Since July 2025, Genpact has been in a holding pattern, posting a small return of 1.4% while floating around $45.95. The stock also fell short of the S&P 500’s 8.2% gain during that period.

Given the weaker price action, is now a good time to buy G? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Do Investors Watch G Stock?

Originally spun off from General Electric in 2005 to provide business process services, Genpact (NYSE:G) is a global professional services firm that helps businesses transform their operations through digital technology, AI, and data analytics solutions.

Three Positive Attributes:

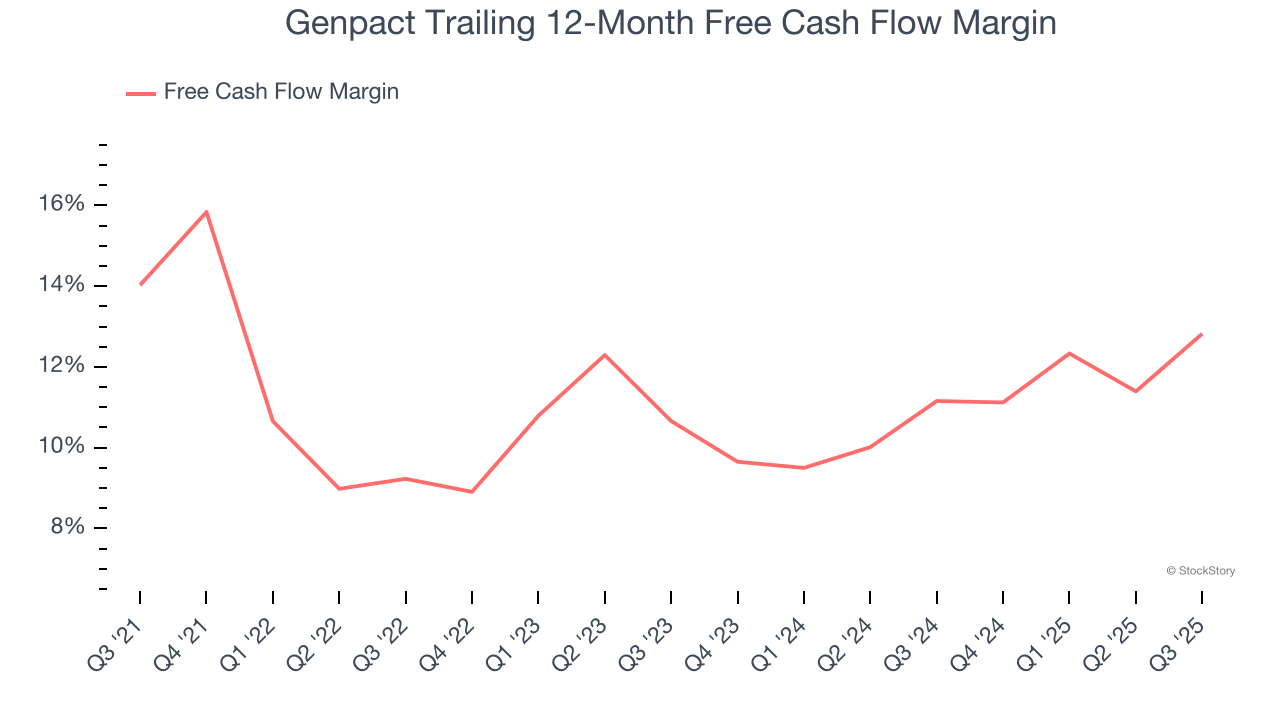

1. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Genpact has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.6% over the last five years, quite impressive for a business services business.

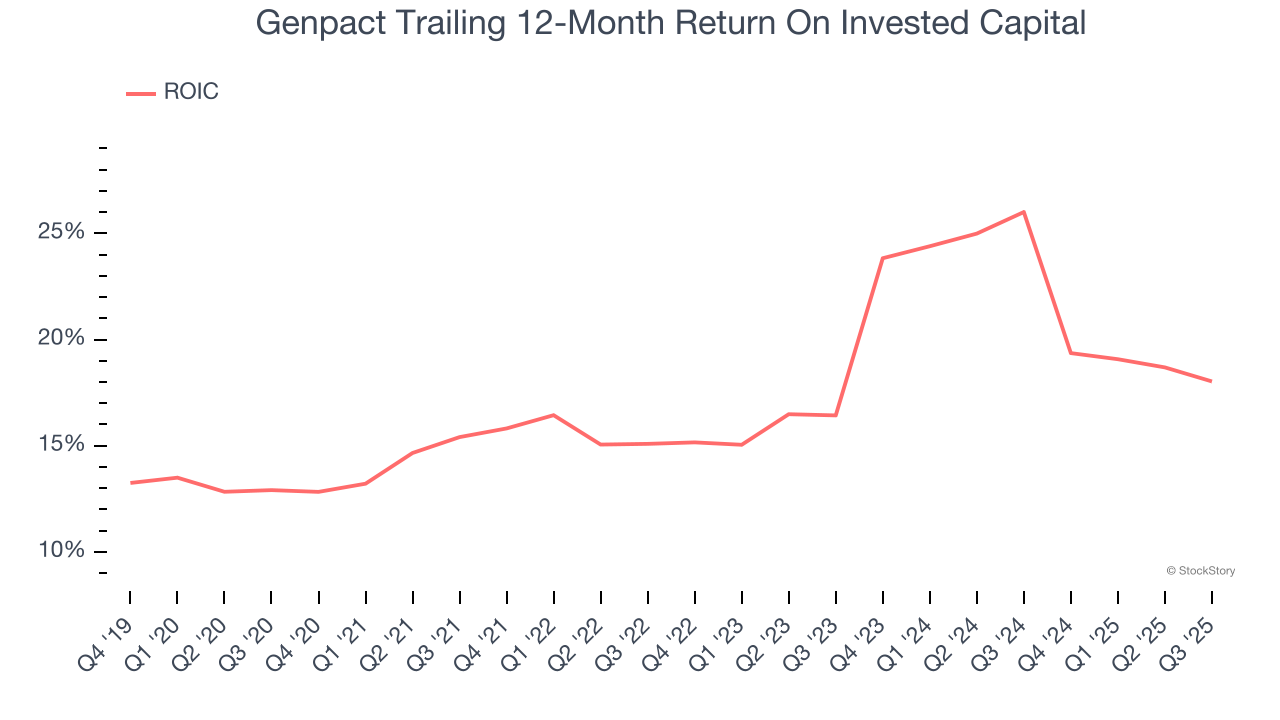

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Genpact’s five-year average ROIC was 18.2%, beating other business services companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

3. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Genpact’s has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

Genpact possesses several positive attributes. With its shares trailing the market in recent months, the stock trades at 11.9× forward P/E (or $45.95 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.