Mountain View, California-based Alphabet Inc. (GOOGL) hardly needs an introduction, as Google sits at the center of daily digital life. Valued at roughly $4 trillion, the company anchors global search and online advertising while expanding aggressively into cloud computing, artificial intelligence (AI), hardware, and emerging healthcare offerings across key international markets.

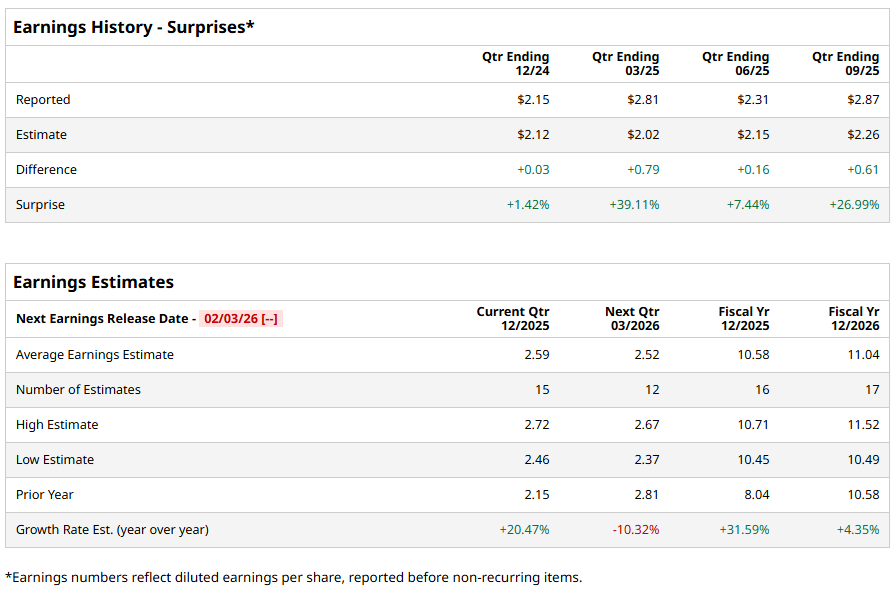

All eyes now turn to earnings, as Alphabet prepares to report fiscal 2025 Q4 results on Wednesday, Feb. 4, after market close. Analysts project diluted EPS of $2.59, up 20.5% from $2.15 a year ago, reflecting both growth and operational consistency, which the company has demonstrated by surpassing EPS expectations in each of the past four quarters.

Looking at the full year, Wall Street expects fiscal 2025 diluted EPS of $10.58, marking a 31.6% year-over-year increase, while momentum is anticipated to continue into fiscal 2026 with projected EPS of $11.04, up 4.4% year over year.

Coming to share-price performance, Alphabet’s shares have surged 69.4% over the past 52 weeks and gained nearly 5% year-to-date (YTD), far outpacing the S&P 500 Index ($SPX), which rose 17.7% and 1.8% over the same periods.

Alphabet’s leadership becomes even clearer within its sector. The State Street Communication Services Select Sector SPDR ETF (XLC) climbed 21.2% over the past year but showed only modest YTD gains, highlighting Alphabet’s sustained edge.

On Oct. 29, 2025, Alphabet reminded Wall Street of its dominance by reporting fiscal Q3 2025 revenue above $100 billion for the first time. Revenue rose 15.9% year over year to $102.35 billion, surpassing the $99.89 billion analyst estimate, while EPS climbed 35.4% to $2.87, blowing past analyst expectations by $0.58.

Advertising continued to drive Alphabet’s business, contributing $74.2 billion, with Google Search delivering $56.6 billion, up 14.5% year-over-year, and YouTube adding $10.3 billion. The standout performer, however, was Google Cloud, which posted $15.2 billion in revenue, up 33.5% year over year, signaling rapid enterprise growth.

Investors responded enthusiastically, sending shares up approximately 2.7% on announcement day and another 2.5% in the following session.

As Alphabet approaches its earnings release, analysts continue to favor the stock, maintaining a “Strong Buy” consensus rating that has held steady for the past three months. Of 55 analysts covering the stock, 45 rate it a “Strong Buy,” four recommend “Moderate Buy,” while six call for “Hold.”

GOOGL’s mean price target of $334.23 represents potential upside of 1.7%. Meanwhile, the Street-high target of $400 suggests a gain of 21.7% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart