San Jose, California-based Cisco Systems, Inc. (CSCO) designs, develops, and sells technologies that help to power, secure, and draw insights from the internet. Valued at a market cap of $304.3 billion, the company is best known for its routers and switches and also offers solutions in areas such as cybersecurity, cloud networking, data center infrastructure, collaboration, and observability.

This tech company has outpaced the broader market over the past 52 weeks. Shares of CSCO have surged 32.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16%. However, on a YTD basis, the stock is up 1.4%, lagging behind SPX’s 1.9% return.

Zooming in further, CSCO has outperformed the First Trust NASDAQ Cybersecurity ETF (CIBR), which rose 10.7% over the past 52 weeks and 1.3% on a YTD basis.

On Jan. 26, shares of CSCO rose 3.2% after Evercore Inc. (EVR) upgraded the stock, citing expectations of high single-digit revenue growth and low-teens EPS growth over the next several years. The upbeat outlook was underpinned by robust demand in campus networking markets and the potential for AI-related revenues to reach $3 billion by fiscal 2026.

For the current fiscal year, ending in July, analysts expect CSCO’s EPS to grow 7.5% year over year to $3.30. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

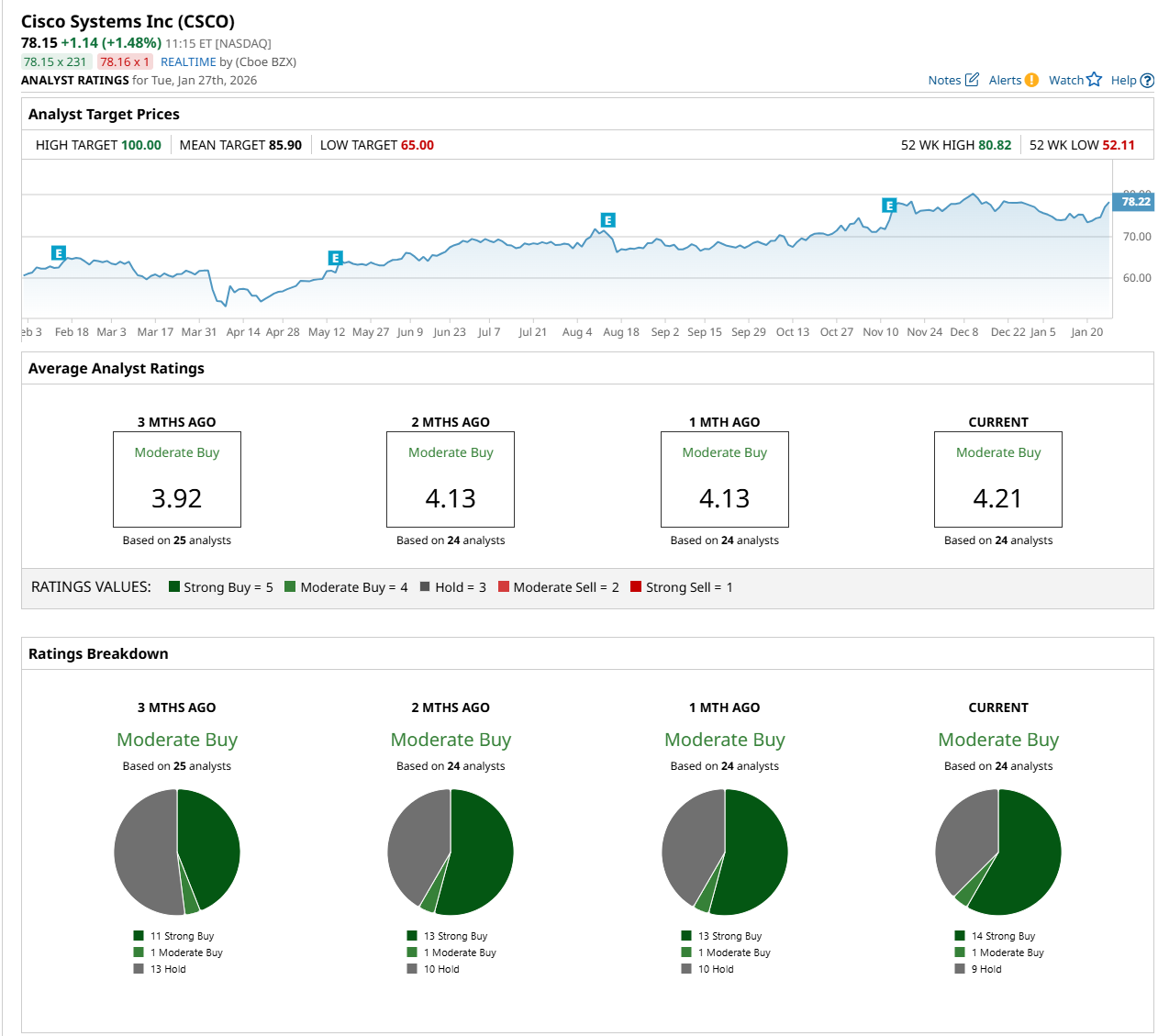

Among the 24 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 14 “Strong Buy,” one "Moderate Buy,” and nine “Hold” ratings.

The configuration is slightly more bullish than a month ago, with 13 analysts suggesting a “Strong Buy” rating.

On Jan. 26, Evercore Inc. (EVR) upgraded CSCO to “Outperform,” with a price target of $100, the Street-high price target, implying a 28% upside potential from current levels.

The mean price target of $85.90 represents a 9.9% premium from CSCO’s current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Is Poised to Report Strong Q4 Results. Is a Share-Price Rebound in SOFI Stock's Future?

- Dear Amazon Stock Fans, More Layoffs Are Coming This Week

- Bullish Price Surprise: Is Lands’ End’s Licensing JV the Beginning of the End or a New Beginning?

- Dear Starbucks Stock Fans, Mark Your Calendars for January 29