With a market cap of $130.8 billion, Eaton Corporation plc (ETN) is a power management company that serves multiple industries through segments including Electrical Americas, Electrical Global, Aerospace, Vehicle, and eMobility. The company provides a wide range of electrical products, hydraulic systems, aerospace components, and industrial solutions.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Eaton fits this criterion perfectly. Eaton offers advanced vehicle technologies and power management systems for both traditional and electric mobility applications.

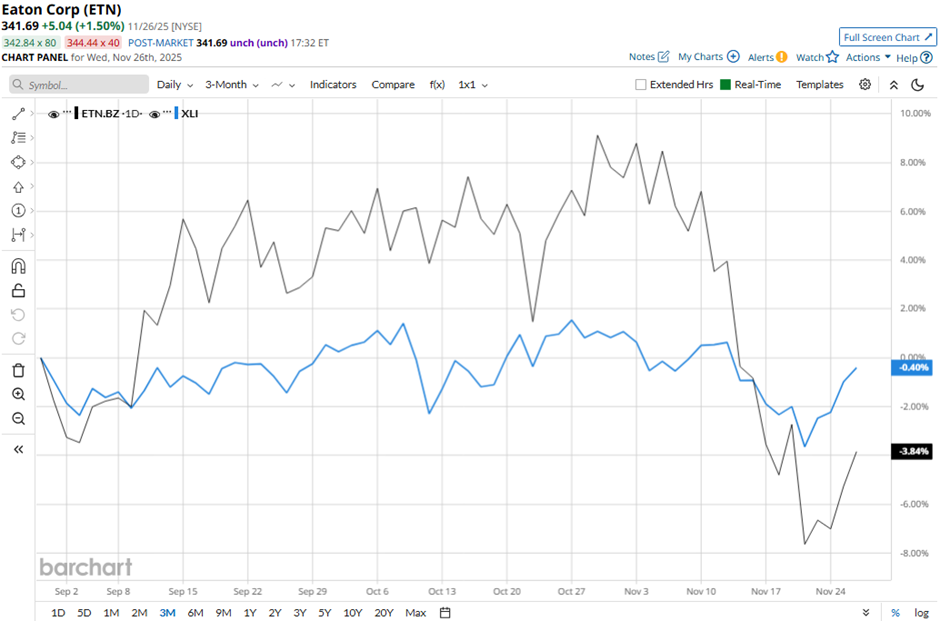

Shares of the Dublin, Ireland-based company have fallen 14.5% from its 52-week high of $399.56. Eaton’s shares have declined 2.9% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) marginal dip over the same time frame.

In the longer term, ETN stock is up nearly 3% on a YTD basis, lagging behind XLI’s nearly 16% return. In addition, shares of the power management company have dropped 9.4% over the past 52 weeks, compared to XLI’s 6.3% return over the same time frame.

Despite recent fluctuations, the stock has been trading above its 50-day moving average since late April.

Despite beating adjusted EPS expectations with $3.07, ETN shares fell 2.3% on Nov. 4 as the company reported weaker-than-expected Q3 2025 revenue of $6.99 billion. Investors were also concerned about significant weakness in Eaton’s Vehicle and e-Mobility segments, which saw sales declines of 8% to $639 million and 19% to $136 million, respectively.

However, ETN stock has performed better than its rival, Honeywell International Inc. (HON). Shares of Honeywell have dipped 10.9% on a YTD basis and 12.6% over the past 52 weeks.

Despite the stock’s underperformance relative to the sector, analysts remain moderately optimistic about its prospects. ETN stock has a consensus rating of “Moderate Buy” from 23 analysts' coverage, and the mean price target of $418.43 is a premium of 22.5% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?