Newport Beach, California-based Chipotle Mexican Grill, Inc. (CMG) sells a variety of food and beverages, including burritos, burrito bowls, quesadillas, tacos, salads, lifestyle bowls, kids’ meals, chips, sides, and drinks. Valued at a market cap of $45 billion, the company also provides delivery and related services through its app and website.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and CMG fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the restaurant industry. The company’s strong brand loyalty, focus on speed and convenience, and commitment to sustainability and clean ingredients position it as a leader in the fast-casual dining segment.

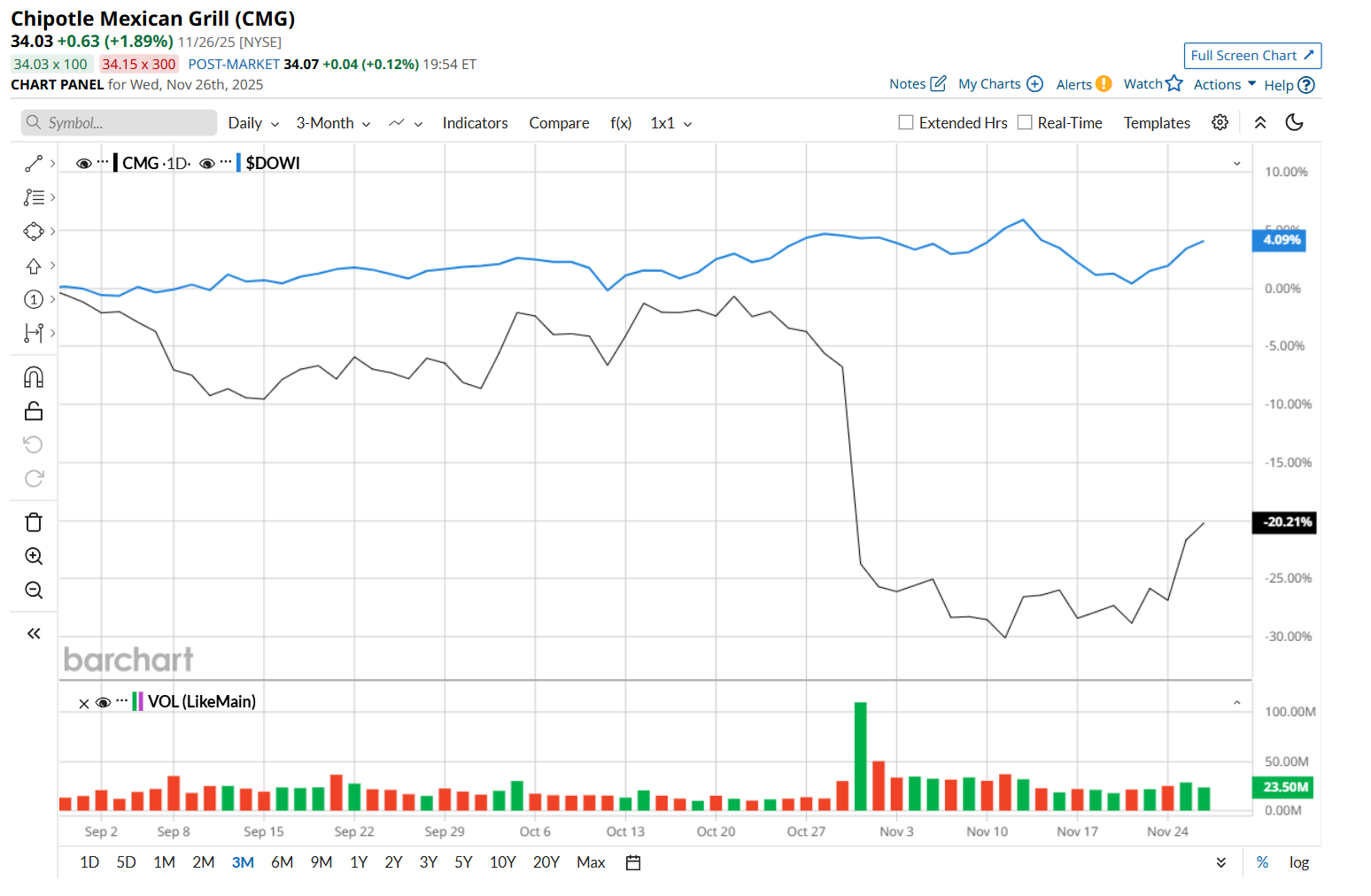

Despite its notable strength, this fast food company has slipped 49% from its 52-week high of $66.74, reached on Dec. 12, 2024. Shares of CMG have declined 20% over the past three months, considerably trailing behind the Dow Jones Industrial Average’s ($DOWI) 4.4% rise during the same time frame.

Moreover, on a YTD basis, shares of CMG are down 43.6%, compared to DOWI’s 11.5% return. In the longer term, CMG has fallen 45.7% over the past 52 weeks, notably underperforming DOWI’s 5.7% uptick over the same time frame.

To confirm its bearish trend, CMG has been trading below its 200-day moving average since early January, with slight fluctuations, and has remained below its 50-day moving average since late July, with minor fluctuations.

On Oct. 29, CMG released mixed Q3 results, and its shares tumbled 18.2% in the following trading session. The company’s total revenue improved 7.5% year-over-year to $3 billion, but missed analyst expectations by a slight margin, which might have lowered investor confidence. The top-line growth was driven by new restaurant openings and higher comparable restaurant sales, though these gains were partially offset by lower transaction volumes. On the other hand, its adjusted EPS of $0.29 grew 7.4% from the year-ago quarter, topping consensus estimates by a penny.

CMG has also considerably lagged behind its rival, Yum! Brands, Inc. (YUM), which gained 10.9% over the past 52 weeks and 14.6% on a YTD basis.

Despite CMG’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 33 analysts covering it, and the mean price target of $44.39 suggests a 30.4% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart