Valued at $65.5 billion by market cap, Norfolk Southern Corporation (NSC) is a leading U.S. freight railroad company that operates roughly 19,000–20,000 route miles across 22 states in the eastern and midwestern regions of the country. Through its rail network and intermodal capabilities, the company transports a wide range of goods, including industrial products, coal, agricultural commodities, automobiles, and consumer freight, connecting key manufacturing hubs and major ports along the Atlantic and Gulf coasts.

Companies worth $10 billion or more are generally described as "large-cap stocks." NSC fits right into that category with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the rail transportation industry.

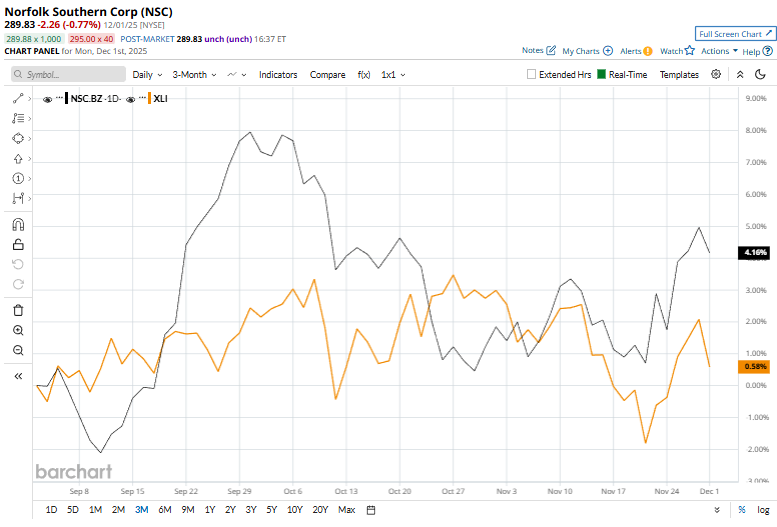

The Atlanta, Georgia-headquartered company touched its 52-week high of $302.24 on Oct. 3 and is currently trading 4.1% below that peak. NSC stock prices have soared 3.5% over the past three months, notably outperforming the Industrial Select Sector SPDR ETF Fund’s (XLI) marginal dropduring the same time frame.

Over the longer term, NSC’s performance has remained mixed. NSC stock has soared 23.5% on a YTD basis and gained 5.1% over the past 52 weeks, outperforming XLI’s 14.9% gains in 2025 but slightly lagging the ETF’s 5.2% rise over the past year.

Supporting the strength of its upward momentum, NSC shares have consistently traded above the 50-day moving average since the end of May and have remained above the 200-day moving average since early June.

Last month, shareholders of Union Pacific Corporation (UNP) and Norfolk Southern overwhelmingly approved an $85 billion merger to form the nation’s first coast-to-coast rail network, with about 99% voting in favor.

Additionally, NSC reported Q3 results on Oct. 23, and its shares fell 1.2% in the next trading session. The company posted revenue of $3.1 billion and adjusted EPS of $3.30, both surpassing analyst estimates. Year over year, revenue grew 1.7% while earnings increased 1.5%. Despite the solid results, management noted that expected volume growth from partners failed to materialize and that an oversupplied truck market added pressure, indicating that external market conditions weighed on performance. The company also warned of continued volume softness ahead, particularly in its Intermodal segment, which further contributed to investor caution.

Compared with its peer Union Pacific Corporation (UNP), Norfolk’s performance stands out. NSC has sharply outperformed UNP’s modest 1.5% rise on a YTD basis and 5.4% plunge over the past 52 weeks.

Among the 20 analysts covering the NSC stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $311.76 represents a 7.6% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Options Strategy Turns Your Stock Portfolio Into a Consistent Income Generator

- This ‘Strong Buy’ Dividend Stock Looks Set to Raise Payouts. Should You Buy Shares Now?

- JPMorgan Just Upgraded CleanSpark Stock. Should You Buy Shares Here?

- Dear Walmart Stock Fans, Mark Your Calendars for December 9