As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the data analytics industry, including Health Catalyst (NASDAQ:HCAT) and its peers.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

The 5 data analytics stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Luckily, data analytics stocks have performed well with share prices up 15.9% on average since the latest earnings results.

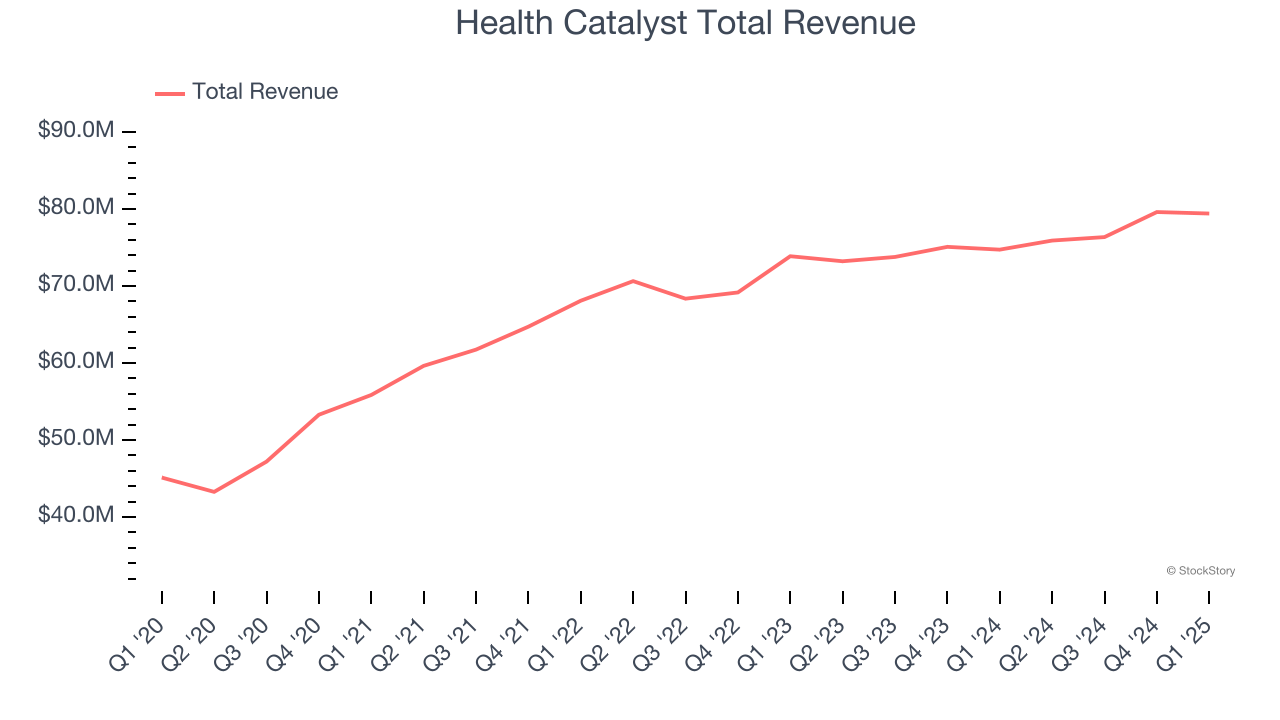

Slowest Q1: Health Catalyst (NASDAQ:HCAT)

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Health Catalyst reported revenues of $79.41 million, up 6.3% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates.

“For the first quarter of 2025, I am pleased by our strong financial results, including total revenue of $79.4 million and Adjusted EBITDA of $6.3 million, with these results beating our quarterly guidance on each metric,” said Dan Burton, CEO of Health Catalyst.

Health Catalyst delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 5.5% since reporting and currently trades at $3.76.

Is now the time to buy Health Catalyst? Access our full analysis of the earnings results here, it’s free.

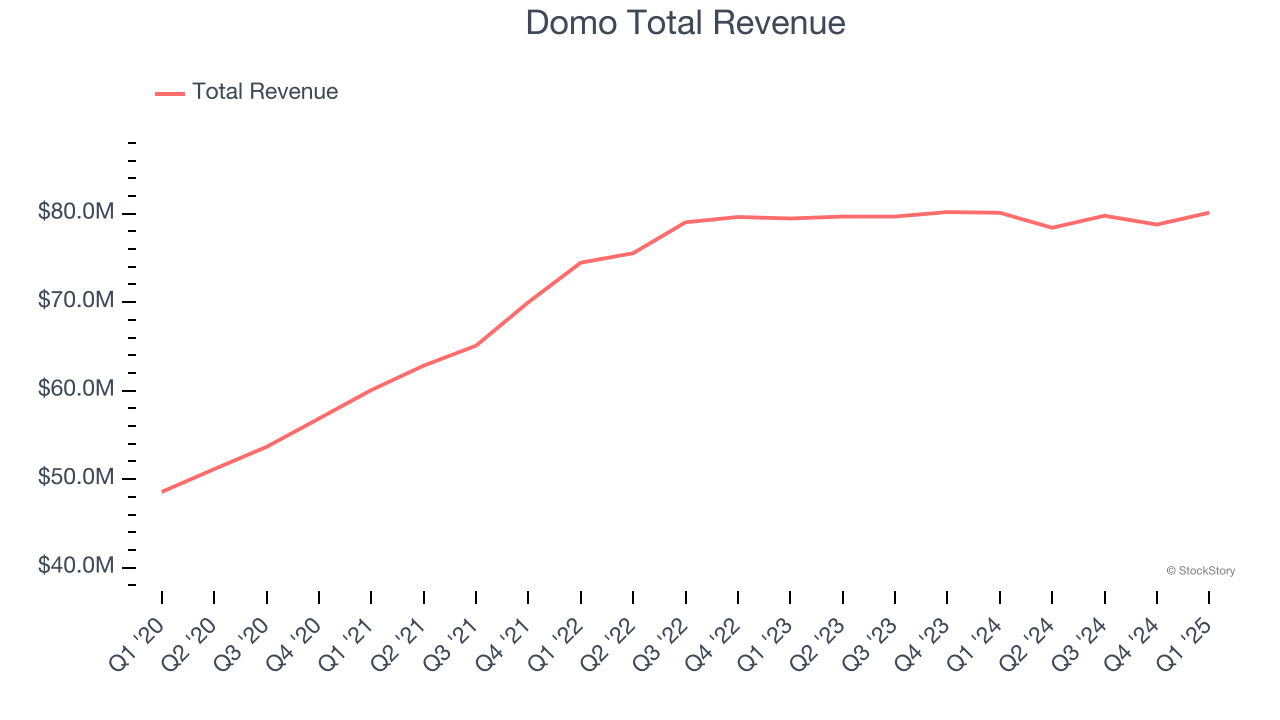

Best Q1: Domo (NASDAQ:DOMO)

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Domo reported revenues of $80.11 million, flat year on year, outperforming analysts’ expectations by 3.1%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 60.4% since reporting. It currently trades at $13.71.

Is now the time to buy Domo? Access our full analysis of the earnings results here, it’s free.

Amplitude (NASDAQ:AMPL)

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Amplitude reported revenues of $79.95 million, up 10.1% year on year, in line with analysts’ expectations. Still, its results were good as it locked in an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 28.3% since the results and currently trades at $12.06.

Read our full analysis of Amplitude’s results here.

Palantir (NASDAQ:PLTR)

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir reported revenues of $883.9 million, up 39.3% year on year. This print beat analysts’ expectations by 2.5%. It was a very strong quarter as it also logged a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Palantir pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 13.9% since reporting and currently trades at $141.21.

Read our full, actionable report on Palantir here, it’s free.

Samsara (NYSE:IOT)

One of the few public companies where famed investor Marc Andreessen is a Board member, Samsara (NYSE:IOT) provides software and hardware to track industrial equipment, assets, and fleets.

Samsara reported revenues of $366.9 million, up 30.7% year on year. This number topped analysts’ expectations by 4.4%. Overall, it was a very strong quarter as it also produced EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Samsara delivered the biggest analyst estimates beat among its peers. The company added 132 enterprise customers paying more than $100,000 annually to reach a total of 2,638. The stock is down 17.6% since reporting and currently trades at $39.

Read our full, actionable report on Samsara here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.