Norwalk, Connecticut-based Booking Holdings Inc. (BKNG) is the world’s leading provider of online travel and related services. With a market cap of $158.1 billion, Booking’s operations span over 220 countries and territories across the Americas, Indo-Pacific, EMEA, and Oceania.

Companies worth $10 billion or more are generally described as "large-cap stocks." Booking fits this bill perfectly. Given the company's widespread operations across the globe, its valuation above this mark is not surprising. Booking offers its services through five primary consumer-facing brands: Booking.com, Priceline, Agoda, KAYAK, and OpenTable, and through a network of subsidiary brands, including Rocketmiles, Fareharbor, HotelsCombined, Cheapflights, and more.

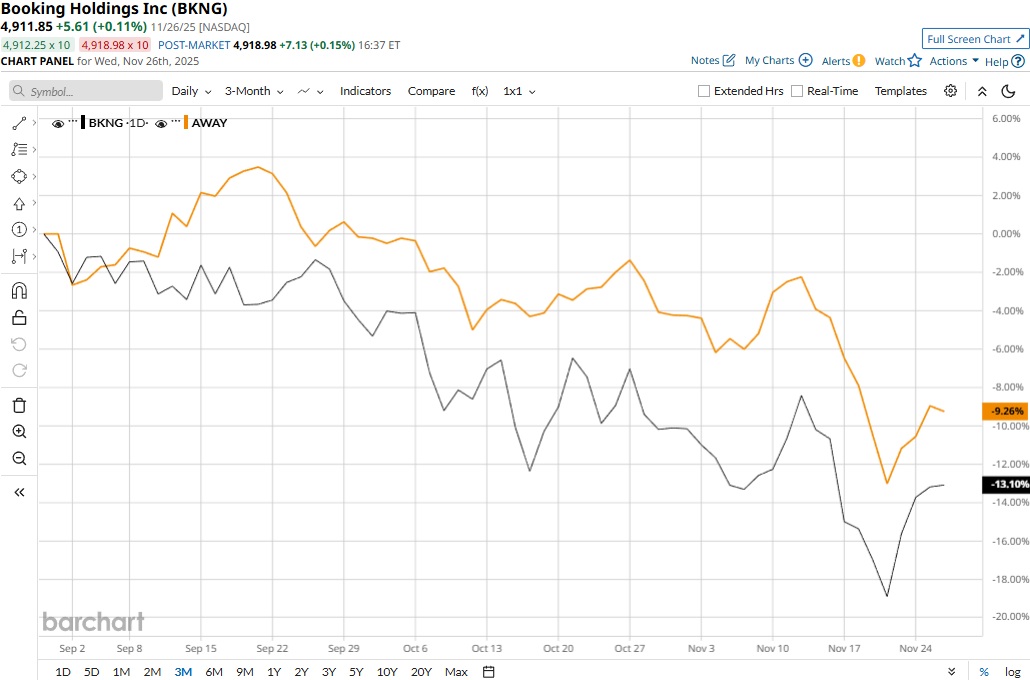

Despite its notable strengths, BKNG stock has dropped 15.9% from its all-time high of $5,839.41 touched on Jul. 8. Meanwhile, BKNG has plunged 13.9% over the past three months, lagging behind the Amplify Travel Tech ETF’s (AWAY) 7.9% decline during the same time frame.

Nonetheless, Booking has performed slightly better than AWAY over the longer term. BKNG stock has dipped 1.1% on a YTD basis and declined 5.8% over the past 52 weeks, compared to AWAY’s 5.6% decline in 2025 and 7.6% plunge over the past year.

BKNG stock dropped below its 50-day moving average in early September and below its 200-day moving average in October, underscoring its bearish movement.

Despite reporting better-than-expected results, Booking Holdings’ stock prices observed a marginal uptick in the trading session following the release of its Q3 results on Oct. 28. The company’s room nights grew by 8%, while gross bookings surged 14% compared to the year-ago quarter. Overall, its net revenues soared 12.7% year-over-year to $9 billion, beating the Street’s expectations by 3.1%. Meanwhile, its adjusted EPS increased 18.6% year-over-year to $99.50, surpassing the consensus estimates by 3.6%. Following the initial dip, BKNG stock observed a notable uptick in the subsequent trading session.

Meanwhile, Booking has significantly lagged behind its peer Expedia Group, Inc.’s (EXPE) 38.3% surge over the past year.

Among the 39 analysts covering the BKNG stock, the consensus rating is a “Strong Buy.” Its mean price target of $6,172.38 suggests a notable 25.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?