As of this writing, Dec. 9, the Fed has begun its December meeting and will announce the policy decision tomorrow. It is the last meeting for 2025, and the U.S. central bank is expected to cut rates by 25 basis points, which would be its third consecutive cut. While the inflation number is stubbornly above 2%, which the Fed targets, a cooling labor market builds the case for a cut. Moreover, several leading indicators point to a slowdown in the world’s largest economy, which would mean that Jerome Powell and Co. might yet again lean towards dovishness even as they haven’t fully won the war against inflation.

Fed Is Expected to Cut Rates in December

A 25-basis-point rate cut is more or less priced into markets, even as Powell’s comments might still move the markets. Meanwhile, the rate cut, if it were to happen, would help bolster the prospects for the U.S. economy in 2026. Interest rates impact nearly all the sectors of the economy, even as the magnitude differs.

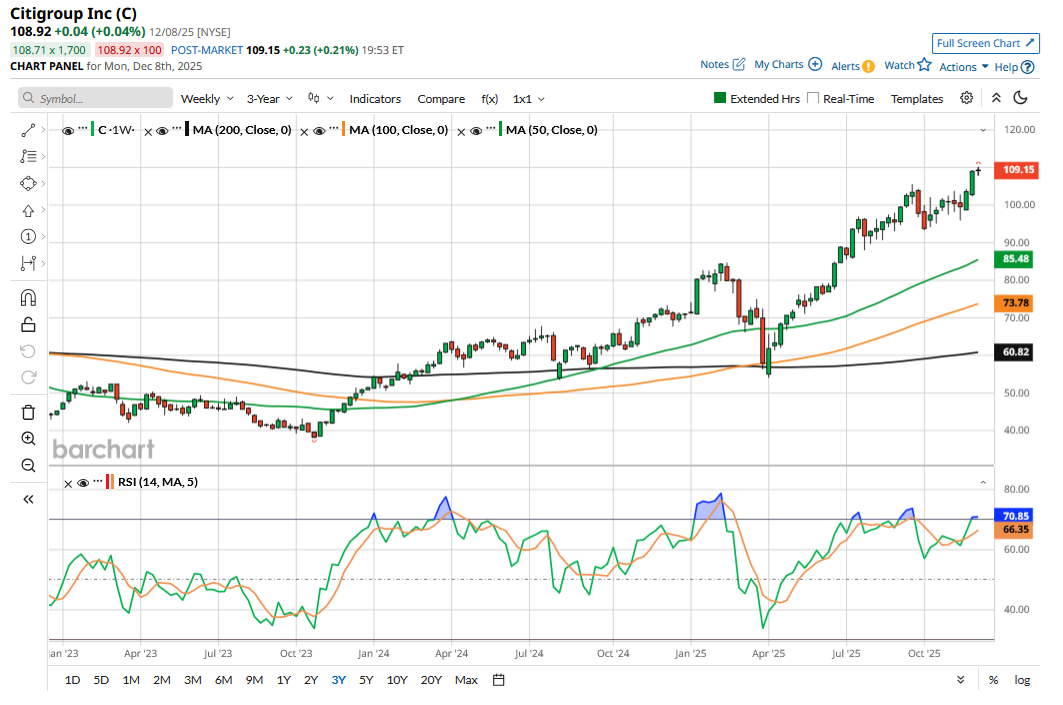

Banks are particularly impacted by the Fed’s policies, as the central bank influences their net interest margin (NIM) as well as the overall business. Among banking stocks, I find Citigroup (C) stock a good buy for 2026, irrespective of the Fed rate cut decision. The stock has soared nearly 53% this year, more than twice the KBW Bank Invesco ETF (KBWB). Moreover, C has outperformed the average KBWB peer by a handsome margin over the last two-year and three-year periods.

Citi’s Dividend Yield Is Quite Healthy

The cherry on top is the 2.1% dividend yield, which is higher than most of its large-cap banking peers. While the gap between Citi’s dividend yield when compared with other banks has narrowed amid the stock’s outperformance, it is still reasonably healthy, especially considering the fact that the S&P 500 Index’s ($SPX) dividend yield recently fell to the lowest levels since the dot-com days.

In my previous article, I had noted that Citi looks like a good buy despite the valuation rerating. The stock has since added to its year-to-date gains and hit a 52-week high yesterday. I believe the stock can still deliver more gains from these levels despite the recent outperformance.

Citi’s Turnaround Remains a Work in Progress

One of the key reasons Citi shares have outperformed in recent years is because of the turnaround actions that it undertook under CEO Jane Fraser, who took over the position in February 2021. Citi had a complex structure and branched out too much, which negatively impacted its return on capital metrics. However, under Fraser—who was named Banker of the Year by Euromoney—Citigroup is a much-changed institution now, which is much leaner and more efficient. Citi has flattened its organizational structure, reduced bureaucracy, and cut its workforce to lower its cost base. It has also exited consumer banking in several international markets, which helped free capital. The bank has consolidated into five core businesses to reduce complexity and focus its energies on key businesses.

Citi announced further actions in its turnaround last month and said that it would integrate the retail bank with the wealth business. “Integrating these businesses puts Citi in a position to accelerate growth by realizing more synergies across relationship tiers,” said the company in its release. Also, it is merging branded credit cards and retail services businesses into U.S. Consumer Cards, which would now be one of the five core businesses.

Citi Stock Looks Like a Good Buy

Citi’s adjusted return on total capital employed was 9.2% in the first nine months of the year, which is now very close to the medium-term target of between 10% and 11% that the company has set. During the Q3 2025 earnings call, Fraser reiterated her previous views, terming the target a “waypoint, not a destination,” while adding that "we see a lot of different areas of upside."

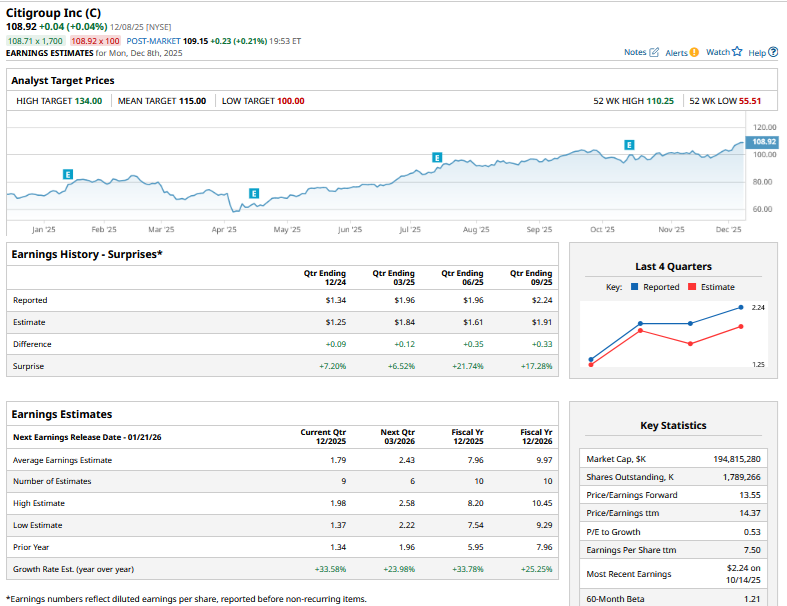

Notably, some of the strategic turnaround actions that Citi undertook over the last couple of years would start reflecting in its bottom line in the coming years, which would keep its profits buoyed. Consensus estimates call for Citi’s per-share earnings to rise by 25.2% in 2026, which is much higher than what U.S. peers are expected to deliver.

From a valuation perspective, while C now trades above its tangible book value, it still trades below the book value per share of $108.41 that it had at the end of Q3. I believe the next milestone in Citi’s valuation rerating would be the stock rising to its book value, which is not an unreasonable expectation given where its peers trade.

The average sell-side analyst does not see much upside in Citi, though, and the stock's mean target price of $115 is just about 5.6% higher than the Dec. 8 closing prices. However, I believe Citi would see target price upgrades sooner rather than later as brokerages reset their target prices following the recent rally. I remain invested in Citi and see the stock building on its 2025 gains, even though not to the same magnitude as we saw this year. America's third-largest lender should also continue to reward investors with healthy dividend growth as its profits rise.

On the date of publication, Mohit Oberoi had a position in: C . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart