Valued at a market cap of $70 billion, Warner Bros. Discovery, Inc. (WBD) is a media and entertainment company based in New York. It creates, produces, and distributes a wide range of content across film, television, sports, news, and gaming. The company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

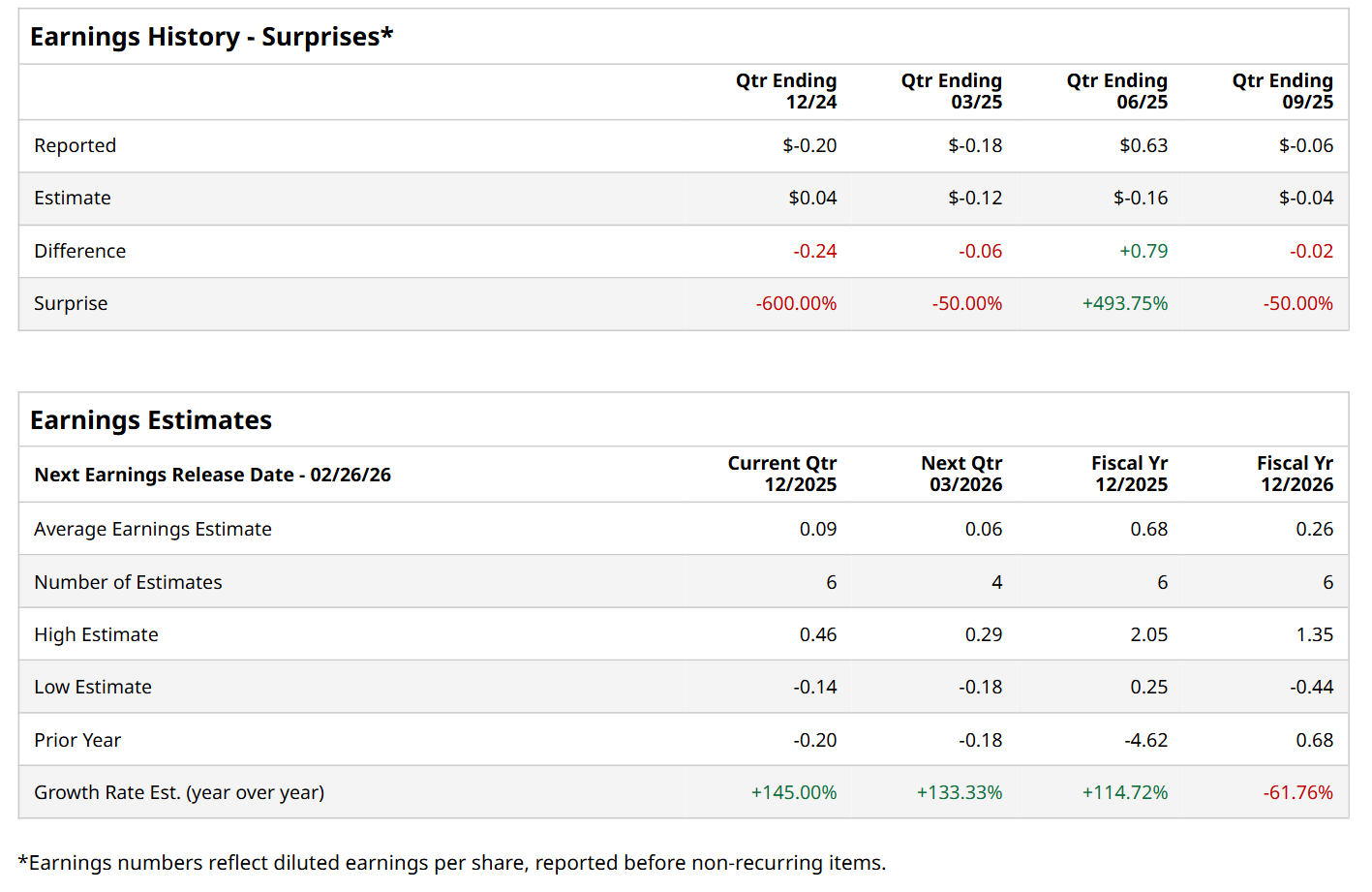

Ahead of this event, analysts expect this media and entertainment company to report a profit of $0.09 per share, up 145% from a loss of $0.20 per share in the year-ago quarter. The company has missed Wall Street’s bottom-line estimates in three of the last four quarters, while surpassing on another occasion. Its loss of $0.06 per share in the previous quarter fell short of the consensus estimates by 50%.

For the current fiscal year, ending in December, analysts expect WBD to report a profit of $0.68 per share, up 114.7% from a loss of $4.62 per share in fiscal 2024. However, its EPS is expected to decline 61.8% year-over-year to $0.26 in fiscal 2026.

WBD has soared 190.6% over the past 52 weeks, significantly outperforming both the S&P 500 Index's ($SPX) 13.3% return and the State Street Communication Services Select Sector SPDR ETF’s (XLC) 14.9% uptick over the same time period.

On Jan. 20, Netflix, Inc. (NFLX) updated its bid for WBD’s studio and streaming assets, moving to an all-cash offer to strengthen shareholder support for its acquisition and potentially head off the rival bid tied to Paramount Skydance Corporation (PSKY). The revised proposal replaces a December cash-and-stock deal that valued Warner at $27.75 per share, or $82.7 billion including debt, with a simpler structure designed to provide greater value certainty and speed up a shareholder vote, possibly by April.

Wall Street analysts are moderately optimistic about WBD’s stock, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, seven recommend "Strong Buy," two advise "Moderate Buy,” and 15 indicate "Hold” ratings. While the company is trading above its mean price target of $24.78, its Street-high price target of $35 suggests a 22.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Could Launch a New PC This Year. Should You Buy NVDA Stock First?

- As Micron Spends $1.8 Billion on a New Chip Fab Site, Should You Buy MU Stock?

- Netflix Just Upped Its Bid for Warner Bros. to All Cash. What Does That Mean for NFLX Stock?

- The New Wegovy Pill Is Already Popular. Does That Make Novo Nordisk Stock a Buy for Q1?