Alphabet Inc. (GOOG) ranks among the world's largest technology conglomerates, with headquarters in Mountain View, California. It manages core operations through Google, including search, online advertising via YouTube, cloud computing services, Waymo’s autonomous driving technology, and cutting-edge artificial intelligence (AI) research.

Recent highlights include strategic acquisitions to drive energy innovation, ongoing AI model advancements such as Gemini, and robust growth in the cloud and advertising sectors, reinforcing its position as a tech leader. The company has a market capitalization of $4.06 trillion.

The company is expected to report its fourth-quarter results for fiscal 2025 soon. Ahead of the earnings release, Wall Street analysts expect its bottom line to grow.

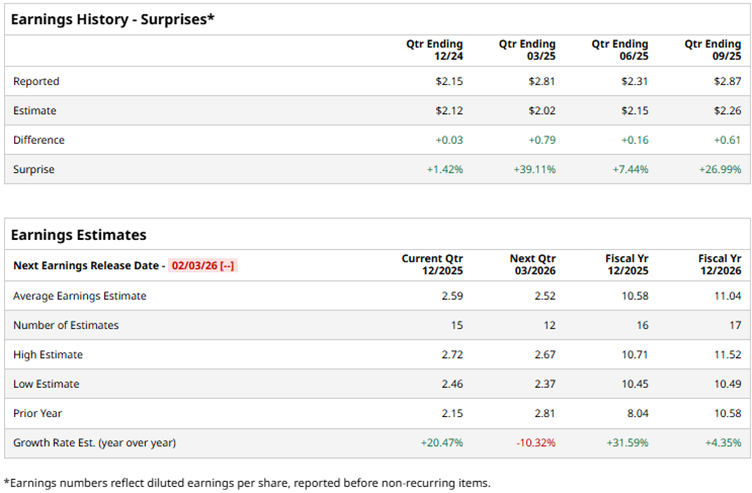

Analysts expect Alphabet to report a profit of $2.59 per share on a diluted basis for Q4, up 20.5% year-over-year (YOY). The tech giant has a solid track record of exceeding consensus estimates, topping them in all four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect Alphabet’s diluted EPS to grow by 31.6% annually to $10.58, followed by a 4.4% improvement to $11.04 in fiscal 2026.

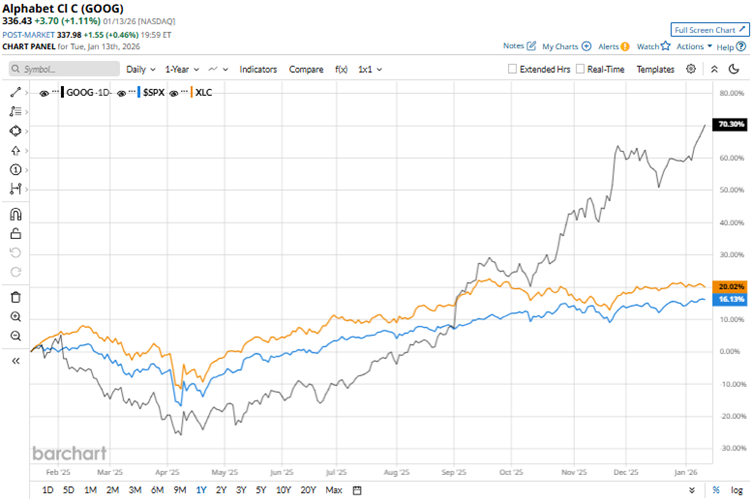

GOOG’s stock has been outperforming the broader market over the past year. The company continues to see tailwinds from its search dominance amid AI enhancements. Its cloud division continues to gain market share, and demand for its custom AI chips seems to be holding strong.

Over the past 52 weeks, the stock has gained 75%, and over the past six months, it has been up 85.6%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 19.3% and 11.3% over the same periods, respectively.

We now compare GOOG’s performance with that of its sector. The State Street Communication Services Select Sector SPDR ETF (XLC) has increased 22% over the past 52 weeks and 10.3% over the past six months. Therefore, the stock has outperformed its sector over these periods.

Alphabet’s stock had a blockbuster year in 2025 and has started this year strong, topping $4 trillion in market capitalization. The company’s shares rose 1.1% intraday on Jan. 12 after reports that Apple Inc. (AAPL) had entered into a multi-year partnership with Alphabet to use its Gemini models and cloud technology for Apple’s AI products, including Siri, with rollouts expected this year.

Alphabet is also set to launch its own AI-powered eyeglasses this year, amid a backdrop in which eyewear is poised to become the next major category, driven by increased visual needs and other lifestyle uses.

Alphabet’s endeavors are supported by its robust financials. The company’s topline grew in double digits in the third quarter of 2025, compared to the prior-year period, as advertising revenues continued to drive growth and cloud revenues continued to expand.

Wall Street analysts have been extremely bullish about Alphabet’s prospects. Among the 55 analysts covering the stock, the consensus rating is “Strong Buy.” The rating configuration is more bullish than it was a month ago, with 45 “Strong Buy” ratings now, up from 44. The stock also has four “Moderate Buy” ratings and six “Holds.” The mean price target of $337.17 implies a slight upside from current levels, while the Street-high price target of $400 implies 18.9% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump Just Juiced the Bull Case for Lockheed Martin to $1.5 Trillion. Does That Make LMT Stock a Buy Here?

- A $2.65 Billion Reason to Buy Bloom Energy Stock in January 2026

- This 1 Greenland Stock Has Surged in the Past Month. Should You Chase the Rally Here?

- This Memory Stock Is Up 745% in the Past 6 Months. Is It Unstoppable?