While the S&P 500 is up 29.3% since April 2025, AMETEK (currently trading at $185.47 per share) has lagged behind, posting a return of 19.5%. This might have investors contemplating their next move.

Is there a buying opportunity in AMETEK, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is AMETEK Not Exciting?

We're swiping left on AMETEK for now. Here are two reasons there are better opportunities than AME and a stock we'd rather own.

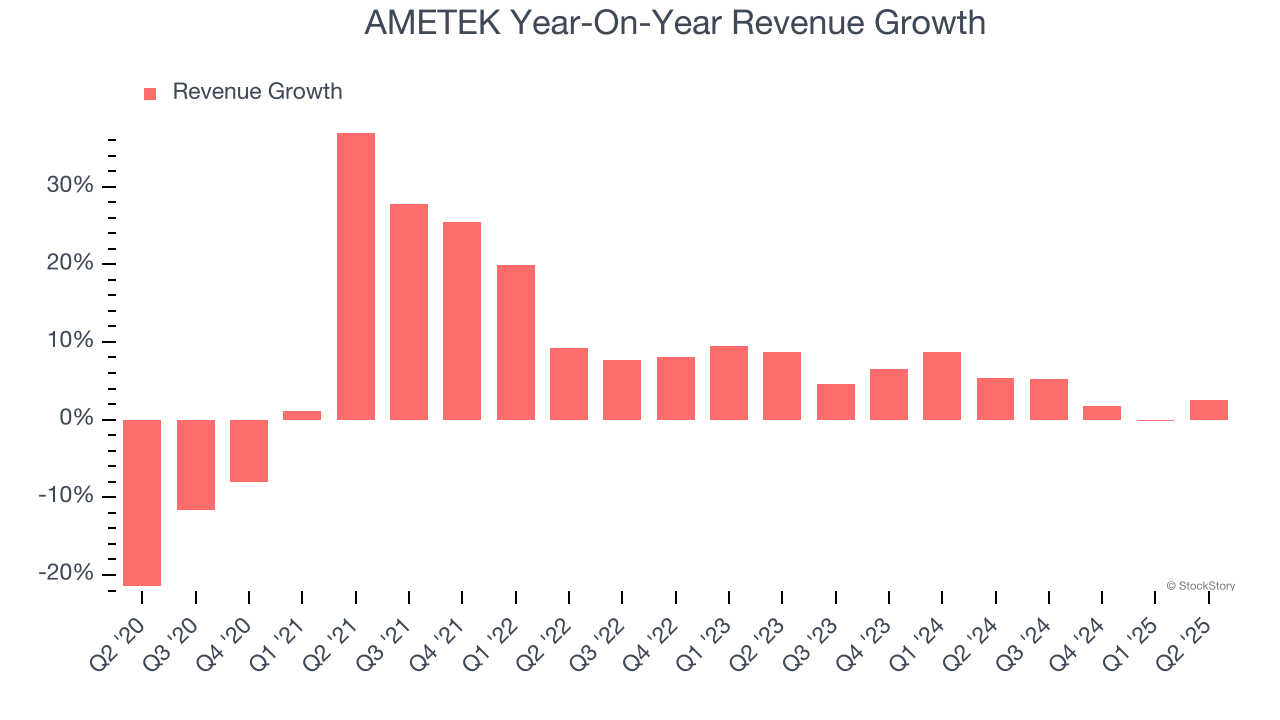

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AMETEK’s recent performance shows its demand has slowed as its annualized revenue growth of 4.3% over the last two years was below its five-year trend. We also note many other Internet of Things businesses have faced declining sales because of cyclical headwinds. While AMETEK grew slower than we’d like, it did do better than its peers.

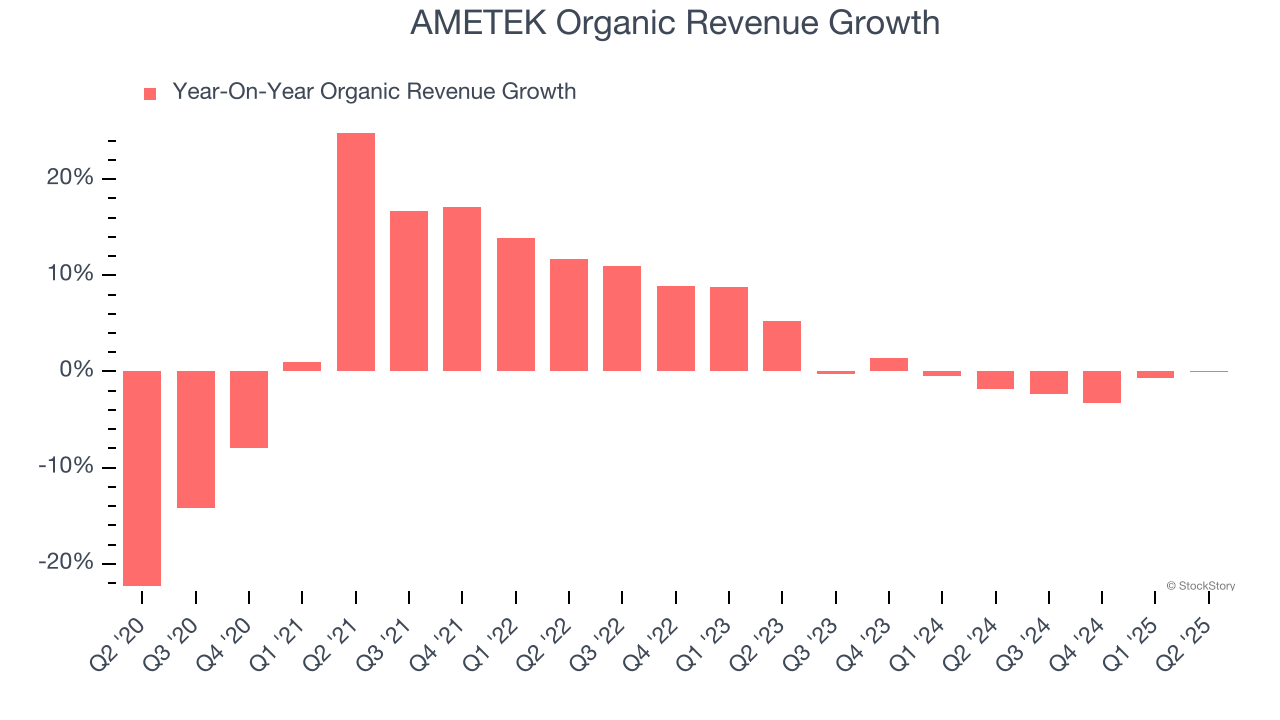

2. Core Business Falling Behind as Demand Plateaus

Investors interested in Internet of Things companies should track organic revenue in addition to reported revenue. This metric gives visibility into AMETEK’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, AMETEK failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests AMETEK might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

Final Judgment

AMETEK isn’t a terrible business, but it isn’t one of our picks. With its shares underperforming the market lately, the stock trades at 24.9× forward P/E (or $185.47 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.