With a market cap of $40.1 billion, Martin Marietta Materials, Inc. (MLM) is a natural resource-based building materials company that supplies aggregates and heavy-side construction materials across the United States and internationally. It serves infrastructure, residential, and nonresidential construction markets as well as industrial and environmental sectors.

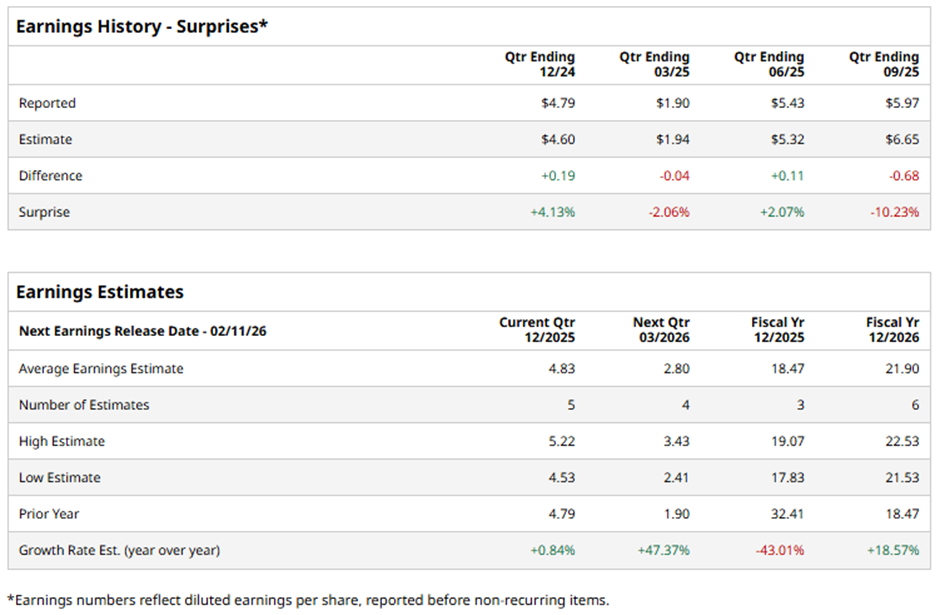

The Raleigh, North Carolina-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of the event, analysts forecast MLM to report an adjusted EPS of $4.83, up marginally from $4.79 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts predict the seller of granite, limestone, sand and gravel to post an adjusted EPS of $18.47, a 43% decrease from $32.41 in fiscal 2024. However, adjusted EPS is projected to grow 18.6% year-over-year to $21.90 in fiscal 2026.

MLM stock has gained 29.7% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 19.3% increase and the State Street Materials Select Sector SPDR ETF's (XLB) 14.4% rise over the same period.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $5.97 and revenue of $1.85 billion, shares of MLM rose nearly 1% on Nov. 4. Martin Marietta raised its full-year adjusted EBITDA forecast to a midpoint of $2.32 billion and reported an 8% increase in aggregates shipments, signaling resilient demand and pricing strength supported by infrastructure spending and data-center-driven construction activity.

Analysts' consensus view on MLM stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 21 analysts covering the stock, 12 recommend a "Strong Buy," one gives a "Moderate Buy" rating, and eight have a "Hold." The average analyst price target for Martin Marietta Materials is $679.25, suggesting a potential upside of 2% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy, Sell, or Hold Visa Stock for January 2026?

- Trump Just Juiced the Bull Case for Lockheed Martin to $1.5 Trillion. Does That Make LMT Stock a Buy Here?

- A $2.65 Billion Reason to Buy Bloom Energy Stock in January 2026

- This 1 Greenland Stock Has Surged in the Past Month. Should You Chase the Rally Here?