With a market cap of $74.4 billion, The Cigna Group (CI) is a long-established U.S.-based provider of insurance and health-related products and services, operating through its Evernorth Health Services and Cigna Healthcare segments. Its offerings span pharmacy and care management solutions, medical and behavioral health coverage, Medicare plans, and international health benefits.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Cigna fits this criterion perfectly. The company distributes its products through brokers, consultants, employers, and public and private exchanges.

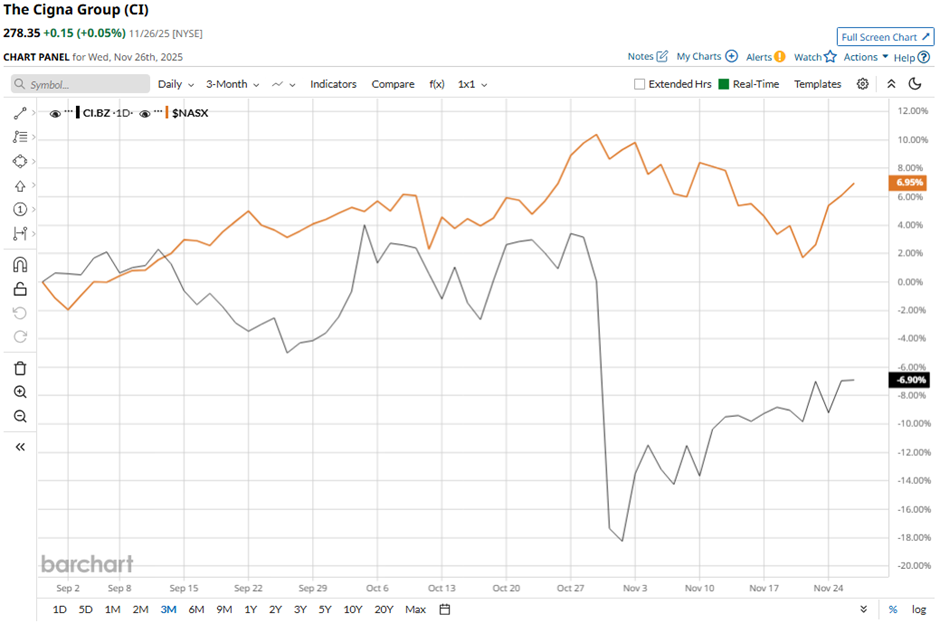

Shares of the Bloomfield, Connecticut-based company have slipped 20.5% from its 52-week high of $350. CI stock has declined 7.3% over the past three months, lagging behind the Nasdaq Composite’s ($NASX) 7.8% gain over the same time frame.

Longer term, CI stock is up marginally on a YTD basis, underperforming NASX’s 20.2% increase. Moreover, shares of the health insurer have decreased 16.9% over the past 52 weeks, compared to NASX’s 21.1% return over the same time frame.

Despite a few fluctuations, the stock has been trading below its 50-day and 200-day moving averages since early May.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $7.83 and adjusted revenue of $69.57 billion, Cigna’s shares tumbled 17.4% on Oct. 30 as the company warned of significant margin pressure over the next two years in its pharmacy benefit services segment. This pressure stems from Cigna’s shift to a no-rebate pricing model beginning in 2027, as well as the repricing and early renewal of three major contracts: Prime Therapeutics, the U.S. Department of Defense, and Centene, together representing about $90 billion in annual revenue.

In contrast, rival UnitedHealth Group Incorporated (UNH) has lagged behind CI stock. UNH stock has dropped 34.8% on a YTD basis and 45.7% over the past 52 weeks.

Despite CI’s weak performance relative to the Nasdaq, analysts remain strongly optimistic about its prospects. The stock has a consensus rating of “Strong Buy” from 23 analysts in coverage, and the mean price target of $329.45 is a premium of 18.4% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart