The quantum computing revolution is gaining momentum, and IonQ (IONQ) has emerged as the potential kingmaker in this transformative space. J.P. Morgan just initiated coverage on the company, noting that its strategic approach mirrors Nvidia's (NVDA) dominance in the artificial intelligence chip market.

The investment bank set a December 2026 price target of $47 while maintaining a “Neutral” rating, citing valuation concerns even as it praised the company's positioning. Valued at a market cap of $14.2 billion, IONQ stock trades at about $39 and is up 20% in the past 52 weeks but down 6% year-to-date (YTD).

IonQ went public in October 2021 as the world's first pure-play quantum computing company, following more than 25 years of academic research. Founded by Chris Monroe and Jungsang Kim with backing from New Enterprise Associates, IonQ has built its business around trapped-ion quantum computers. This technology uses ionized atoms to perform longer and more sophisticated calculations with fewer errors than competing approaches.

Similar to how Nvidia built an ecosystem around its AI chips through CUDA software and partnerships, IonQ is developing an integrated approach spanning hardware, software, and ecosystem development. The company has already secured cloud integrations with Amazon (AMZN) Web Services, Microsoft (MSFT) Azure, and Alphabet's (GOOG) (GOOGL) Google Cloud, making quantum computing accessible to a broader audience.

J.P. Morgan analysts, led by Peter Peng, see IonQ addressing three core areas of quantum technology: computing, sensing, and communications. This represents a total addressable market ranging from $46 billion to $97 billion by 2035. Strategic partnerships with major players like Hyundai, AstraZeneca (AZN), and Ansys demonstrate real-world commercial traction beyond pure research applications.

The Bull Case for IONQ Stock

IonQ delivered a standout third quarter that showcased why it stands alone as the only quantum computing company named to the prestigious 2025 Deloitte Technology Fast 500 list. The company reported revenue of $39.9 million, an increase of 222% year-over-year (YoY) and 37% higher than its initial guidance.

This marked IonQ's largest-ever quarterly revenue beat, demonstrating accelerating commercial momentum across its quantum platform.

IonQ achieved some notable technical milestones during the quarter.

- It unveiled the fifth-generation Tempo system three months ahead of schedule with an algorithmic qubit score of 64.

- IonQ demonstrated a world-record two-qubit gate fidelity of 99.99%, making it the first company in history to achieve all key technical milestones needed for full fault tolerance.

- The Tempo system offers a computational space roughly 36 quadrillion times larger than leading commercial superconducting systems and approximately 260 million times more powerful than IonQ's current Forte machines.

IonQ's transformation into a comprehensive quantum platform company accelerated through strategic acquisitions. It closed the purchase of Oxford Ionics, gaining access to breakthrough Electronic Qubit Control technology that enables scalability using standard semiconductor manufacturing processes.

Post-quarter, IonQ completed the acquisition of Vector Atomic, adding world-class quantum sensing capabilities for applications like next-generation GPS and positioning systems critical for defense and commercial use.

The company raised $1 billion during the quarter at a 25% premium to market price, followed by an additional $2 billion capital raise in October, bringing total cash to $3.5 billion with zero debt.

This positions IonQ as the most well-capitalized pure-play quantum provider globally. Management used this war chest to assemble an exceptional leadership team, including General Jay Raymond, founder of the Space Force, who joined the board, and Robert Cardillo, former director of the National Geospatial-Intelligence Agency (NGA), who chairs the newly created IonQ Federal division.

What’s Next for IONQ Stock?

Management emphasized the company's unique ability to address large-scale contract opportunities exceeding $100 million by offering integrated solutions across quantum computing, networking, sensing, and cybersecurity verticals.

In Q3, IonQ generated around 30% of its total sales from international markets, while in the year-ago period, global sales were nonexistent. IonQ raised its full-year 2025 guidance to $108 million, up from $43 million in 2024.

Analysts tracking IONQ stock forecast revenue to increase from $108.3 million in 2025 to $677 million in 2029. In this period, adjusted loss per share is forecast to narrow from $1.01 to $0.51.

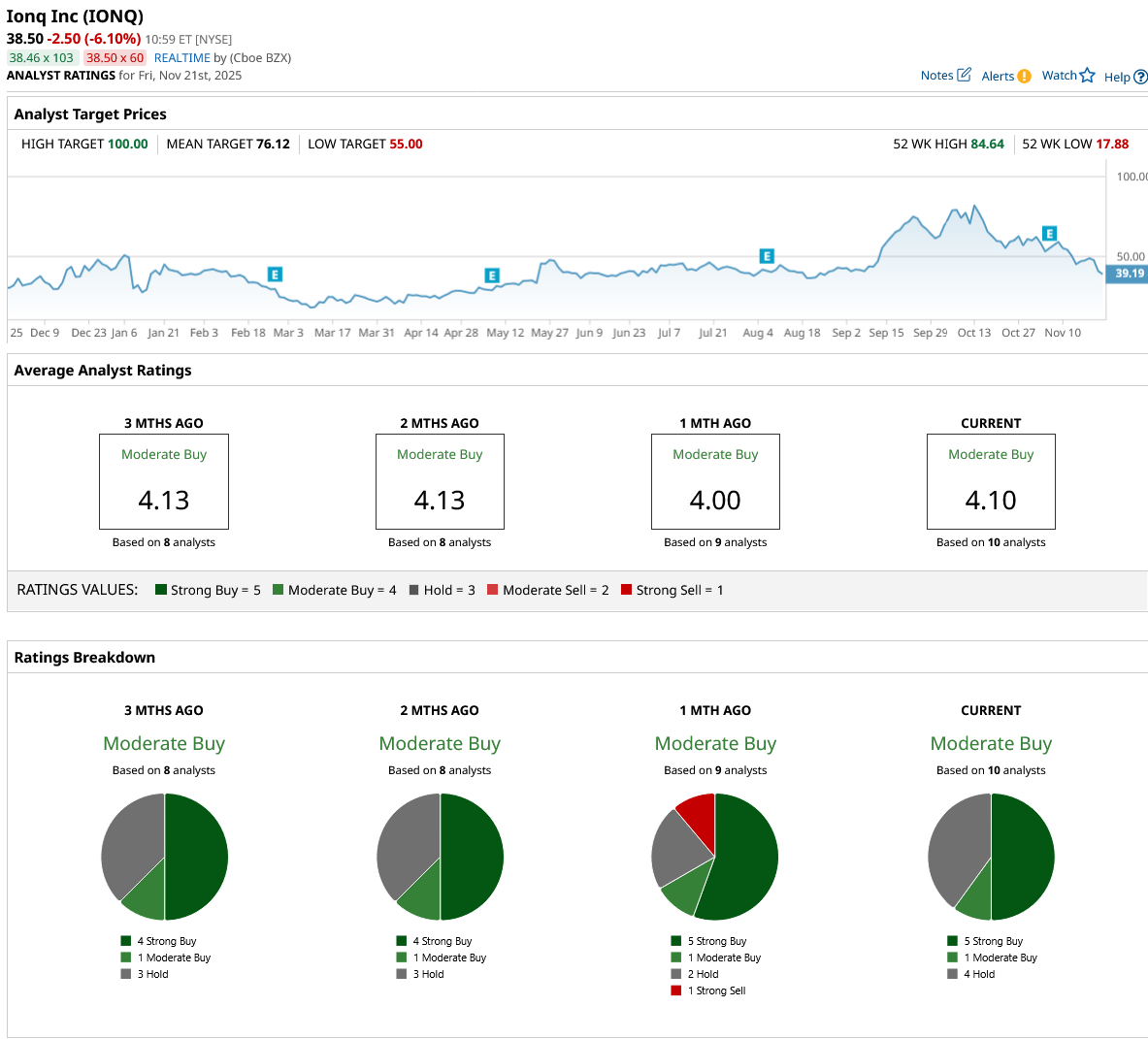

Out of the 10 analysts covering INOQ stock, five recommend “Strong Buy,” one recommends “Moderate Buy,” and four recommend “Hold.” The average IONQ stock price target is $76.12, above the current price of $39.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart