Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Liberty Broadband (NASDAQ:LBRDK) and the best and worst performers in the advertising & marketing services industry.

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

The 7 advertising & marketing services stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.8% below.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

Best Q1: Liberty Broadband (NASDAQ:LBRDK)

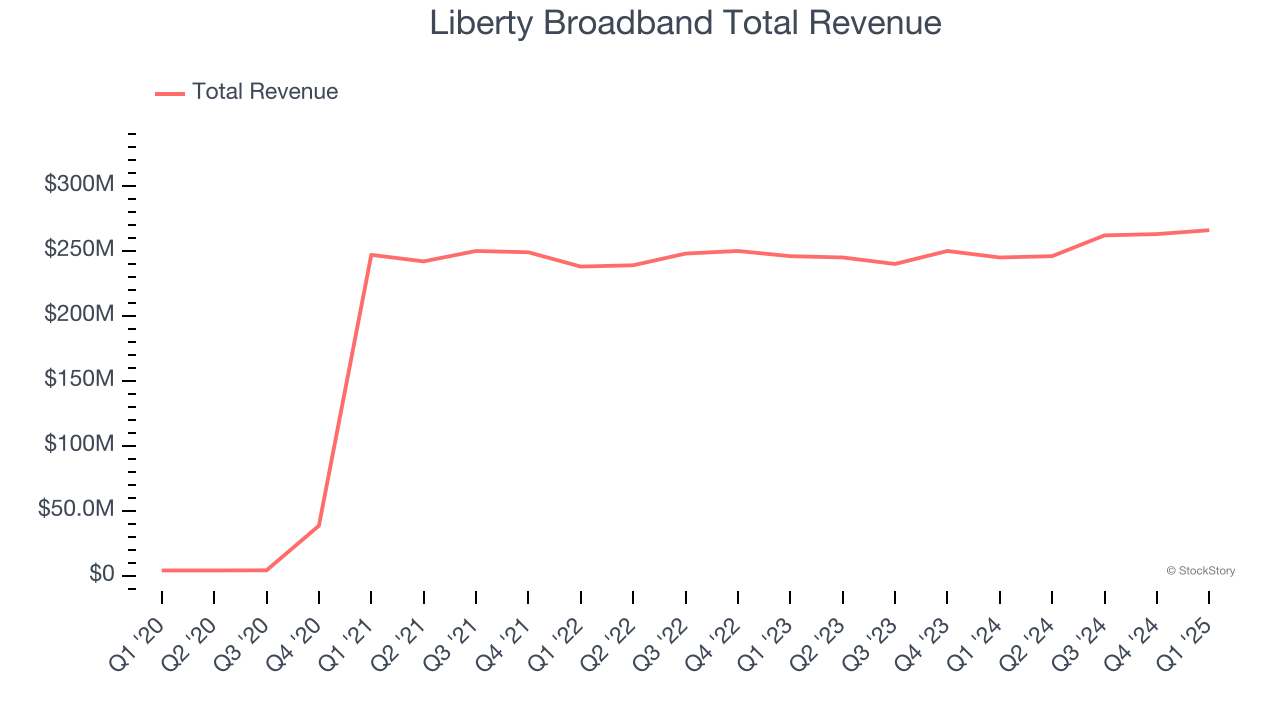

Operating across the United States, Liberty Broadband (NASDAQ:LBRDK) is a provider of high-speed internet, cable television, and telecommunications services across various markets.

Liberty Broadband reported revenues of $266 million, up 8.6% year on year. This print exceeded analysts’ expectations by 7%. Overall, it was an incredible quarter for the company.

Liberty Broadband pulled off the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 4.5% since reporting and currently trades at $89.37.

Is now the time to buy Liberty Broadband? Access our full analysis of the earnings results here, it’s free.

Interpublic Group (NYSE:IPG)

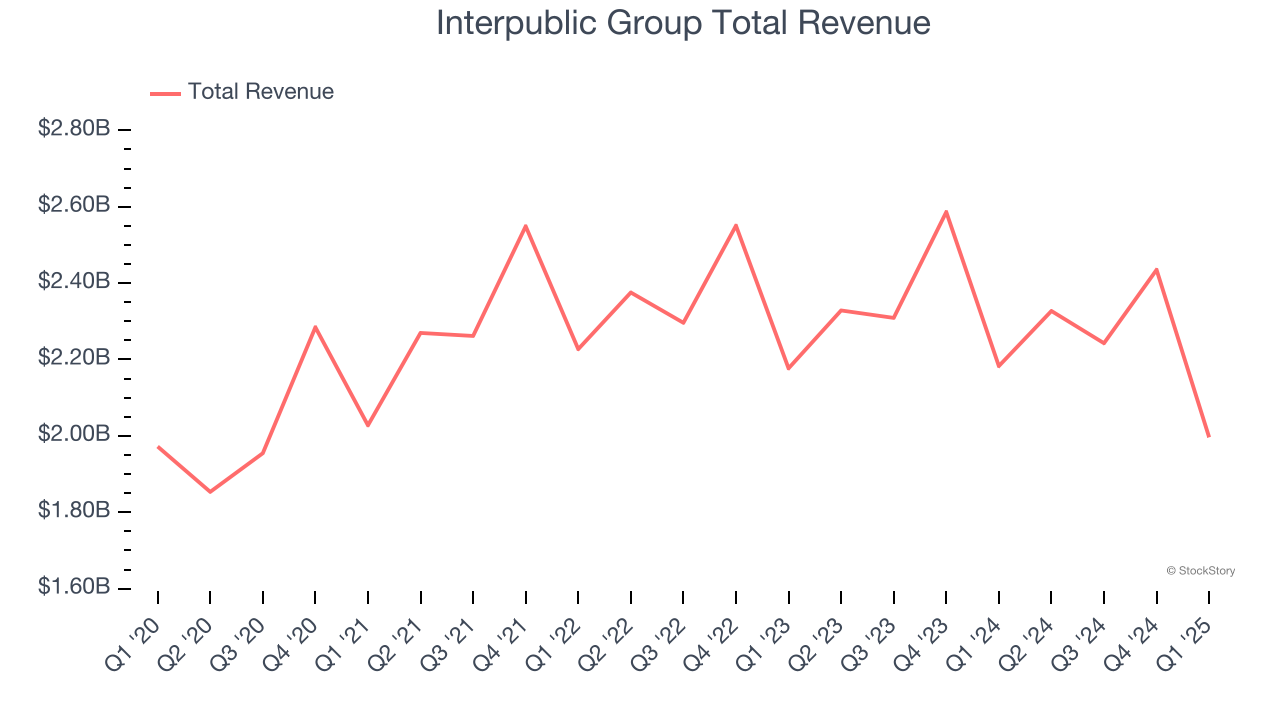

With a history dating back to 1902 and roots in the McCann-Erickson agency, Interpublic Group (NYSE:IPG) is a marketing and communications holding company that owns agencies specializing in advertising, media buying, public relations, and digital marketing services.

Interpublic Group reported revenues of $2.00 billion, down 8.5% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and a narrow beat of analysts’ organic revenue estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.3% since reporting. It currently trades at $23.40.

Is now the time to buy Interpublic Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Omnicom Group (NYSE:OMC)

With a vast network of creative agencies that helped craft some of the most memorable ad campaigns in history, Omnicom Group (NYSE:OMC) is a strategic holding company that provides advertising, marketing, and communications services to many of the world's largest companies.

Omnicom Group reported revenues of $3.69 billion, up 1.6% year on year, falling short of analysts’ expectations by 0.6%. It was a mixed quarter as it posted a decent beat of analysts’ EPS estimates but organic revenue in line with analysts’ estimates.

As expected, the stock is down 8.1% since the results and currently trades at $70.70.

Read our full analysis of Omnicom Group’s results here.

Magnite (NASDAQ:MGNI)

Born from the 2020 merger of Rubicon Project and Telaria, Magnite (NASDAQ:MGNI) operates the world's largest independent sell-side advertising platform that automates the buying and selling of digital advertising inventory across all channels and formats.

Magnite reported revenues of $155.8 million, up 4.3% year on year. This result lagged analysts' expectations by 2.6%. Aside from that, it was a satisfactory quarter as it recorded a solid beat of analysts’ EPS estimates.

Magnite had the weakest performance against analyst estimates among its peers. The stock is up 47.7% since reporting and currently trades at $18.40.

Read our full, actionable report on Magnite here, it’s free.

Ibotta (NYSE:IBTA)

Originally launched as a way to make grocery shopping more rewarding for budget-conscious consumers, Ibotta (NYSE:IBTA) is a mobile shopping app that allows consumers to earn cash back on everyday purchases by completing tasks and submitting receipts.

Ibotta reported revenues of $84.57 million, up 2.7% year on year. This print topped analysts’ expectations by 3.1%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ EPS estimates.

The stock is down 17.7% since reporting and currently trades at $41.34.

Read our full, actionable report on Ibotta here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.