Palantir (PLTR) has been riding a huge AI-driven rally in 2025, and its latest news has investors buzzing. The tech giant has already been known for its deep government ties and expanding commercial footprint, but this time it just announced a fresh partnership with TWG AI after a highly successful multi-demo customer event that drew praise from Wedbush.

This partnership follows a recent Palantir customer conference where 30+ AI demos were shown to clients, and analysts were “surprised at the breadth” of Palantir’s use cases. Aside from TWG, Palantir struck a few notable deals. It announced an expanded partnership with Nvidia (NVDA) for using AI chips and tools, and even received a U.S. Army directive to use its Vantage platform across all commands and organizations.

In other words, we can say that Palantir is aggressively expanding its AI footprint into finance. So investors would be asking: Is there more upside ahead, or is the stock already priced for perfection? Let's find out the answers.

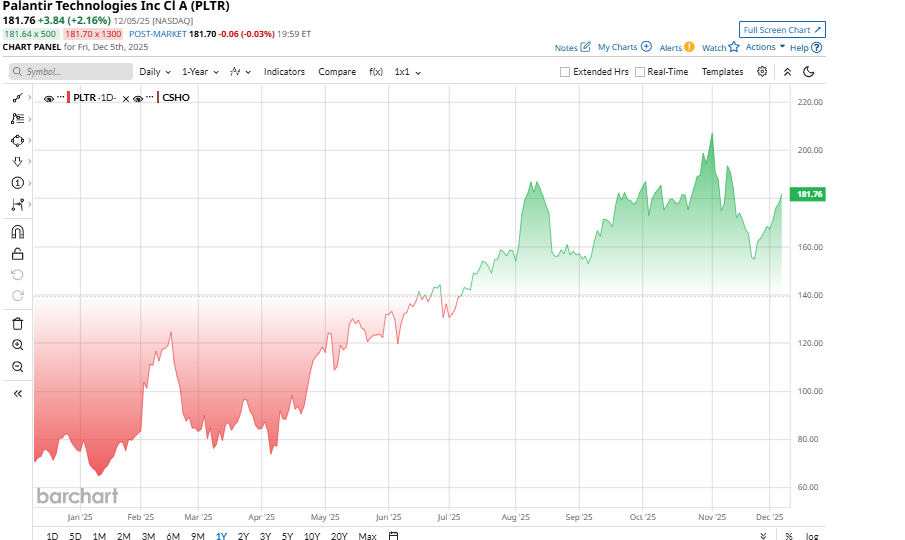

Palantir Stock Performance

Founded in 2003, Palantir is an AI-driven software company whose platforms, like Foundry and its newer AIP, help governments and businesses make sense of complex data. Once focused on national security, Palantir now serves finance, healthcare, defense, and more, turning siloed data into real-time intelligence. Its products are used by U.S. agencies and also by banks, insurer,s and others to automate workflows and decisions.

Valued at around $435 billion by market cap, shares of PLTR have surged about 140% year-to-date (YTD). It climbed to an all-time high $207 in early November. This rally was fueled by blowout earnings and AI optimism, even outpacing gains in Nvidia. However, after hitting that peak, the stock pulled back 12% to around $182, roughly on par with today’s trading level, due to insider pressure and valuation concerns. In short, PLTR went from a deep-value perch earlier this year to trading near record highs, as investors priced in rapid growth.

Nothing is new about Palantir's valuation; it is rich. It trades at roughly 320x trailing P/E versus about 24x for the tech sector, and its EV/sales is on the order of 100x verses the sector median of 4x. It seems like virtually all potential big wins already seem baked into PLTR’s stock. These sky-high multiples suggest most investors are counting on continued explosive AI-driven growth, so the bar for disappointment is very high.

The TWG Partnership

Palantir established its new collaboration with TWG Global based on the principle of applying its AI software in financial services. TWG is an investment company that is focused on implementing AI within a complicated sector such as banking. The agreement consolidates a partnership targeting the application of the Palantir AIP platform to transform large bank and insurer processes like underwriting, trading, and risk management. Theoretically, this is a good one; by integrating the technology of Palantir with the industry contacts of TWG, it would allow the company to open a significant new client base. It was considered by many analysts another signal that the Palantir ecosystem is growing: as it was reported, three giants, xAI bleeding-edge models, Palantir's proven data platform, and TWG's execution muscle are joining forces.

Investors are, however, advised not to read too much into this collaboration right now. Large collaborations are not usually immediately rewarding. Integration has been a problem at past consortia of Palantir and even xAI of Musk or Nvidia. Nevertheless, regardless of all the hype, there are some analysts who worry about the existence of an “AI bubble,” and even renowned investor Michael Burry recently bet Palantir bearish, which means betting against the stock.

So, the TWG alliance is interesting news; it is not a short-term revenue generator but a long-term project. At least at present, it is more of a vote of confidence in the strategy of Palantir, though investors can see whether it will lead to actual contracts and an increase in profits.

Palantir Smashes Q3 Earnings Estimate

Palantir’s Q3 earnings were nothing short of explosive. The company easily topped analyst estimates on both top and bottom line and showed immense growth, fueled by surging demand from both its government and commercial customers.

The company posted $1.18 billion in revenue, soaring 63% year-over-year (YoY) and easily topping Wall Street’s expectations. Growth was strong across the board: commercial sales jumped 73% to $548 million, U.S. revenue surged 77% to $883 million, and profitability hit new highs.

GAAP net income climbed to $476 million, up from $144 million last year, while EPS came in at $0.18, crushing the $0.12 analysts were looking for. Cash generation was equally impressive, with $508 million in operating cash flow and $540 million in free cash flow, pushing Palantir’s cash balance to $6.4 billion.

Management raised guidance across the board. For Q4, Palantir now expects revenue between $1.327 billion and $1.331 billion, representing roughly 60% growth, and full-year revenue is projected at $4.396 to $4.40 billion, well above prior estimates. CEO Alex Karp even said this was “arguably the best any software company has ever delivered,” and based on the numbers, he’s not exaggerating (too much at least).

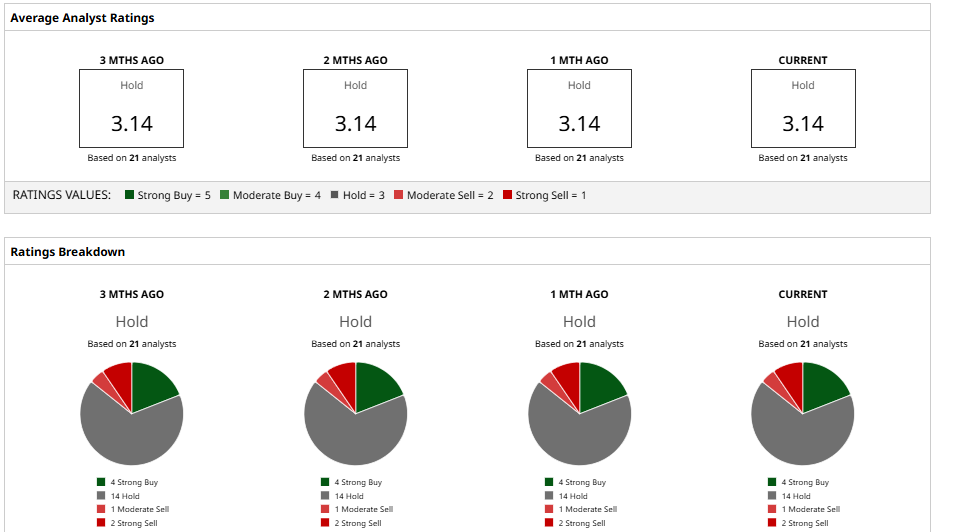

What Do Analysts Say About PLTR Stock?

Wall Street is generally positive but cautious on PLTR Stock. Wedbush’s Dan Ives remains bullish; he kept an “Outperform” rating and raised his 12-month target to $230, citing Palantir’s expanding AI-led growth.

Morgan Stanley has an “Equal-Weight” rating with a $205 target, and Goldman Sachs has a $188 target. These analysts note the beat-and-raise quarter was impressive, but they also highlight PLTR’s sky-high multiples and the need for continued execution. In short, analysts see plenty of long-term potential but acknowledge that Palantir has to deliver on those big promises.

Overall, Wall Street has a consensus “Hold” rating on PLTR, with an average 12-month price target of $191.7 implies an upside of 6% from current levels.

The Bottom Line

In my opinion, Palantir continues to deliver strong fundamentals and widen its moat with partnerships like TWG, but the stock now trades as if everything will go right. Much of the good news is already priced in. Even so, the stock keeps hitting new highs thanks to its momentum and growth narrative. If you can digest the valuation, PLTR could still be a long-term buy.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- DeepSeek Just Launched a New Challenger to Gemini 3. Will It Hurt the Bull Case for GOOGL Stock?

- A Major Shift in Adobe’s (ADBE) Risk Geometry Points to Fresh Upside

- Snowflake Stock is Down But Its FCF Margin Guidance Could Lead to a 22% Higher Price Target

- Is a Short Squeeze Brewing in iRobot Stock?