Over the last six months, Hamilton Lane’s shares have sunk to $118.04, producing a disappointing 10.2% loss - a stark contrast to the S&P 500’s 29.3% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is this a buying opportunity for HLNE? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Hamilton Lane?

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ:HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

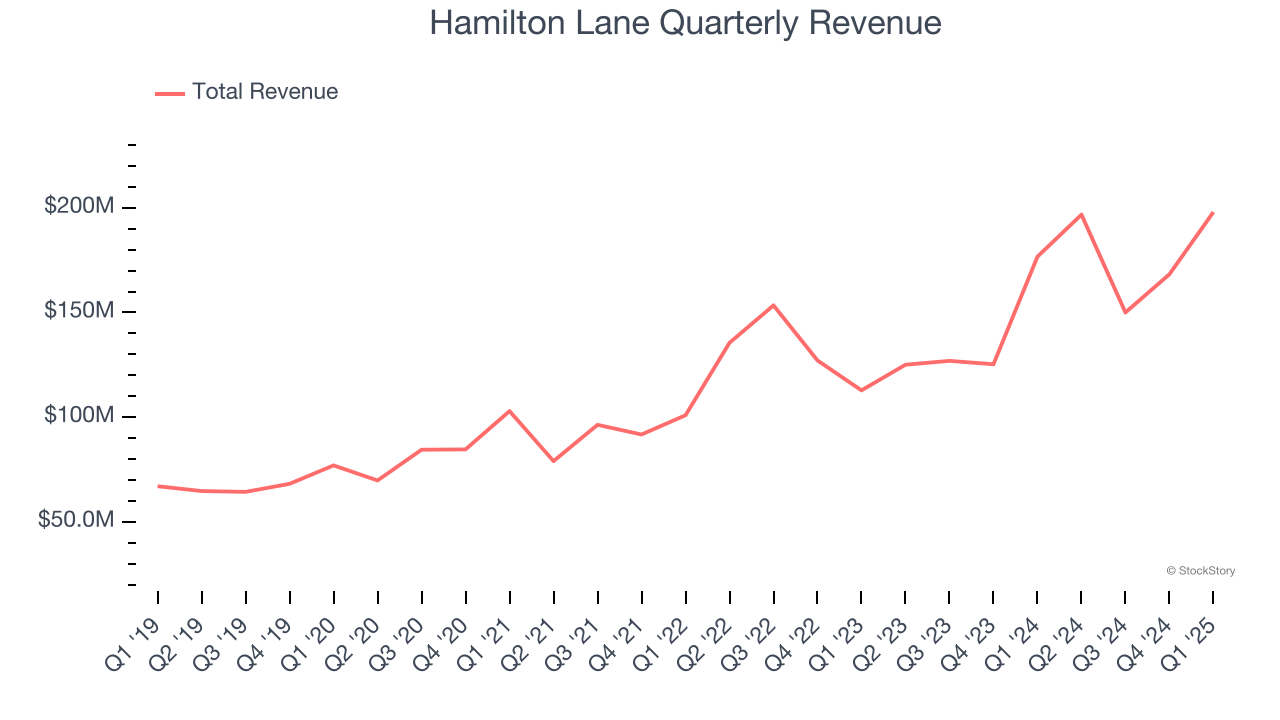

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

Thankfully, Hamilton Lane’s 21.1% annualized revenue growth over the last five years was excellent. Its growth beat the average financials company and shows its offerings resonate with customers.

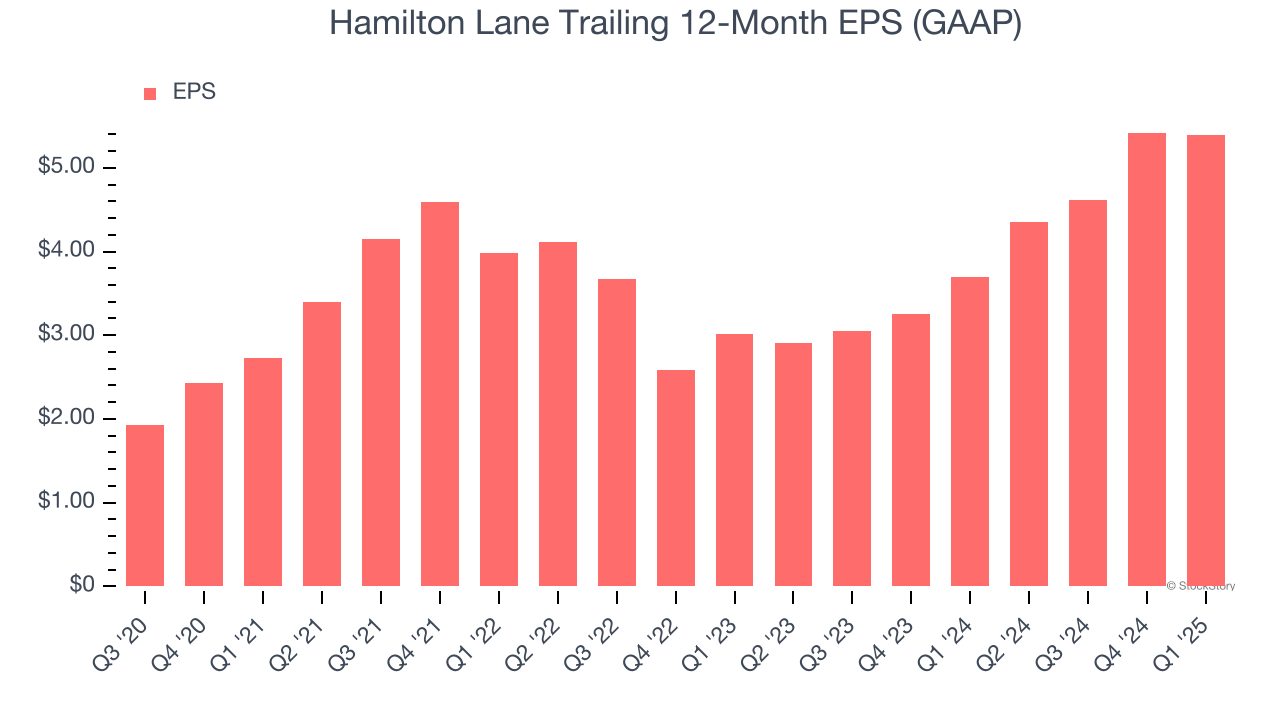

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Hamilton Lane’s EPS grew at a remarkable 17.1% compounded annual growth rate over the last five years. This performance was better than most financials businesses.

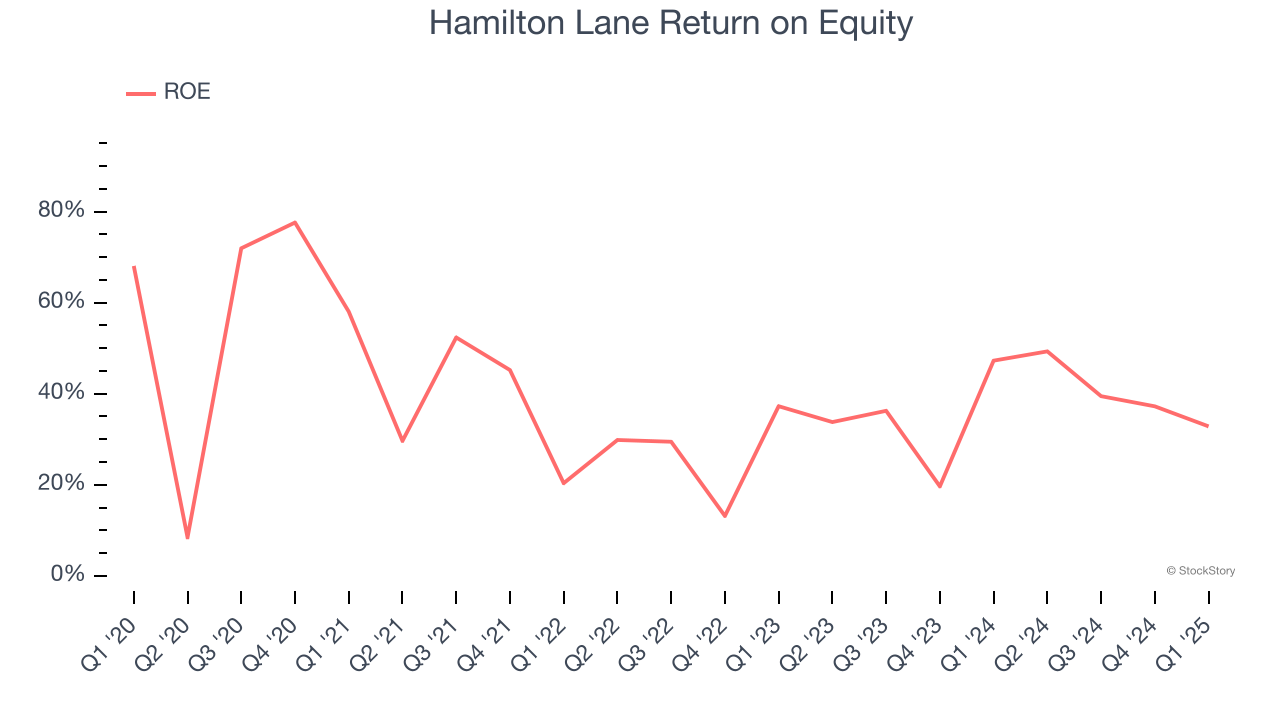

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Hamilton Lane has averaged an ROE of 38.5%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Hamilton Lane has a strong competitive moat.

Final Judgment

These are just a few reasons why we think Hamilton Lane is an elite financials company. With the recent decline, the stock trades at 25.4× forward P/E (or $118.04 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.