Let’s dig into the relative performance of EPAM (NYSE:EPAM) and its peers as we unravel the now-completed Q1 it services & consulting earnings season.

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

The 7 it services & consulting stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

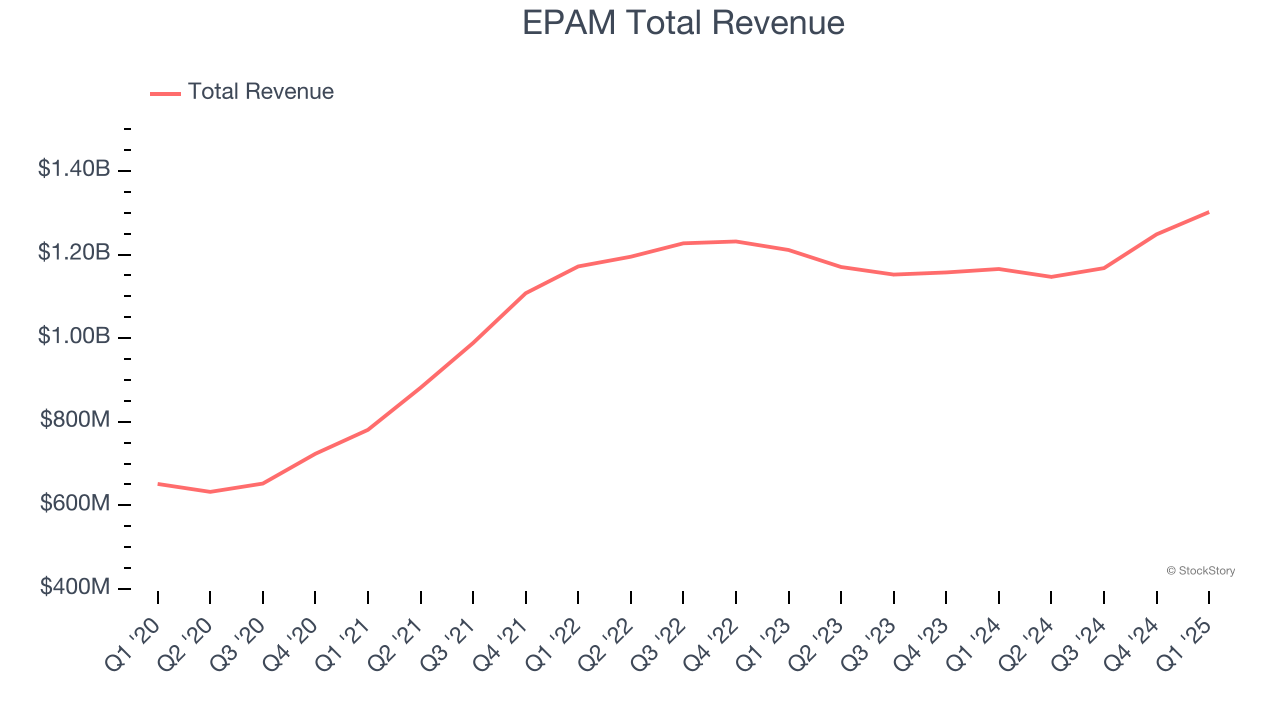

EPAM (NYSE:EPAM)

Founded in 1993 during the early days of offshore software development, EPAM Systems (NYSE:EPAM) provides digital engineering, cloud, and AI transformation services to help global enterprises and startups modernize their technology systems and create digital products.

EPAM reported revenues of $1.30 billion, up 11.7% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ constant currency revenue estimates.

"We reported strong first quarter results amidst a dynamic macroeconomic landscape, which highlights our unique differentiation in supporting our clients through their transformation journeys," said Arkadiy Dobkin, CEO and President at EPAM.

The stock is up 8.2% since reporting and currently trades at $172.58.

Is now the time to buy EPAM? Access our full analysis of the earnings results here, it’s free.

