Insulet Corporation (PODD), headquartered in Acton, Massachusetts, specializes in innovative diabetes management solutions. The company is renowned for its Omnipod Insulin Management System, a tubeless, wearable pump that delivers continuous insulin for up to three days without needles or infusion sets.

This discreet technology empowers people with type 1 and insulin-dependent type 2 diabetes, offering simplicity and mobility. Insulet operates globally in several countries, with advanced manufacturing driving scalable production and R&D. The company has a market capitalization of $20 billion.

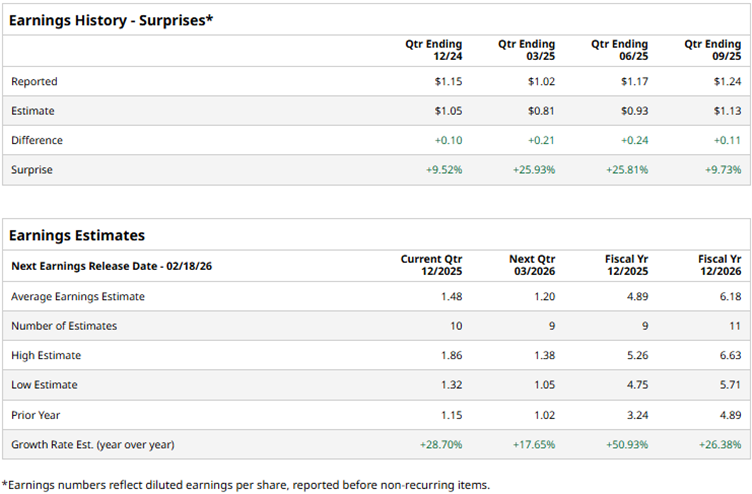

The company is expected to report its fourth-quarter results for fiscal 2025 soon. Ahead of the earnings release, Wall Street analysts expect its bottom line to grow.

Analysts expect Insulet to report a profit of $1.48 per share on a diluted basis for Q4, up 28.7% year-over-year (YOY). The company has a solid track record of exceeding consensus estimates, topping them in all four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect Insulet’s diluted EPS to grow by 50.9% annually to $4.89, followed by a 26.4% improvement to $6.18 in fiscal 2026.

Over the past 52 weeks, the stock has gained 3.2%, and over the past six months, it has gained 1.4%. The stock has underperformed the broader market, as the S&P 500 Index ($SPX) has increased by 13.7% and 9% over the same periods, respectively. We now compare PODD’s performance with that of its sector. The State Street Health Care Select Sector SPDR ETF (XLV) has increased 11.1% over the past 52 weeks and 20.7% over the past six months. Therefore, the stock has underperformed its sector over these periods.

Insulet’s stock gained 2.9% intraday on Nov. 6, 2025, as the company reported better-than-expected third-quarter results. Its revenue increased by 29.9% YOY to $706.30 million. Insulet’s total Omnipod revenue increased by a solid 31% to $699.20 million. Its non-GAAP EPS increased 37.8% from the prior-year period to $1.24. Based on this growth, the company raised its fiscal 2025 revenue (in constant currency) guidance from a growth range of 24%-27% to 28%-29%.

Wall Street analysts have been bullish about Insulet’s prospects. Among the 26 analysts covering the stock, the consensus rating is “Strong Buy.” The rating configuration is less bullish than it was a month ago, with 22 “Strong Buy” ratings now, down from 23. The stock also has two “Moderate Buy” ratings, one “Hold,” and one “Strong Sell.” The mean price target of $376.42 implies a 32.1% upside from current levels, while the Street-high price target of $450 implies 57.9% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart