I hope you’re up for some math. Because when a market event like the recent slide in Bitcoin (BTCUSD), coupled with Tuesday’s attempted “buy the dip” rally occurs, my number-crunching side really takes over. And for good reason, I think. Because these are the times when the math of risk management couples with the apparent never-say-die attitude of cryptocurrency traders.

The result is some of the best reward/risk tradeoffs we’ll see this year. Or next.

Why? Because the math makes it so. Specifically, the potential for a deep selloff in a stock or ETF to create a bigger percentage gain required to recover its old high.

So if you think there’s a reasonable chance Bitcoin can do that in the next several months or sooner, there’s a reason for intrigue here. And, using option collars, we can see how the math works in another, complementary way. The more volatile an asset, the more favorable the option collar terms. That’s typical, at least. If the options are not liquid, that’s another story.

So here, I’m looking at what’s out there for those who want to try to play a Bitcoin comeback that lasts more than a day or week. But not at the risk of losing a huge percentage of their investment. That’s where the collar comes in.

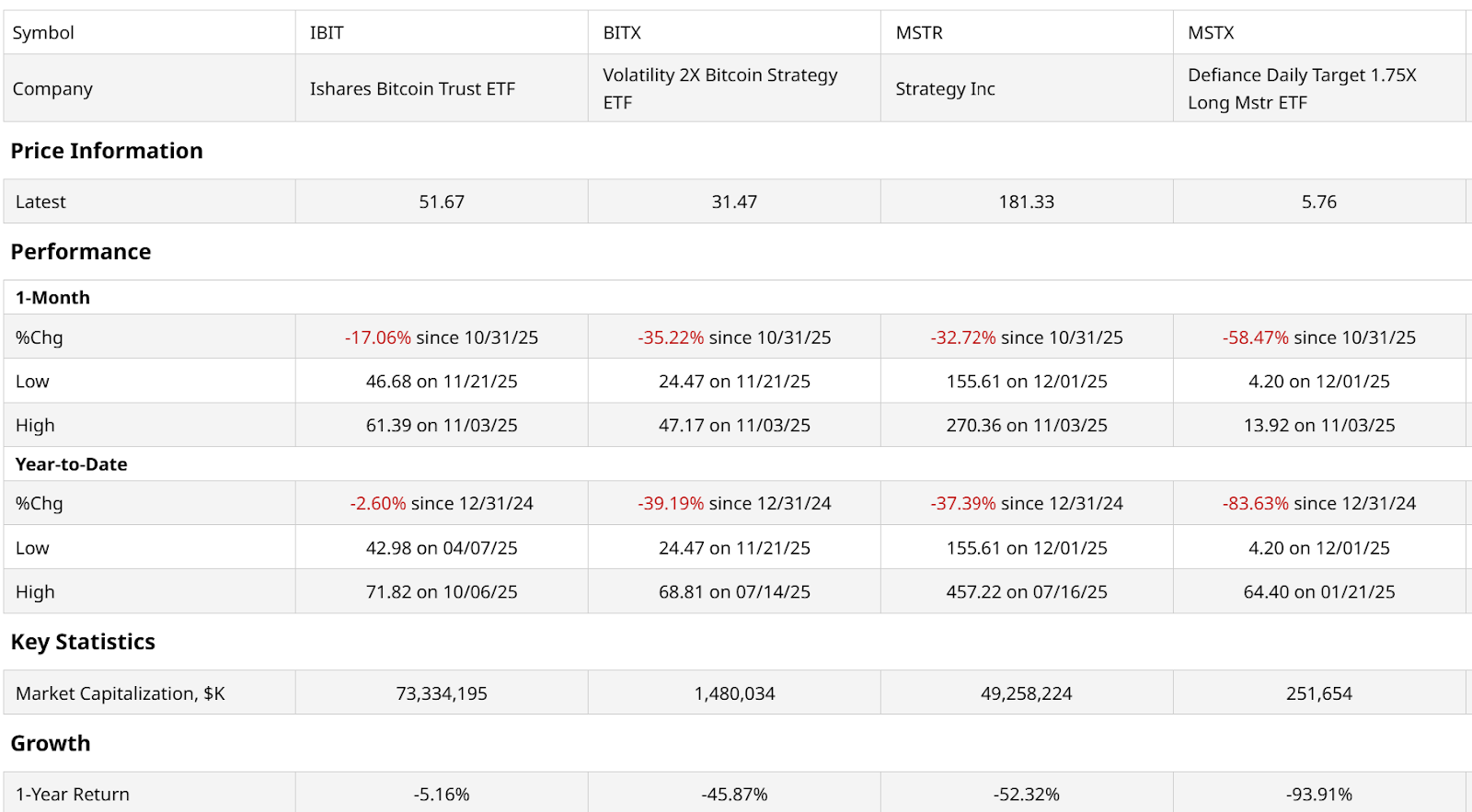

The three Bitcoin proxies I’m using here are:

The iShares Bitcoin Trust ETF (IBIT), the largest spot Bitcoin ETF, with more than $73 billion in assets. Not bad for an ETF still shy of its second anniversary. Those assets are net of a nearly one-third decline in value in under 8 weeks recently.

The Volatility 2X Bitcoin Strategy ETF (BITX), a leveraged ETF tracking Bitcoin’s price. It moves about two times as much as Bitcoin does on a daily basis. That’s a big negative when the underlying asset falls as quickly as Bitcoin just did.

Strategy (MSTR), the stock formerly known as MicroStrategy, Michael Saylor’s Bitcoin-buying machine. Recently, for obvious reasons, that ship has sailed south, if you will. In the table above, I’ve also included a leveraged version of MSTR. But for the sake of the squeamish in the audience, I’ll refrain from delving into the possibilities of using options on a leveraged stock ETF of a Bitcoin Treasury company.

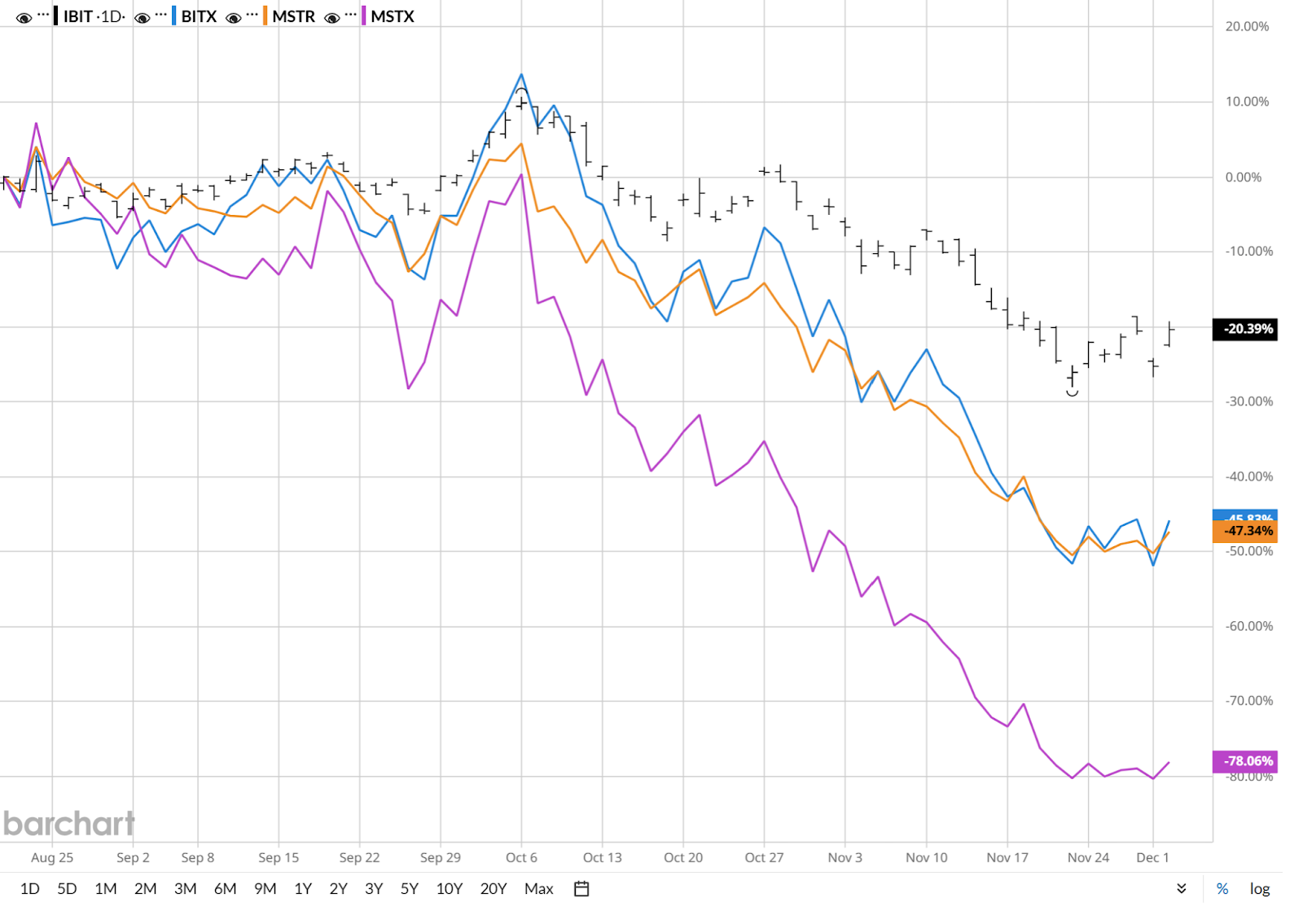

I just showed you the charts for three of those tickers. Here’s one showing them side by side over the past 3 months. Summary: different degrees of lost capital. But now, with at least a shot at redemption, it’s time to look at how these might be collared.

As a review, for every 100 shares of the ETF or stock purchased, 1 covered call option and one protective put option creates a “collar” around that volatile asset. That means the ticker can trade below the put strike price level, but that option acts like a “get out of jail” card if it does. It allows us to sell the stock at that strike price, until the option expires. We pay for that protection. A lot, these days, given the ride Bitcoin has taken.

That’s why the other part of the collar can be helpful. The covered call does limit the upside to that option’s strike price level, but pays us now for potentially stunting our investment’s growth. And, if Bitcoin tanks more, the puts will act as a “worst-case get me out” price through the expiration date.