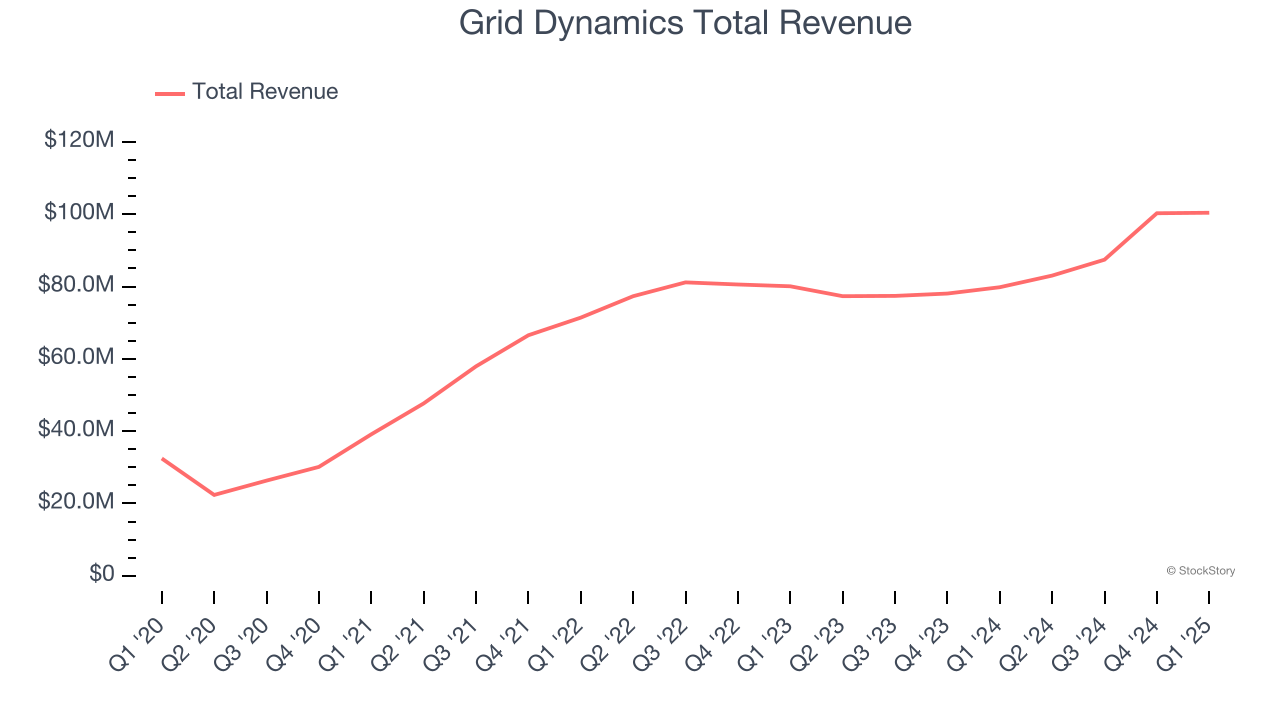

Best Q1: Grid Dynamics (NASDAQ:GDYN)

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ:GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Grid Dynamics reported revenues of $100.4 million, up 25.8% year on year, outperforming analysts’ expectations by 2%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

Grid Dynamics pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems unhappy with the results as the stock is down 18.7% since reporting. It currently trades at $11.45.

Is now the time to buy Grid Dynamics? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: ASGN (NYSE:ASGN)

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE:ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

ASGN reported revenues of $968.3 million, down 7.7% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

ASGN delivered the slowest revenue growth in the group. As expected, the stock is down 11.3% since the results and currently trades at $51.89.

Read our full analysis of ASGN’s results here.

Kyndryl (NYSE:KD)

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE:KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

Kyndryl reported revenues of $3.8 billion, down 1.3% year on year. This result topped analysts’ expectations by 0.8%. More broadly, it was a mixed quarter as it also logged a decent beat of analysts’ EPS estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

The stock is up 22.2% since reporting and currently trades at $40.47.

Read our full, actionable report on Kyndryl here, it’s free.

DXC (NYSE:DXC)

Born from the 2017 merger of Computer Sciences Corporation and HP Enterprise's services business, DXC Technology (NYSE:DXC) is a global IT services company that helps businesses transform their technology infrastructure, applications, and operations.

DXC reported revenues of $3.17 billion, down 6.4% year on year. This number beat analysts’ expectations by 0.9%. However, it was a slower quarter as it logged a significant miss of analysts’ EPS guidance for next quarter estimates.

DXC had the weakest full-year guidance update among its peers. The stock is down 4.2% since reporting and currently trades at $15.88.

Read our full, actionable report on DXC here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.