With a market cap of $12.2 billion, Stanley Black & Decker, Inc. (SWK) is a global provider of hand tools, power tools, outdoor products, and related accessories, serving customers across the Americas, Europe, and Asia. It operates through its Tools & Outdoor and Industrial segments, offering a wide range of professional and consumer solutions under well-known brands such as DEWALT, CRAFTSMAN, and BLACK+DECKER.

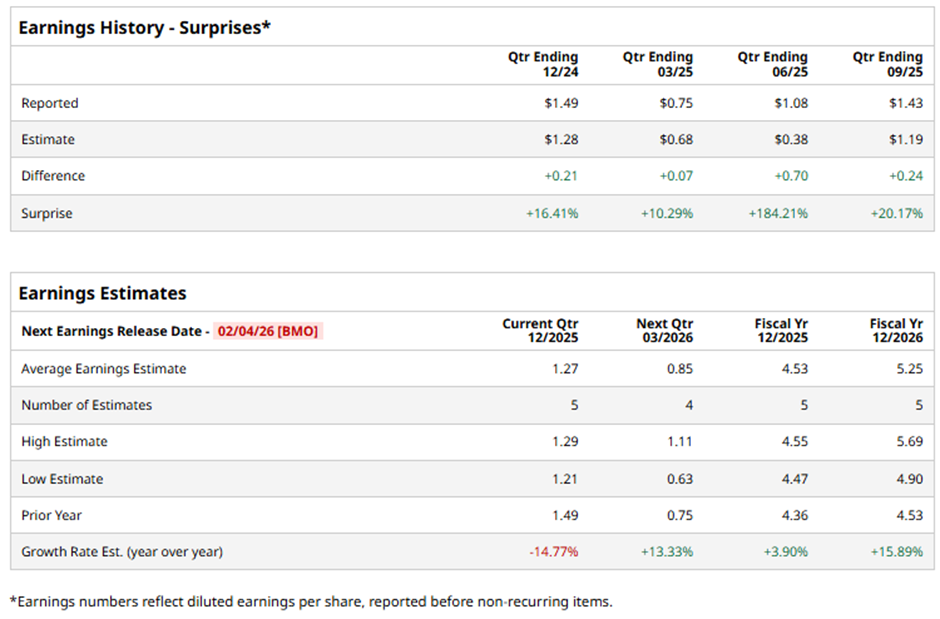

The New Britain, Connecticut-based company is expected to deliver its fiscal Q4 2025 results before the market opens on Wednesday, Feb. 4. Ahead of this event, analysts forecast SWK to report an adjusted EPS of $1.27, down 14.8% from $1.49 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict the tool company to report an adjusted EPS of $4.53, up 3.9% from $4.36 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 15.9% year-over-year to $5.25 in fiscal 2026.

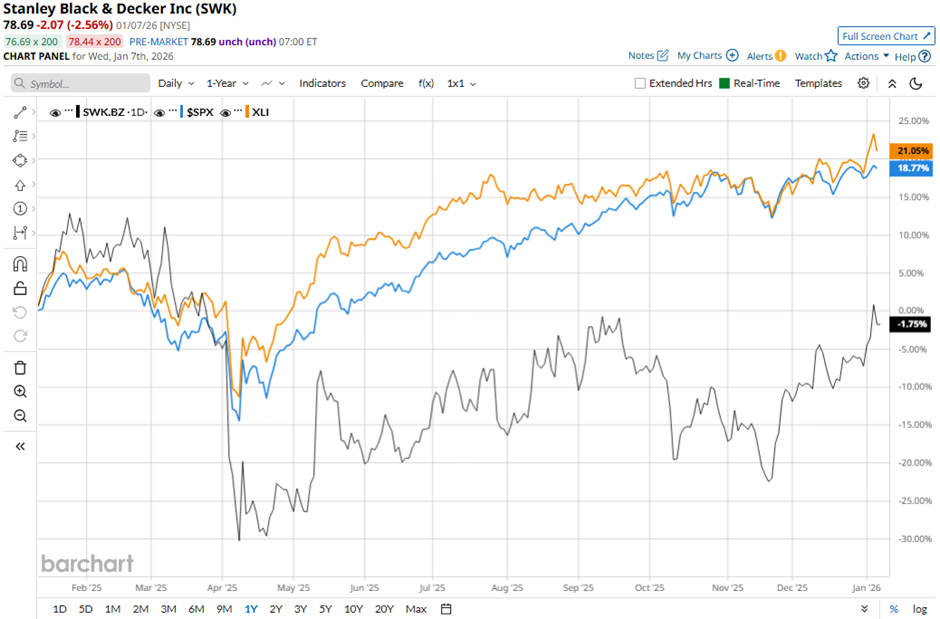

Shares of Stanley Black & Decker have declined 3.6% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 17.1% gain and the State Street Industrial Select Sector SPDR ETF’s (XLI) 20.2% increase over the same period.

Despite reporting weaker-than-expected Q3 2025 revenue of $3.76 billion, shares of Stanley Black & Decker recovered marginally on Nov. 4 as adjusted EPS significantly beat expectations, coming in at $1.43. Investors were encouraged by strong profitability trends, including gross margin expansion to 31.4%, solid free cash flow of $155 million, and continued growth in the DEWALT brand.

Analysts' consensus view on SWK stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 16 analysts covering the stock, five recommend "Strong Buy," 10 suggest "Hold," and one advises "Strong Sell." The average analyst price target for Stanley Black & Decker is $82.33, suggesting a potential upside of 4.6% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This AI Data Center Power Stock is About to Break Out. Spot the Trade as It Unfolds With This Chart Signal.

- This Covered-Call Google ETF Yields 41%. These 2 Option Trades Are Even Better.

- Here’s How You Can Intercept IONQ Stock’s Play-Action Pass for a 127% Payout

- Can This New ETF Be a Game-Changer in a Market Stuck Waiting for the AI Bubble to Burst?