PayPal Holdings, Inc. - Common Stock (PYPL)

41.70

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 4th, 5:47 AM EST

Detailed Quote

| Previous Close | 41.70 |

|---|---|

| Open | - |

| Bid | 42.34 |

| Ask | 42.40 |

| Day's Range | N/A - N/A |

| 52 Week Range | 41.43 - 89.71 |

| Volume | 207,955 |

| Market Cap | 38.36B |

| PE Ratio (TTM) | 8.373 |

| EPS (TTM) | 5.0 |

| Dividend & Yield | 0.1400 (0.34%) |

| 1 Month Average Volume | 22,181,802 |

Chart

About PayPal Holdings, Inc. - Common Stock (PYPL)

PayPal Holdings is a leading digital payments platform that enables individuals and businesses to make and receive payments electronically. The company provides a secure and convenient way to conduct transactions online and through mobile devices, allowing users to link their bank accounts, credit cards, and debit cards to their PayPal accounts. With a focus on enhancing the user experience, PayPal offers a range of services including online money transfers, payment processing for e-commerce, and digital wallet solutions, empowering users to manage their finances and engage in global commerce seamlessly. Read More

News & Press Releases

Executives of big tech firms have taken to X to shed light and give insights into PayPal’s disappointing run over the past few years.

Via Stocktwits · February 4, 2026

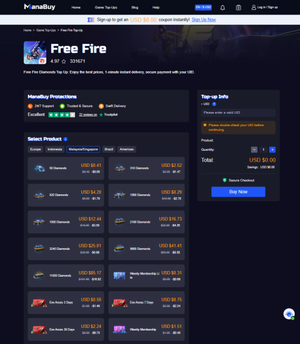

ManaBuy’s 2026 platform update enhances the Free Fire top-up experience with a faster purchase flow, clearer order tracking, improved local-currency checkout in select markets, quicker delivery after payment verification, and more competitive deals—while keeping transactions safer by fulfilling via the player’s UID without requiring passwords.

Via Binary News Network · February 4, 2026

AI Panic Hits Software, PayPal Faceplants, Walmart Joins the $1T Clubchartmill.com

Via Chartmill · February 4, 2026

Former CEO David Marcus slams PayPal's "lost soul" and "defensive" strategy as stock plunges 20% on stagnant 1% growth and CEO shake-up.

Via Benzinga · February 4, 2026

PayPal Stock Craters 20% On Earnings Miss; CEO Shake-Up Spooks Investorsstocktwits.com

Via Stocktwits · February 3, 2026

Digital payments platform PayPal (NASDAQ:PYPL) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.7% year on year to $8.68 billion. Its non-GAAP profit of $1.23 per share was 4.5% below analysts’ consensus estimates.

Via StockStory · February 4, 2026

The Russell 2000 (^RUT) is home to many small-cap stocks, offering investors the chance to uncover hidden gems before the broader market catches on.

However, these companies often come with higher volatility and risk, as their smaller size makes them more vulnerable to economic downturns.

Via StockStory · February 3, 2026

CEO Alex Chriss is stepping down.

Via The Motley Fool · February 3, 2026

Major U.S. indices closed lower on Tuesday, with the Dow Jones Industrial Average slipping 0.3% to 49,240.99.

Via Benzinga · February 3, 2026

Today, Feb. 3, 2026, investors are weighing a rare earnings stumble against fresh leadership, buybacks, and a balance-sheet reset.

Via The Motley Fool · February 3, 2026

PayPal Holdings, Inc. (NYSE:PYPL) stock plunged more than 20% Tuesday, following a triple threat of bad news: a surprise CEO shake-up, an earnings miss and a weak outlook

Via Benzinga · February 3, 2026

Today, Feb. 3, 2026, Walmart’s $1 trillion milestone stands out as rising bond yields and tech weakness drag major U.S. indexes lower.

Via The Motley Fool · February 3, 2026

Despite strength in defensive sectors and select earnings winners, a deepening selloff in enterprise software stocks and a sharp decline in PayPal Holdings Inc. weighed heavily on sentiment.

Via Talk Markets · February 3, 2026

Investors dumped technology stocks as they move to safer assets like Gold and Silver that rose today.

Via Stocktwits · February 3, 2026

Shares of digital payments platform PayPal (NASDAQ:PYPL) fell 19.8% in the afternoon session after the company reported fourth-quarter 2025 results that missed Wall Street's expectations for both revenue and earnings. The digital payments company posted revenue of $8.68 billion, a 3.7% increase year on year, but this fell short of analyst estimates of $8.78 billion. Its adjusted earnings per share of $1.23 also missed the consensus forecast of $1.29. While PayPal's pre-tax profit margin improved by 1.9 percentage points from the same quarter last year to 18.8%, the top- and bottom-line misses overshadowed this improvement. The report was broadly seen as weak, with the company failing to meet investor expectations and struggling to show strong momentum, leading to a significant sell-off in the stock.

Via StockStory · February 3, 2026

PayPal named a new CEO as Q4 earnings and full-year guidance missed Wall Street estimates. Here’s why PYPL stock isn’t worth buying despite its historically cheap valuation.

Via Barchart.com · February 3, 2026

Law Offices of Howard G. Smith announces an investigation on behalf of PayPal Holdings, Inc. (“PayPal” or the “Company”) (NASDAQ: PYPL) investors concerning the Company’s possible violations of federal securities laws.

By Law Offices of Howard G. Smith · Via Business Wire · February 3, 2026

The Law Offices of Frank R. Cruz announces an investigation of PayPal Holdings, Inc. (“PayPal” or the “Company”) (NASDAQ: PYPL) on behalf of investors concerning the Company’s possible violations of federal securities laws.

By The Law Offices of Frank R. Cruz · Via Business Wire · February 3, 2026

Which S&P500 stocks are moving on Tuesday?chartmill.com

Via Chartmill · February 3, 2026

Gaxos.AI Inc. announced on Tuesday that Amazon Web Services has committed to funding the preliminary development of its AI-powered sales coaching platform.

Via Stocktwits · February 3, 2026

Explore the S&P500 index on Tuesday and find out which stocks are the most active in today's session.chartmill.com

Via Chartmill · February 3, 2026

Fiserv shares are trading lower Tuesday after PayPal's latest earnings disappointed investors and raised fresh worries about the health of consumers and retail merchants.

Via Benzinga · February 3, 2026

Gary Black, managing partner of Future Fund, said in a post on X that PayPal’s limitation is that it is very expensive for sellers compared to other online payment providers.

Via Stocktwits · February 3, 2026

The fintech leader dropped like a rock, and it wasn't just because of an earnings miss.

Via The Motley Fool · February 3, 2026

Toast shares are sliding Tuesday after PayPal posted weaker-than-expected fourth-quarter results and withdrew its long-term financial targets.

Via Benzinga · February 3, 2026