Funeral services company Carriage Services (NYSE:CSV) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 3.5% year on year to $107.1 million. On the other hand, the company’s full-year revenue guidance of $405 million at the midpoint came in 0.9% below analysts’ estimates. Its non-GAAP profit of $0.96 per share was 14.3% above analysts’ consensus estimates.

Is now the time to buy Carriage Services? Find out by accessing our full research report, it’s free.

Carriage Services (CSV) Q1 CY2025 Highlights:

- Revenue: $107.1 million vs analyst estimates of $104.2 million (3.5% year-on-year growth, 2.8% beat)

- Adjusted EPS: $0.96 vs analyst estimates of $0.84 (14.3% beat)

- Adjusted EBITDA: $32.9 million vs analyst estimates of $32.86 million (30.7% margin, in line)

- The company reconfirmed its revenue guidance for the full year of $405 million at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $3.20 at the midpoint

- EBITDA guidance for the full year is $130.5 million at the midpoint, below analyst estimates of $131.4 million

- Operating Margin: 29.5%, up from 20.3% in the same quarter last year

- Free Cash Flow Margin: 12.5%, down from 20.2% in the same quarter last year

- Market Capitalization: $633.1 million

Carlos Quezada, Vice Chairman and CEO, stated, “We are proud of our first-quarter results, which reflect the strength of our strategy and execution discipline. Our solid financial performance, highlighted by a 4.6% increase in comparable funeral home revenue was primarily driven by a 2.4% increase in funeral home at-need volume and a 2.2% increase in average revenue per at-need contract, delivering adjusted diluted EPS of $0.96 cents, an increase of $0.21 cents or 28%, demonstrating our focus on the execution of our strategic objectives. Through continued investments in innovation, the expansion of key partnerships, and the empowerment of our people, we are building the Carriage of the future. As we become a premier experience company, we are proving that passion, operational excellence, and financial discipline turns vision into value for our shareholders,” concluded Mr. Quezada.

Company Overview

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Sales Growth

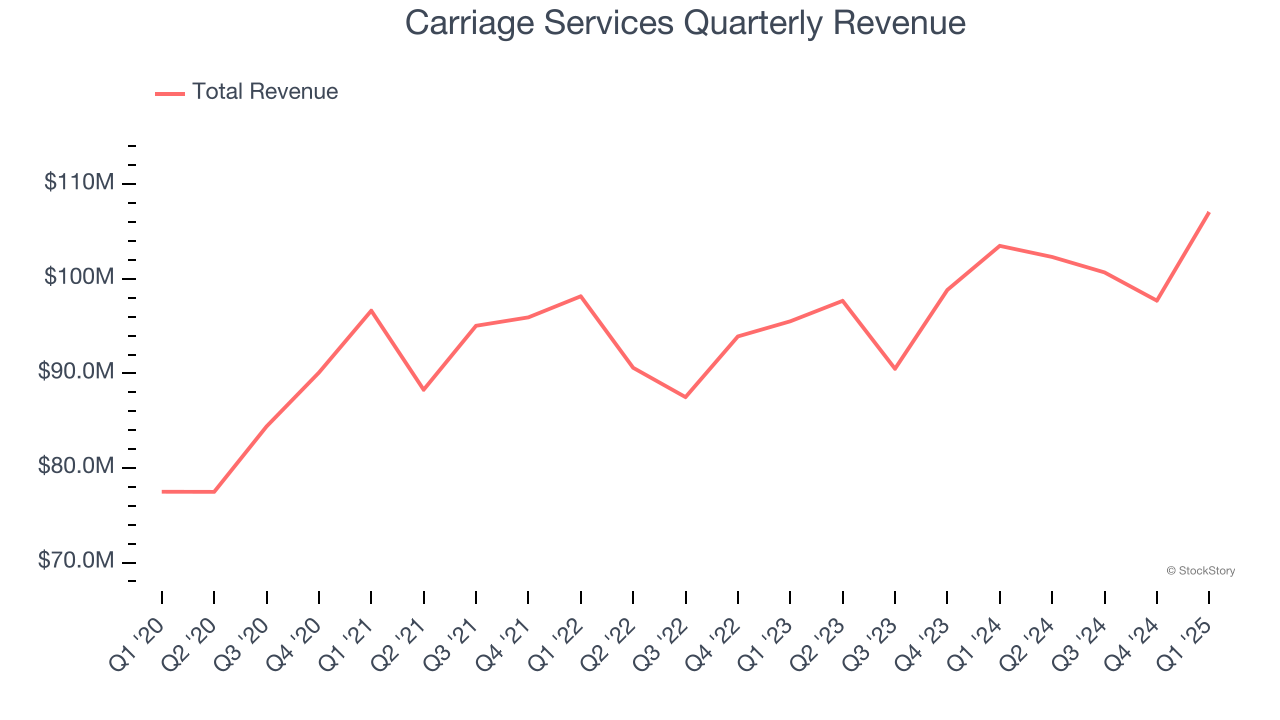

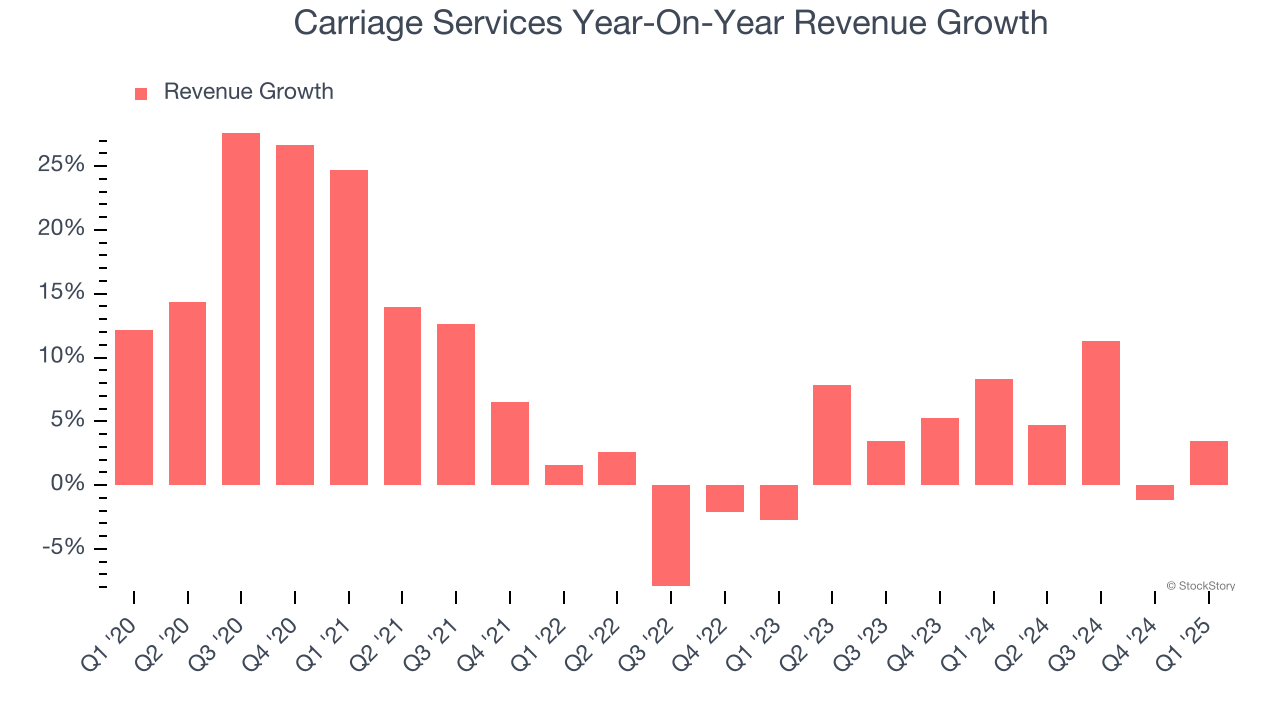

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Carriage Services’s 7.6% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Carriage Services’s recent performance shows its demand has slowed as its annualized revenue growth of 5.3% over the last two years was below its five-year trend.

This quarter, Carriage Services reported modest year-on-year revenue growth of 3.5% but beat Wall Street’s estimates by 2.8%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

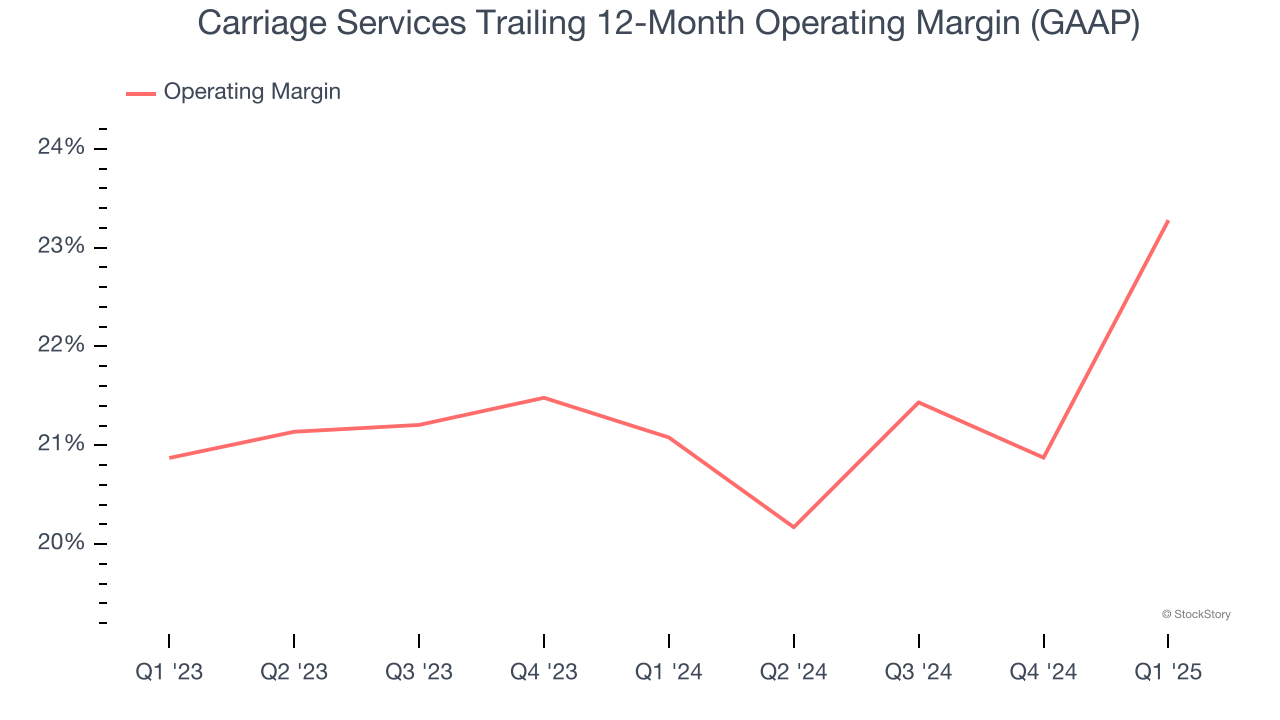

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Carriage Services’s operating margin has risen over the last 12 months and averaged 22.2% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q1, Carriage Services generated an operating profit margin of 29.5%, up 9.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

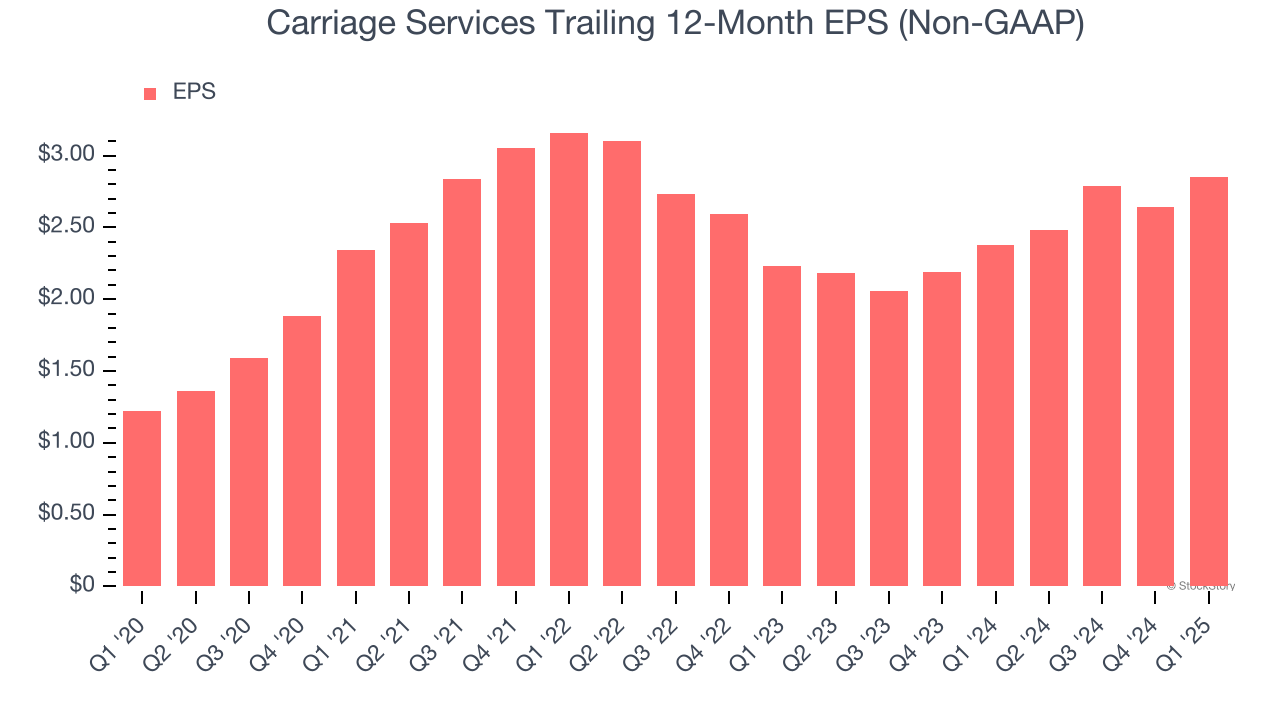

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Carriage Services’s EPS grew at a remarkable 18.5% compounded annual growth rate over the last five years, higher than its 7.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q1, Carriage Services reported EPS at $0.96, up from $0.75 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Carriage Services’s Q1 Results

It was encouraging to see Carriage Services beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $39.78 immediately after reporting.

Is Carriage Services an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.