The S&P 500 Index’s ($SPX) dividend yield has plummeted to levels last seen during the late 1990s, prompting comparisons between the dot-com bubble and the feared artificial intelligence (AI) bubble. Meanwhile, the dividend yield of the world's most popular index has fallen because dividends haven’t kept pace with the rapid rise in stock prices. However, we see the opposite in many stocks, whose dividend yields have actually spiked this year. For instance, sneaker giant Nike (NKE) currently boasts a dividend yield of 2.4%, which is comfortably twice what its average S&P 500 Index peer pays.

Nike’s Dividend Yield Is Twice the S&P 500 Index

To be sure, Nike was never known for its dividends for good reasons. The company characterizes itself as a “growth company,” and investors don’t really expect such companies even to match the S&P 500 Index constituent’s dividend yield, let alone beat it.

However, while Nike has gradually raised its dividends—it is actually quite close to becoming a Dividend Aristocrat—its stock has sagged. Nike stock peaked in late 2021 and currently trades at just over a third of those levels after having closed in the red for three consecutive years. This year looks no different, and NKE is on track to close in the red for yet another year unless it comes up with a really impressive set of numbers later this week or we see a Santa Claus rally in broader markets.

Will Nike Stock Go Up in 2026?

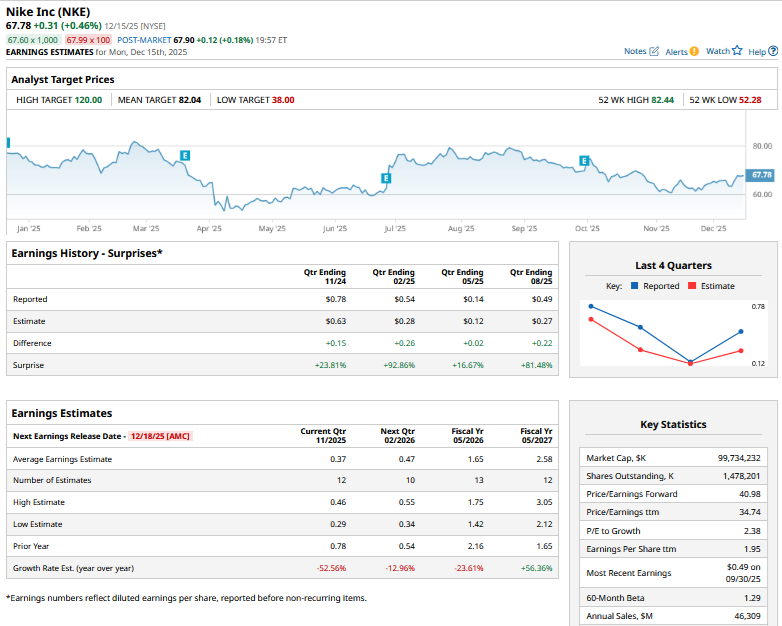

While Nike currently pays a healthy dividend, its price action has been frustrating. I was bullish on the stock heading into 2025, as I found it cheap based on its long-term earnings potential. The multiples based on near-term earnings have been elevated for the last few quarters as Nike’s earnings have fallen. Along with the slowdown, Nike’s turnaround actions under CEO Elliot Hill’s “Win Now” plan have taken a toll on Nike’s earnings.

As part of the turnaround, Nike has doubled down on innovation, tweaked its market strategy by cozying up with third-party sellers, and cut costs structurally. The company rejigged its C-suite earlier this month to eliminate management layers. While many of the turnaround actions have meant near-term pressure on profitability, they should help drive long-term growth while helping improve the margins.

For instance, while analysts expect Nike’s earnings to fall by 23.6% this fiscal year, they are modeling them to rise over 56% in the next fiscal year. The expected rise in earnings would also help Nike increase shareholder payouts.

Nike Faces Several Headwinds

That said, Nike faces several headwinds, some of which look structural in nature. For instance, China remains a structural headwind for Nike, as not only is that market not growing as fast as it once used to, but Chinese consumers have increasingly been preferring domestic brands over U.S. rivals. Then we have the U.S. tariffs, and while Nike has reduced the sourcing from China, the products it imports from other countries to the U.S. are also subject to tariffs. Moreover, as is the case with many other consumer goods, newer brands are giving established brands like Nike a tough fight in most markets.

While I have been disappointed with Nike’s price action, I continue to stay invested and believe that markets will soon start appreciating the turnaround efforts. While Nike might not rise to its 2021 highs in a hurry, at these price levels, the risk-reward looks quite attractive, especially for patient investors. Overall, I find Nike to be a good high-yield dividend stock that also brings prospects of strong capital appreciation in 2026.

NKE Stock Forecast

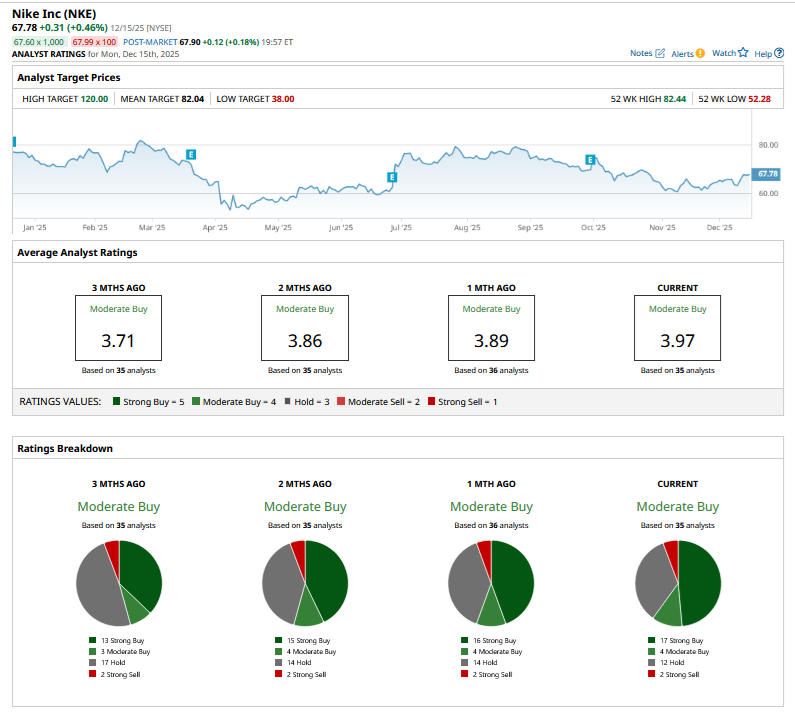

Meanwhile, recent sell-side activity has been mixed, and while BWG Global downgraded its view on Nike from “Positive” to “Mixed,” Guggenheim initiated coverage on the stock with a “Buy” rating. The stock has a consensus rating of “Moderate Buy” from the 25 analysts polled by Barchart, while its mean target price of $82.04 is 21% higher than the current price levels.

On the date of publication, Mohit Oberoi had a position in: NKE . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart