Pharmaceutical company Organon (NYSE:OGN) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales fell by 6.7% year on year to $1.51 billion. Its non-GAAP profit of $1.02 per share was 14.2% above analysts’ consensus estimates.

Is now the time to buy Organon? Find out by accessing our full research report, it’s free.

Organon (OGN) Q1 CY2025 Highlights:

- Revenue: $1.51 billion vs analyst estimates of $1.50 billion (6.7% year-on-year decline, 0.6% beat)

- Adjusted EPS: $1.02 vs analyst estimates of $0.89 (14.2% beat)

- Adjusted EBITDA: $484 million vs analyst estimates of $458.6 million (32% margin, 5.5% beat)

- Operating Margin: 21.5%, down from 23.2% in the same quarter last year

- Market Capitalization: $3.36 billion

“We have reset our capital allocation priorities to accelerate progress towards deleveraging, enabling a path to achieve a net leverage ratio of below 4.0x by year-end. Over the last year, we have established a leaner, more fit-for-purpose cost structure while increasing revenue contribution from our core growth drivers. By deleveraging more rapidly, we will continue to strengthen the future prospects of the company. Over time, this will position us to execute more of the compelling business development we’ve done to date, bringing in additional growth drivers to our portfolio, while maintaining lower leverage,” said Kevin Ali, Organon’s CEO.

Company Overview

Spun off from Merck in 2021 to create a company dedicated to addressing unmet needs in women's health, Organon (NYSE:OGN) is a global healthcare company focused on improving women's health through prescription therapies, medical devices, biosimilars, and established medicines.

Sales Growth

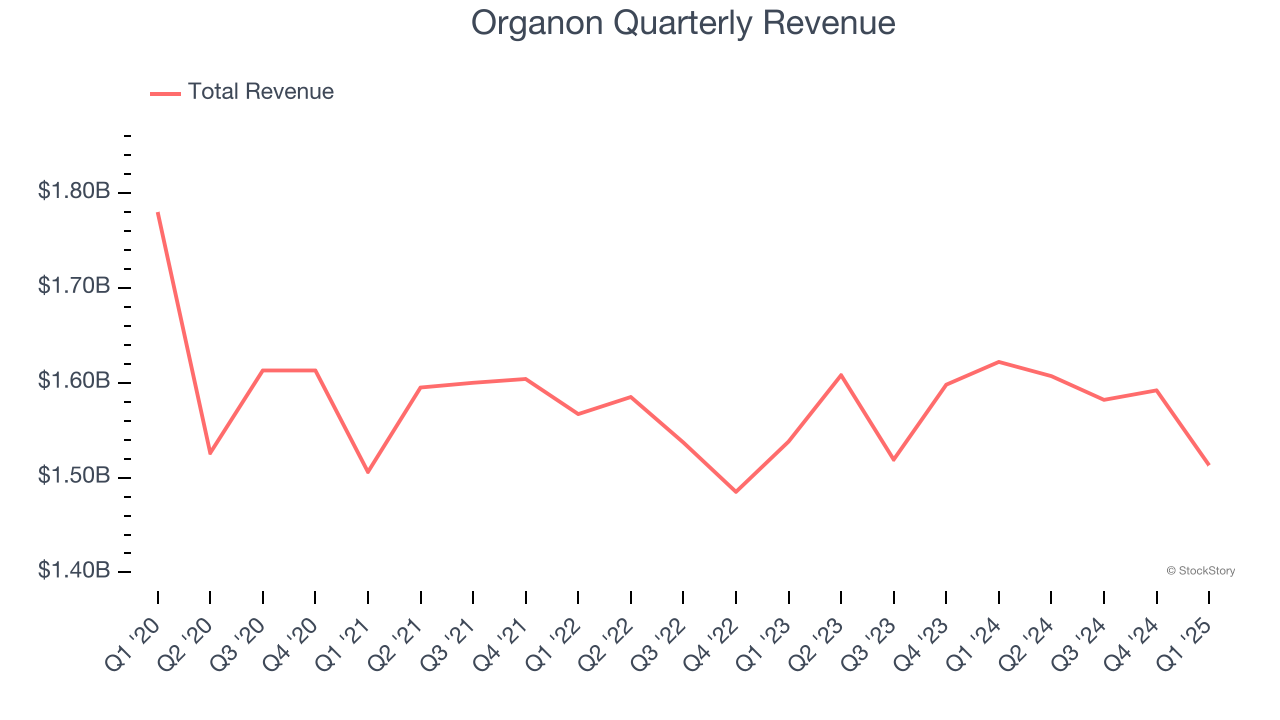

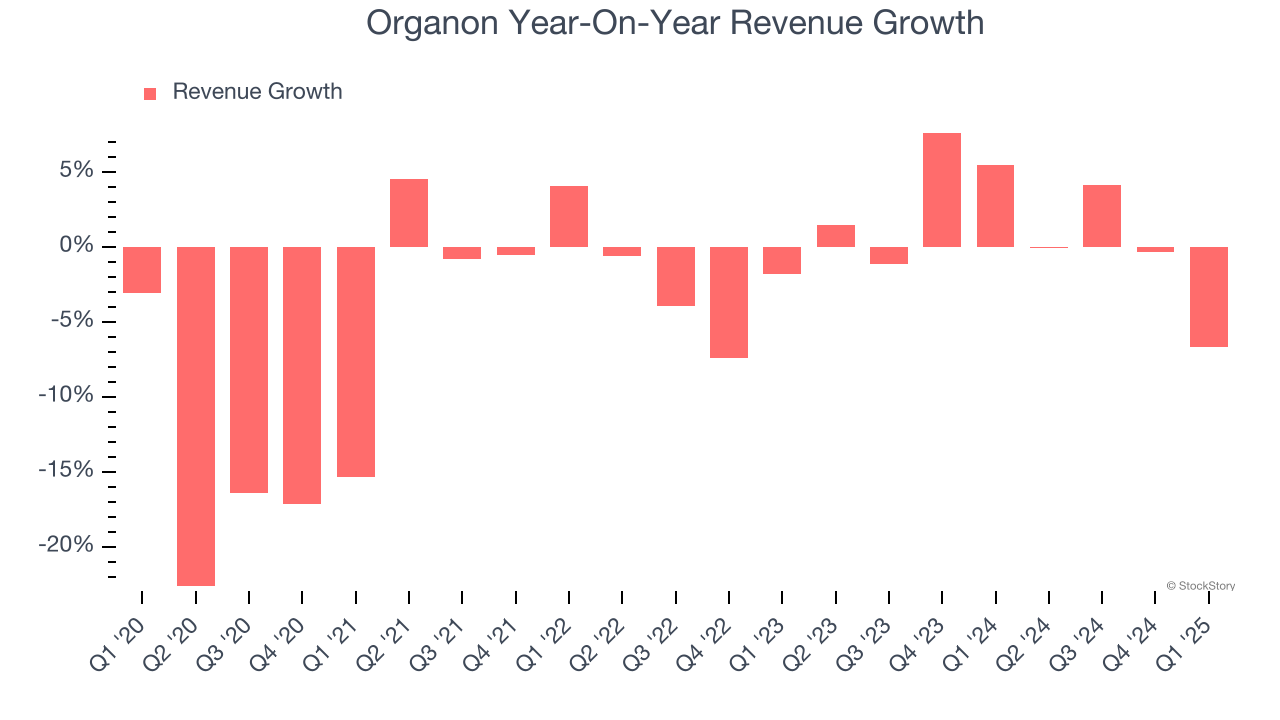

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Organon’s demand was weak over the last five years as its sales fell at a 3.8% annual rate. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Organon’s annualized revenue growth of 1.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Organon’s revenue fell by 6.7% year on year to $1.51 billion but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to decline by 1.4% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

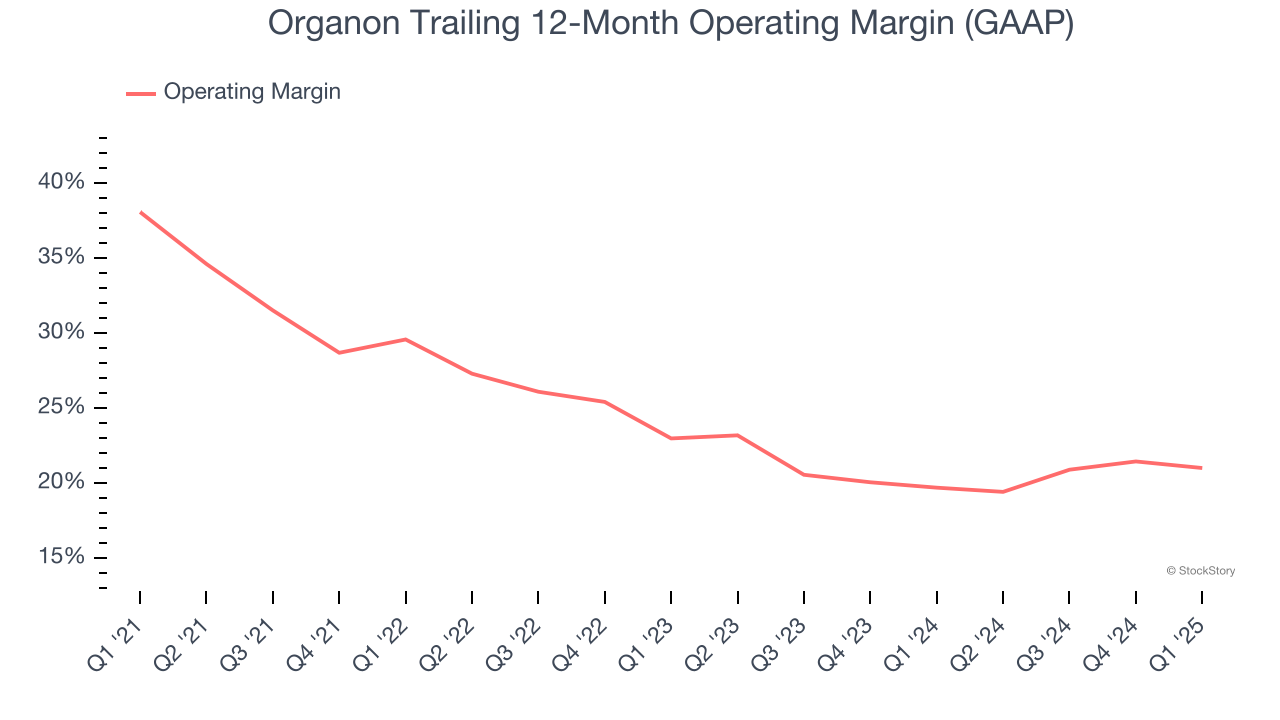

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Organon has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 26.3%.

Analyzing the trend in its profitability, Organon’s operating margin decreased by 17.1 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q1, Organon generated an operating profit margin of 21.5%, down 1.7 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

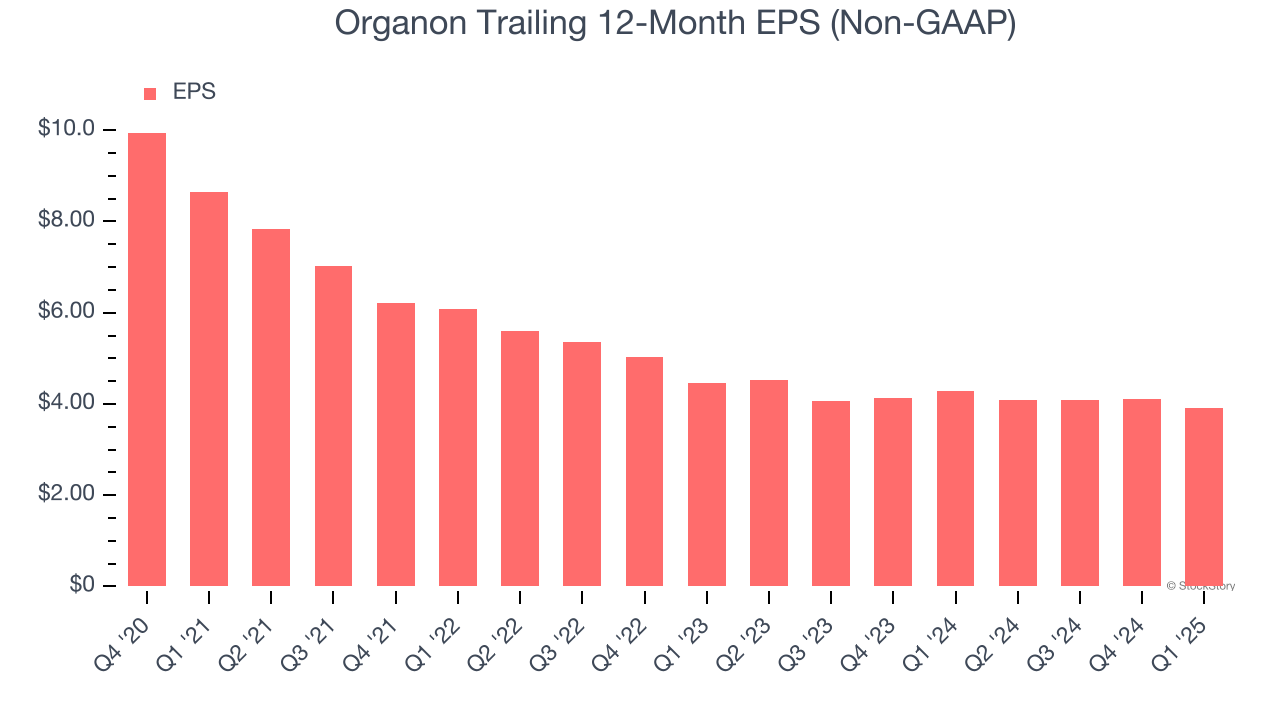

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Organon’s full-year EPS dropped 93.7%, or 18% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Organon’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, Organon reported EPS at $1.02, down from $1.22 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Organon’s full-year EPS of $3.91 to shrink by 1.1%.

Key Takeaways from Organon’s Q1 Results

We enjoyed seeing Organon beat analysts’ EPS and EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a solid quarter, but the market seemed to be hoping for more. The stock traded down 23.5% to $9.88 immediately following the results.

Is Organon an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.