There are too many ETFs.

That’s not a knock on any particular provider or fund. This is a redundancy issue, or one of correlation. In the way that Henry Ford once said about his Model T car, as it started to fill the roads of America: “Customers can have any color they want… as long as it’s black.” That same lack of differentiation has infected the ETF business. The same way it did the mutual fund industry 30 years ago, when there were more funds than listed U.S. stocks.

The issue here is two-fold. First, investors, and particularly traders, will have an idea, and decide to find an ETF to execute it. For instance, biotech stocks. OK, so which one to use? There are some that can be separated clearly in terms of performance, type and weight of holdings, or a sub-theme within that slice of the healthcare sector, and the stock market in general.

But there’s so much correlation in today’s stock market that different ETFs of the same general breed are more likely to move up and down together.

This is not the most pressing issue for traders and inventors. But it could be going forward. Because the maze of products has made it more difficult to distinguish between wheat and chaff. Furthermore, this is not about which ETF is “better,” since that will be based on what any particular investor or trader is looking for.

My concern: the more product glut we endure, the more likely we are to blur the lines about what may work for us. And, given how many ETFs there are now, the more that chase the same, diminished number of stocks, the more that market price movement tends to be in sync.

In other words, that “market of stocks” we old-timers were trained to understand is rapidly turning into a “stock market.”

One Market, Indivisible, with Liberty and Confusion for All

Sure, we have the freedom to do our own research. And the ETF managers and sponsors have every right to feed the frenzy that has ramped up interest in the modern stock market. Perhaps the differentiator will ultimately be the closing of funds that fail to gather sufficient assets. That was the downfall of mutual funds.

But ETFs tend to be less expensive to start and run, thanks to strong innovation within the industry over the past decade. So the key thing investors and traders look for in their research, more basic than “will it go up after I buy it,” will continue to be less clear. Because so many ETFs look and act alike.

CHPX: Solid Set of Stocks, but How Unique Is It?

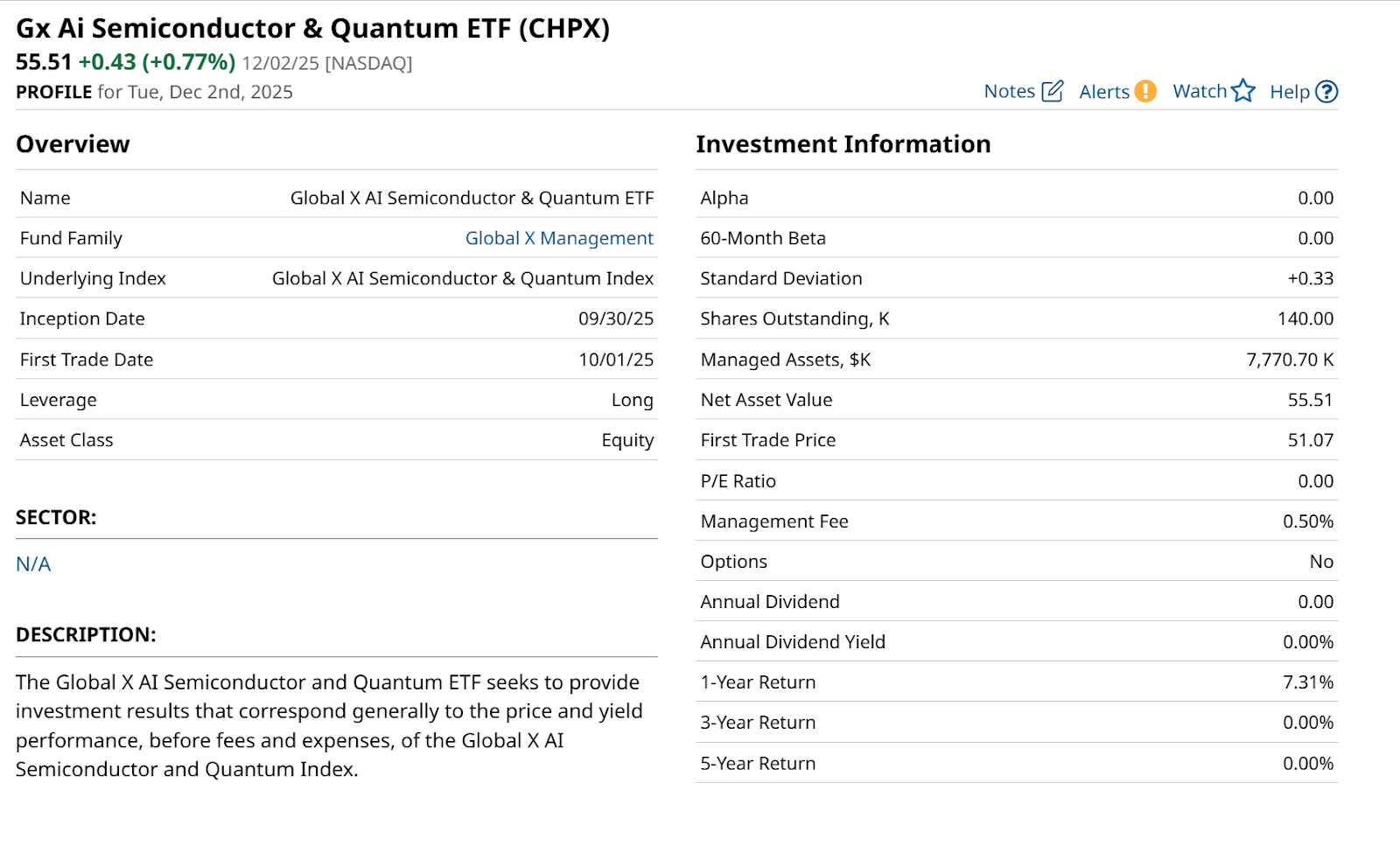

Case in point: a new fund from a tenured ETF provider that is actually one of my personal favorites. Because they have been willing to go where others don’t, go early in the process of indexing a part of the market, and provide excellent online information about the funds they back. That’s Global X. And the ETF in question here is one of their newest, the Global X AI Semiconductor & Quantum ETF (CHPX).

It debuted two months ago, and for an ETF company not named iShares or Vanguard, it is off to a decent start, gathering more than $9 million in assets. As with many equity ETFs, it is based on an index created specifically for the purpose of managing an ETF, as listed below.

A quick glance at the biggest holdings from the Global X site shows a set of familiar names including Broadcom (AVGO), ASML (ASML), Nvidia (NVDA), Intel (INTC), and Advanced Micro Devices (AMD).

Global X describes the index weighting scheme as follows:

- Index components are weighted according to their Free Float Market Capitalization.

- Single security cap of 10%.

- The aggregate weight of companies weighted above 5% cannot exceed 40% of the index weight. The remaining companies are capped at 4.5%.

This explains why the biggest stocks are toward the top of the weightings. Some stocks are bigger based on total market cap, but not “free float” market cap, due to closely held shares by founders and other insiders.

The key point here is that this is a nice collection of stocks that are currently having a historic run as market leaders. However, for a new ETF to get and maintain traction with traders, its biggest hurdle is to represent something different. Otherwise, the bigger the marketing budget, the bigger the assets gathered.

I applaud any ETF firm for making the effort to bring something unique to the market. But given that the market is more in sync than ever before and attention spans keep shrinking, I wonder if we could use more colors of today’s version of the Model T.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Is Michael Burry So Bullish on Lululemon Stock? And Should You Be, Too?

- Google Is Gaining Ground in TPUs, But This 1 Other Chipmaker Is Still a Strong Buy According to Morgan Stanley

- Can Trump Save the Day for iRobot Stock?

- 3 Ways to Trade Bitcoin’s Big Comeback While Hedging Against a Permanent Crypto Winter