In addition, the calls will fall in value in that case, which means some or potentially all of that cash that flowed into the account for accepting that upside cap would be kept. That assumes the expiration date arrives, and the call strike price has not been reached. I often think of this as a structured, risk-managed, professional game of chicken. Between the market and me, that is.

Collar Samples for IBIT, BITX, MSTR

Here’s IBIT. I went out to the middle of next year for this one. I accepted some downside (15%) but kept the cost low (2.2%). And the upside of more than 30% makes for a decent 2:1 ratio with the risk.

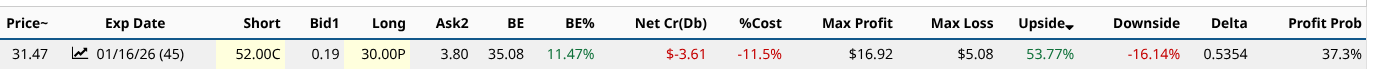

This is BITX, the 2x leveraged Bitcoin ETF. I don’t own any of these, but I like this one the best. That upside is greater than 50% and the collar only goes out 6 weeks. Sure, there’s some significant downside risk (16%), but the assumption I’m making with all of these sample collar combinations is that the position size will be quite small. And with a stock price of $31.47, 100 shares of BITX can be purchased for only about $3,150. Downside risk of 16% on that is around $500. So for $500 risk, this combination can potentially deliver nearly $1,700 if Bitcoin flies into the new year.

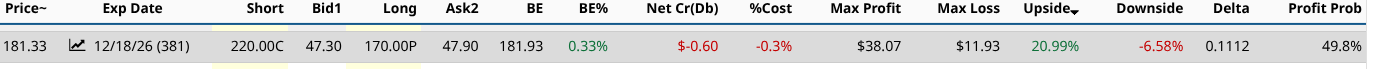

And finally, MSTR. My observation here is that if I’m going to try to play a rally in a stock that has eroded so much value, I’d want a lot more upside than is afforded here. With a much bigger out of pocket net cost for the options, I could pursue that. But that’s not my style.

As I said, this is mainly about the math involved in considering how to use options to trade comeback stories in stocks and ETFs which are already notoriously volatile. As I see it, any time I can use volatility to my advantage as an active trader, the time to crank out the calculations using Barchart’s straightforward presentation of this data is well worth it.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Selling Palantir Stock. Should You?

- Netflix Stock Breaks Below 20-Day Moving Average Amid Selloff. Should You Buy the Dip?

- Michael Burry Says Tesla Is ‘Ridiculously Overvalued.’ Should You Ditch TSLA Stock Here?

- Why Is Michael Burry So Bullish on Lululemon Stock? And Should You Be, Too?