Data protection software company Commvault (NASDAQ:CVLT) will be reporting earnings this Tuesday before the bell. Here’s what investors should know.

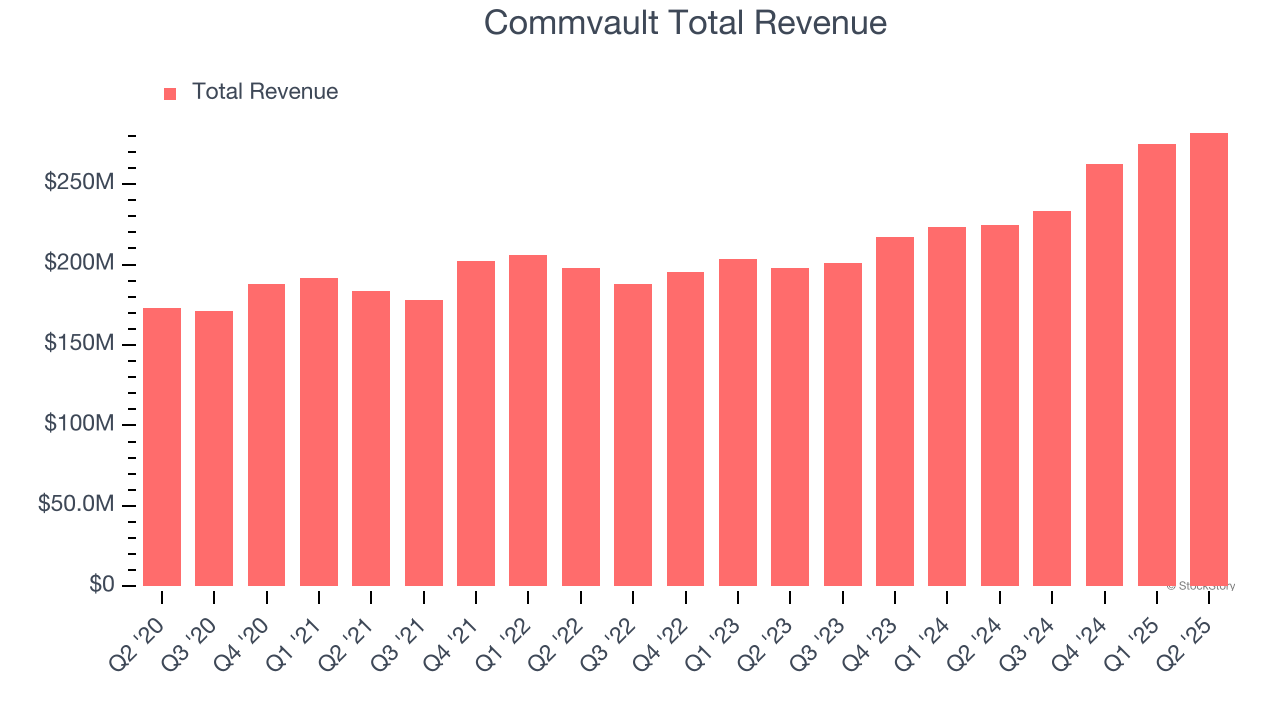

Commvault beat analysts’ revenue expectations by 5.2% last quarter, reporting revenues of $282 million, up 25.5% year on year. It was a very strong quarter for the company, with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ annual recurring revenue estimates.

Is Commvault a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members.

This quarter, analysts are expecting Commvault’s revenue to grow 17.2% year on year to $273.3 million, improving from the 16.1% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.94 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Commvault has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 4.9% on average.

With Commvault being the first among its peers to report earnings this season, we don’t have anywhere else to look to get a hint at how this quarter will unravel for data and analytics software stocks. However, investors in the segment have had steady hands going into earnings, with share prices flat over the last month. Commvault is down 12% during the same time and is heading into earnings with an average analyst price target of $214.56 (compared to the current share price of $169.89).

P.S. While everyone's chasing Nvidia, we found a hidden AI semiconductor winner trading at a fraction of the price. See our #1 pick before Wall Street catches on.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.