy security remains at the forefront of geopolitical discourse, Cheniere’s role as the primary bridge between North American shale abundance and energy-hungry markets in Europe and Asia has [...]

Via Finterra · February 26, 2026

The natural gas market has undergone a dramatic reversal in late February 2026, as the "weather premium" that propelled prices to historic highs just weeks ago has completely evaporated. After a period of extreme volatility, natural gas prices have surrendered to persistent negative pressure, decisively breaking below the critical $3.

Via MarketMinute · February 26, 2026

Cheniere Energy, Inc. (“Cheniere”) (NYSE: LNG) today announced its financial results for the fourth quarter and full year 2025.

By Cheniere Energy, Inc. · Via Business Wire · February 26, 2026

Cheniere Energy, Inc. (“Cheniere” or the “Company”) (NYSE: LNG) announced today that its subsidiary, Cheniere Marketing International LLP (“Cheniere Marketing”), has entered into a long-term liquefied natural gas (“LNG”) sale and purchase agreement (“SPA”) with CPC Corporation, Taiwan (“CPC”).

By Cheniere Energy, Inc. · Via Business Wire · February 26, 2026

The era of broad-based commodity cycles, where a rising tide of global growth or a falling dollar lifted all boats, appears to have reached a definitive end. According to the February 2026 commodity price forecast released this week by Oxford Economics, the market is entering a phase of "widening dispersion.

Via MarketMinute · February 25, 2026

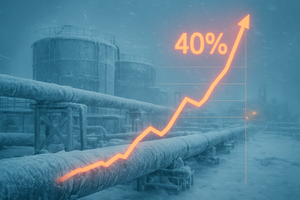

The U.S. Energy Information Administration (EIA) has sent shockwaves through the energy markets with the release of its February 2026 Short-Term Energy Outlook (STEO), significantly upwardly revising near-term natural gas price forecasts by a staggering 40%. The revision comes in the wake of "Winter Storm Fern," an aggressive Arctic

Via MarketMinute · February 25, 2026

US natural gas prices have undergone a violent transformation in early 2026, with the Henry Hub benchmark surging 78% to reach $7.82 per million British thermal units (MMBtu). This represents the highest sustained price level since the global energy crisis of late 2022, signaling a definitive end to the

Via MarketMinute · February 24, 2026

Cheniere Energy, Inc. (“Cheniere”) (NYSE: LNG) today celebrates the 10th anniversary of its first export cargo of liquefied natural gas (“LNG”).

By Cheniere Energy, Inc. · Via Business Wire · February 24, 2026

The United States energy market is reeling after a historic mid-winter "perfect storm" sent natural gas prices skyrocketing by more than 78% in the first weeks of 2026. This dramatic escalation, driven by a combination of record-breaking Arctic temperatures and structural supply constraints, has rippled through the broader economy, contributing

Via MarketMinute · February 23, 2026

The American energy landscape was sent into a tailspin in early 2026 as U.S. natural gas prices experienced a staggering 78.4% spike, a move that reverberated through global commodities and sent shockwaves across industrial and residential sectors. This unprecedented volatility was the primary driver behind a 12% surge

Via MarketMinute · February 20, 2026

In a month defined by atmospheric volatility, the U.S. natural gas market has undergone a historic convulsion. Prices on the New York Mercantile Exchange (NYMEX) recently skyrocketed, with front-month futures jumping a staggering 18.1% in a single session to settle at $7.8270 per million British thermal units

Via MarketMinute · February 19, 2026

In a move that significantly recalibrates the geopolitical and economic landscape of the Pacific, the United States and Taiwan finalized a sweeping trade agreement on February 13, 2026. This "U.S.–Taiwan Agreement on Reciprocal Trade" (ART) marks a transformative shift in bilateral relations, centering on a massive exchange: the

Via MarketMinute · February 17, 2026

The natural gas market faced a decisive technical breakdown today, February 17, 2026, as prices officially breached the long-held $3.20 per million British thermal units (MMBtu) support level. A combination of unseasonably warm weather forecasts and a federal storage report that failed to meet market expectations has sent the

Via MarketMinute · February 17, 2026

The United States natural gas market is currently navigating a period of extraordinary volatility, transitioning from a historic price surge in January to a rapid cooling phase as of February 11, 2026. Just weeks ago, Winter Storm Fern gripped the nation, driving spot prices to record highs and forcing the

Via MarketMinute · February 11, 2026