Valued at a market cap of $461.7 billion, Micron Technology, Inc. (MU) designs, develops, manufactures, and sells memory and storage products. The Boise, Idaho-based company serves the data center, PC, graphics, networking, automotive, industrial, and consumer embedded markets.

This semiconductor company has significantly outpaced the broader market over the past 52 weeks. Shares of MU have skyrocketed 379.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. Moreover, on a YTD basis, the stock is up 48.3%, compared to SPX’s 1.9% return.

Zooming in further, MU has also outperformed the Invesco Semiconductors ETF (PSI), which rose 68.2% over the past 52 weeks and 21.9% on a YTD basis.

On Jan. 21, MU shares surged 6.6% after analysts at multiple firms, including Barclays PLC (BCS), Stifel Financial Corp. (SF), and The Toronto-Dominion Bank (TD), raised their price targets on the stock, citing strong demand for its AI-related memory chips.

For fiscal 2026, ending in August, analysts expect MU’s EPS to grow 319.5% year over year to $32.22. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

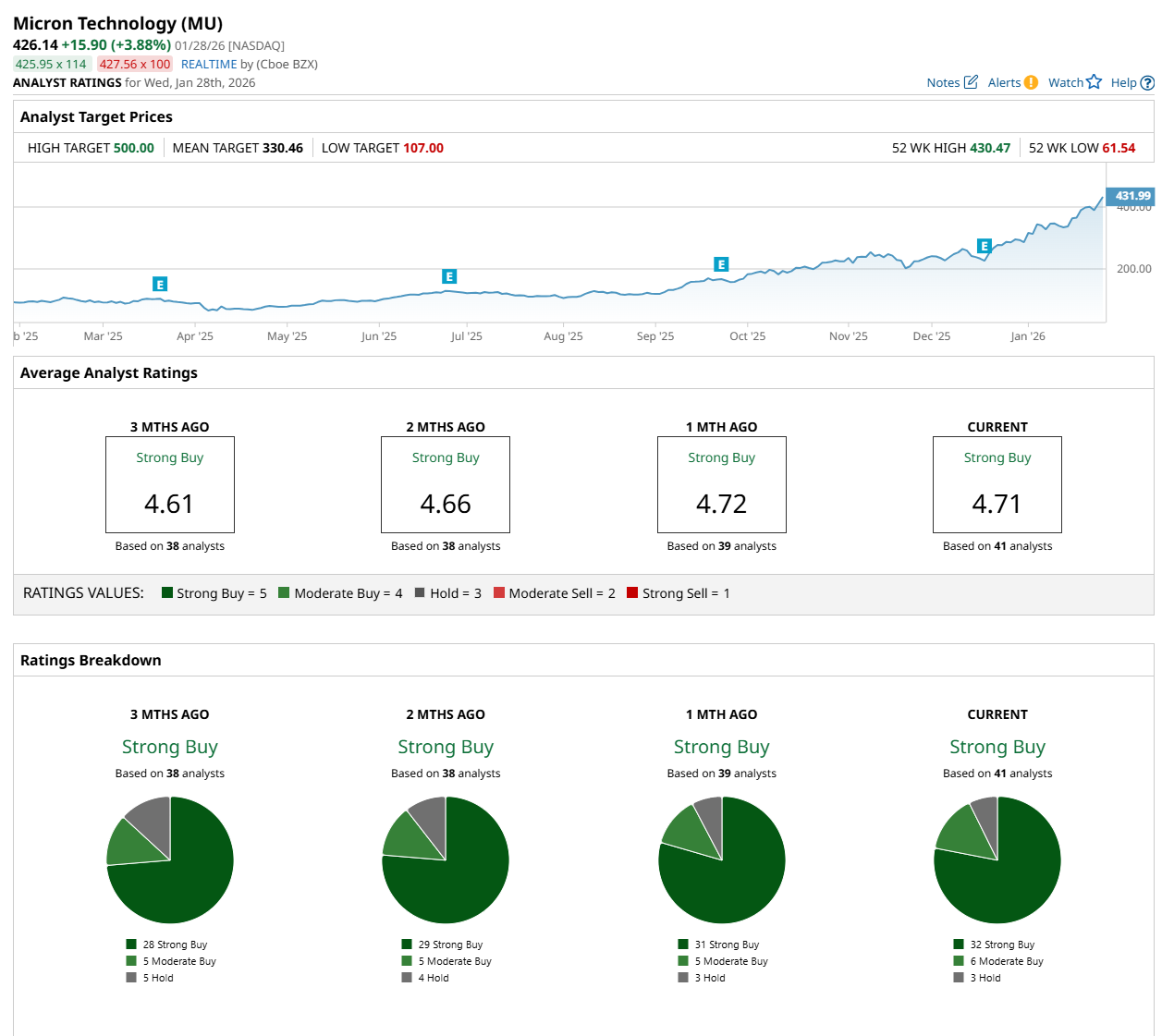

Among the 41 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 32 “Strong Buy,” six “Moderate Buy,” and three “Hold” ratings.

The configuration is more bullish than a month ago, with 31 analysts suggesting a "Strong Buy” rating.

On Jan. 27, Sebastien Naji from William Blair maintained a "Buy" rating on MU, with a price target of $450, indicating a 5.6% potential upside from the current price levels.

While the company is trading above its mean price target of $330.46, its Street-high price target of $500 suggests a 17.3% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart