Valued at a market cap of $86.2 billion, Airbnb, Inc. (ABNB) is an online marketplace that connects hosts offering accommodations and unique stays with guests seeking lodging and travel experiences. The San Francisco, California-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

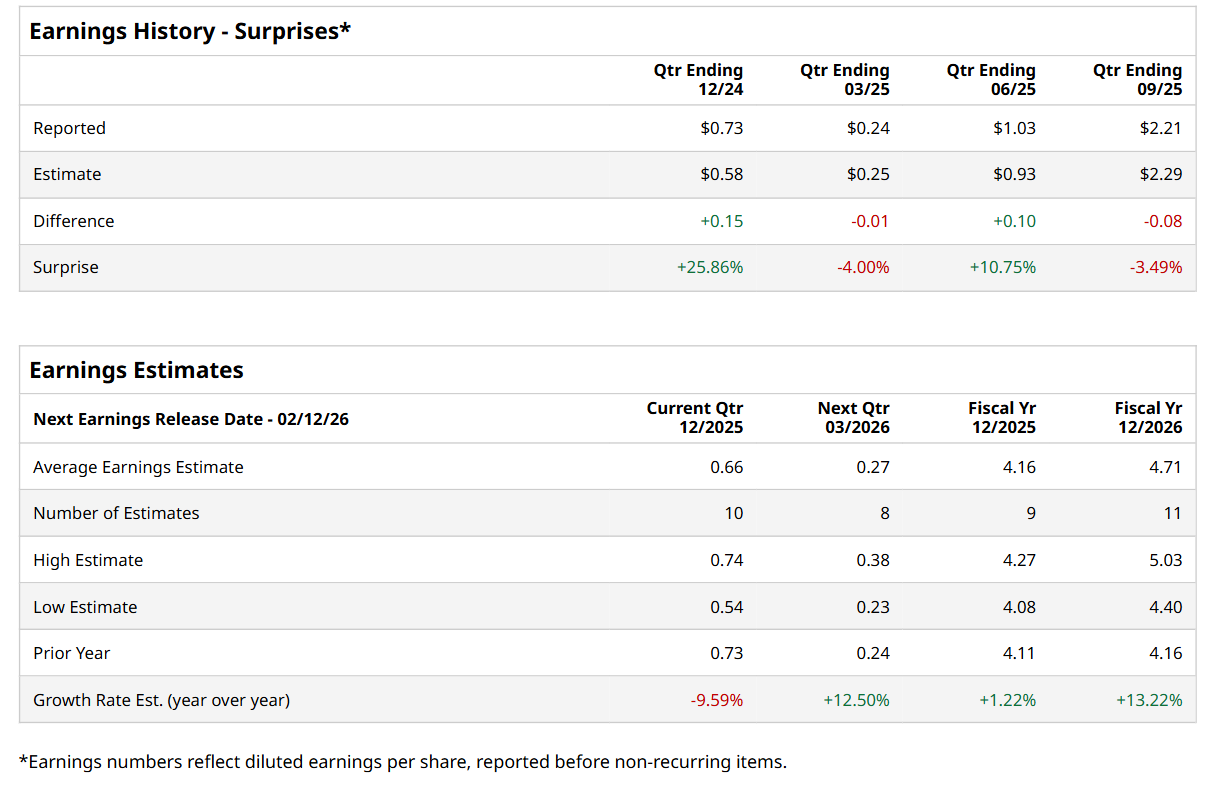

Ahead of this event, analysts expect this travel services provider to report a profit of $0.66 per share, down 9.6% from $0.73 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. In Q3, its EPS of $2.21 fell short of the consensus estimates by 3.5%.

For the current fiscal year, ending in December, analysts expect Airbnb to report a profit of $4.16 per share, up 1.2% from $4.11 per share in fiscal 2024. Furthermore, its EPS is expected to grow 13.2% year-over-year to $4.71 in fiscal 2026.

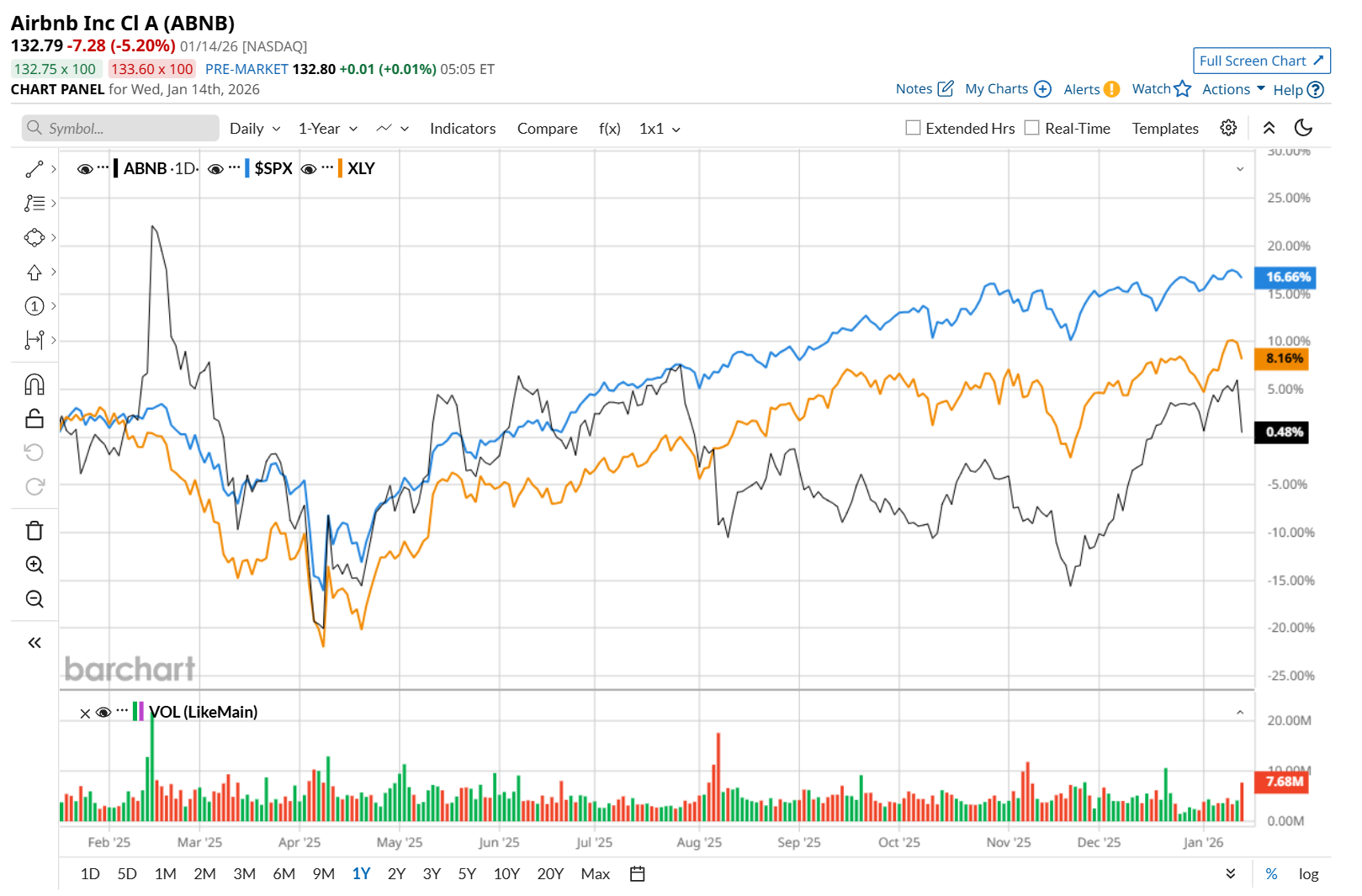

Airbnb has gained 4.1% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 18.6% return and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 10.3% uptick over the same time period.

On Nov. 6, ABNB delivered its Q3 results, and its shares closed up marginally in the following trading session. The company’s revenue grew 9.7% year-over-year to $4.1 billion, meeting analyst estimates. Other key business metrics also remained strong, with Gross Booking Value (GBV) rising 13.9% to $22.9 billion and Nights and Seats Booked increasing 8.8%, driven by strong U.S. demand and new features like Reserve Now, Pay Later. However, its net income per share improved 3.8% from the year-ago quarter to $2.21, but missed consensus expectations of $2.29.

Wall Street analysts are moderately optimistic about ABNB’s stock, with a "Moderate Buy" rating overall. Among 40 analysts covering the stock, 12 recommend "Strong Buy," three indicate "Moderate Buy,” 22 suggest "Hold,” one advises a "Moderate Sell,” and two suggest "Strong Sell.” The mean price target for ABNB is $145.94, indicating a 9.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Spats With Exxon CEO Darren Woods Over Venezuela, Should You Take a Risk and Buy XOM Stock?

- Is This Nvidia-Backed AI Stock a Buy Before It Soars 177%?

- Analyzing a Butterfly Spread on Marvell Technology

- Stocks Climb Before the Open as TSMC Reignites AI Optimism, U.S. Economic Data and Earnings in Focus